The Coverage Principle: Setting the scope of disclosure for beneficial ownership transparency of corporate vehicles

Photo by Ilnur Kalimullin in Unsplash

When jurisdictions implement beneficial ownership transparency (BOT), which corporate vehicles should be required to disclose beneficial ownership (BO) information? Open Ownership's policy briefing on the Coverage principle explains that, to generate actionable and usable data across the widest set of policy aims, BO disclosure requirements should apply to all corporate vehicles through or by which assets can be owned, benefitted from, and controlled. This is because they can all be used in ways that undermine the achievement of policy aims associated with BOT.

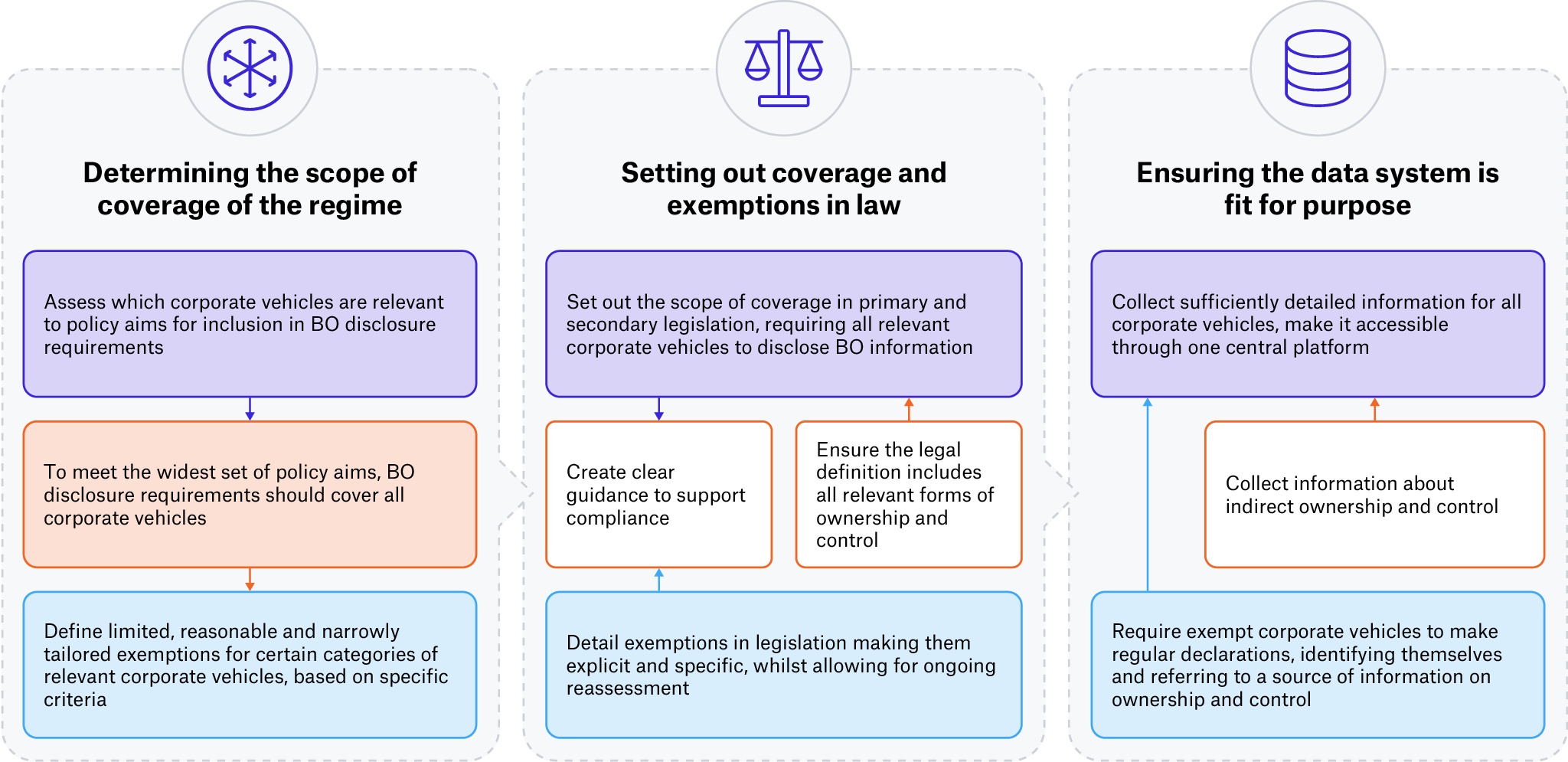

Coverage is a core tenet of the Open Ownership Principles, as it ensures all relevant corporate vehicles are included within the scope of disclosure requirements. The term corporate vehicles refers to entities and arrangements through which commercial activities are conducted and assets are held, such as different types of companies, partnerships, associations, foundations, and trusts. The briefing details the considerations for policymakers and others with responsibilities for setting out the scope of coverage in their jurisdiction, which broadly includes the following stages.

