Why firms want more company ownership data - guest blogpost

The COVID-19 pandemic has led to a raft of urgent measures by governments across the world as they seek to shore up companies amid a mounting economic crisis. In tandem, many have also disbursed unprecedented sums, via expedited procurement procedures, in order to obtain new healthcare equipment and supplies that will enable them to respond to the pandemic.

Emergency procurement processes are particularly susceptible to integrity challenges, as was already illustrated during previous crises, notably during the responses to Hurricane Katrina in 2005 or the Ebola outbreak between 2014 and 2016. Similar issues have emerged on this occasion, with several reported instances of corruption and fraud among the urgent purchases that governments have been making.

Such cases have meant that supply-chain risk has come increasingly in the spotlight during the COVID-19 outbreak. But the medical and economic crises have also brought greater regulatory and policy attention on the issue of company ownership transparency. Knowing who ultimately owns or controls a firm supplying healthcare equipment, for example, is of vital importance if government officials are to properly assess the risk of purchasing goods or services from them.

Indeed, without access to this information, it becomes significantly more challenging to identify vendors that have been banned, censured, or cited as some way problematic by governments, multilateral organisations or non-governmental organisations and agencies.

This problem is not just one faced by government agencies, nor is it one limited to this time of emergency. Private sector organisations regularly need to conduct due diligence checks on their customers and supplies in order to understand and assess their exposure to, among others, legal, operational and reputational risks.

However, for global companies, obtaining the necessary information to conduct supplier and customer due diligence is especially complex. They often need to cover supply chains that span dozens of countries, with all the administrative, linguistic and other challenges that this entails. Given the substantial cost burden associated with this, many organisations instead prefer to use data companies, such as Refinitiv, to obtain this data.

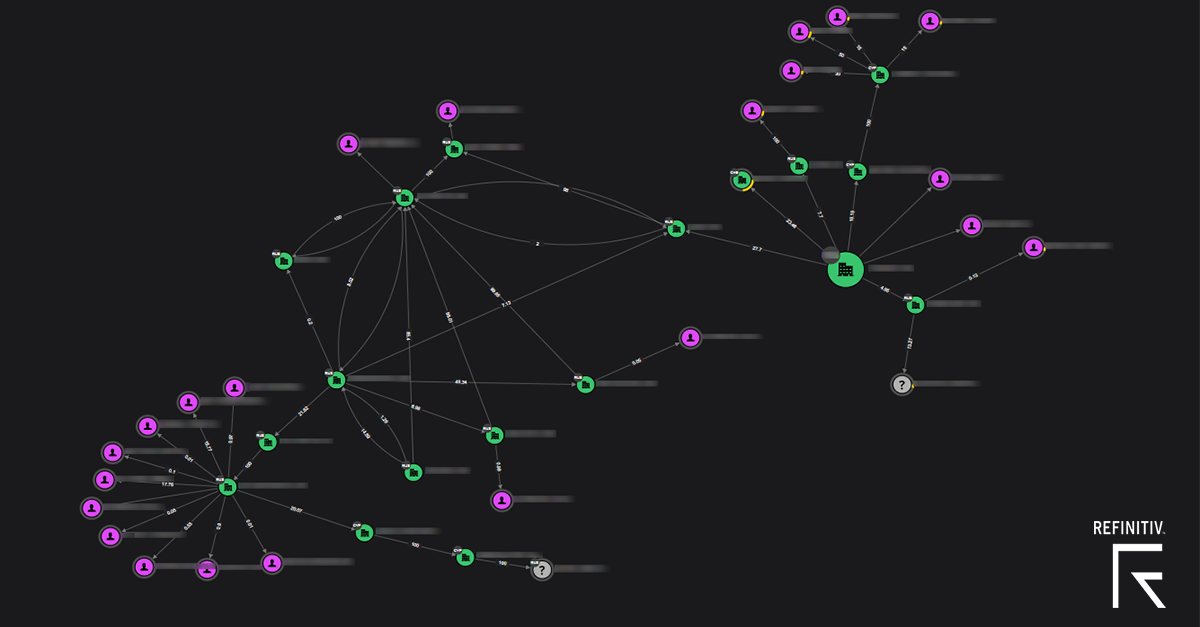

A key starting point for any such investigation is for the firm to know who it is that they are considering doing business with. In this context, the advantages of having access to data on the legal and beneficial ownership of companies are clear. Such data is crucial to allowing businesses to understand the extent of their exposure to supply chain risk, and to avoid entering into commercial arrangements with customers on sanctions lists.

Yet, many countries suffer significant shortcomings in the data available in their registers of legal company owners, let alone those for the more complex area of beneficial ownership (BO). A study conducted by Refinitiv, for example, found that of the 247 jurisdictions globally that have some kind of company registry, only 51% provide any information on companies’ directors. And only 57% disclose shareholders.

For beneficial ownership registers (‘BO’), the situation is more challenging, even for businesses that operate exclusively within the European Union. A recent report by Global Witness found that 63% of EU countries either do not have a centralised registry of beneficial ownership or have not made this available to the public (including private sector actors). Furthermore, where such registers do exist in Europe, their usability and accessibility is often limited by being behind a paywall or because users may only search for companies by tax number, rather than by name.

Improving company access to reliable BO data would require greater numbers of countries to be creating and publishing registers, in the first instance. However, an important additional step would be for implementation of the registers to be made consistent across countries.

As things stand, there is significant disparity between jurisdictions, even in basic areas, such as the definition of what constitutes a disclosable beneficial ownership arrangement. Legislative harmonisation on such issues would improve efficiency and effectiveness, and would likely also help efforts to better sync registers internationally, making the available data of far greater use to business.

While international organisations are increasingly recognising the importance of centralised BO registers, there have been few substantive moves towards a unified vision of exactly what BO is, what BO registers should look like or how they should communicate with each other. As part of our work with the B20’s Integrity & Compliance Taskforce, these issues are front and centre as we begin to finalise our recommendations to the G20. On May 7th, the European Commission published its AML Action Plan which is far-reaching and sets out explicit measures to ensure beneficial ownership registers are populated with high-quality data and that the interconnection between them are operational in 2021.

Technical experts, such as Open Ownership, are doing important work in driving forward the harmonisation of such registers. This includes work at the policy level, through the publication of the Open Ownership Principles for effective beneficial ownership disclosure, and at the level of data harmonisation, through the development of the Beneficial Ownership Data Standard.

Such tools are highly important in encouraging additional countries to publish more, better quality and increasingly standardised BO data. Greater availability of such information internationally would represent a boon to those, from the private and public sector alike, who are seeking to accurately assess their supply chain risk.

• Che Sidanius is Global Head of Financial Crime & Industry Affairs at Refinitiv. This blog was originally posted online here.

Publication type

Blog post

Sections

Technology