Figure 1. Setting out the coverage of corporate vehicles in a BO disclosure regime. Image from OO’s policy briefing Coverage of corporate vehicles in beneficial ownership disclosure regimes.

Determining the scope of coverage of the regime

The starting point for setting out a regime’s coverage is to form a picture of the domestic and foreign corporate vehicles operating in a jurisdiction, taking into account that these may change over time. The definition of beneficial ownership determines which corporate vehicles can be legally beneficially owned, and should be considered jointly with coverage. Those designing reforms should assess the relevance of corporate vehicles based on a jurisdiction’s policy aims. When doing so, they should consider that all corporate vehicles through or by which assets can be owned, benefitted from, and controlled can be used in ways that undermine the achievement of policy aims associated with BOT.

When assessing which corporate vehicles are relevant for combating money laundering and the financing of terrorism, jurisdictions have used a number of criteria. These have included whether or not a corporate vehicle has a legal personality and the risk it poses. Using these to determine the scope of coverage can limit the effectiveness of BOT reforms. Excluding certain corporate vehicles can increase their attractiveness for misuse. Given the risks of not making coverage comprehensive, it is recommended that all corporate vehicles be covered, unless reasonably exempt.

Exemptions from the obligation to disclose BO information can be created for certain corporate vehicles that would otherwise be considered relevant. Exemptions help ensure that the requirements any laws and regulations place on individuals and corporate vehicles are proportionate to achieving the policy aims. Publicly listed companies are an example of a category of corporate vehicles that often qualify for exemption. The main bases for reasonable, narrowly tailored exemptions are:

- certain corporate vehicles are already disclosing adequate and up-to-date information on ownership and control to a third-party body that is regulated or subject to supervision, and that maintains and performs reporting and oversight;

- the information that is being disclosed to this third-party body is as easily accessible to all relevant data user groups as it would be through a government register; and

- complying with the disclosure requirements is impossible or excessively difficult for certain corporate vehicles.

Setting out coverage and exemptions in law

A regime’s coverage and any exemptions policymakers opt for should be set out in law. Primary legislation should refer to the legal definition of beneficial ownership. It should place a requirement on all relevant corporate vehicles to disclose BO information, unless reasonably exempt, and it should use language that helps future-proof the reforms. Secondary legislation can then provide further details, such as a non-exhaustive list of examples of covered corporate vehicles.

The creation of exemptions in law should be balanced against the risks of shifting misuse to exempt corporate vehicles, and of leading to confusion that negatively impacts compliance. Making exemptions explicit and specific can help mitigate these risks. Provisions should be made for the ongoing reassessment of exemptions. Exempt entities should have a legal obligation to routinely declare the basis for their exemption, along with identifying and other relevant information. In addition, it is important to harmonise both exemptions and coverage with any complementary policies, such as those addressing money laundering and terrorist financing.

Policymakers should also consider developing clear guidance based on legislation and regulations. Guidance can help those responsible for disclosing information understand the requirements and comply with reporting obligations. Separate guidance may be required for different categories of corporate vehicles. This is especially true where the definition of beneficial ownership is more complex to apply; where there are differentiated reporting requirements for a category of corporate vehicles; or both. State-owned-enterprises are an example of this.

Ensuring the data system is fit for purpose

Those implementing reforms will need to ensure that the data system in place can completely and accurately capture and store BO information for all relevant corporate vehicles. The data system should be able to accommodate foreign corporate vehicles that are operating in the jurisdiction as well as those that are part of an ownership chain. It should also ensure there is up-to-date data on all exempt corporate vehicles, and where a third party is carrying out oversight outside a BO register and publishes relevant information on ownership and control, a clear reference to this information should be included in a declaration.

Where coverage is comprehensive, there may be one or multiple registers capturing BO information. Whether there is one or multiple registers, information should be structured, interoperable and accessible through a central platform. This ensures the information offers a comprehensive overview of ownership and control, and that it is usable and actionable. Finally, jurisdictions should use a whole-of-government approach to verification.