Beneficial ownership transparency and listed companies

Introduction and recommendations

This technical note supports implementers of national beneficial ownership registers to reduce risks associated with exemptions from disclosure that exist for listed companies. It is not intended as an endorsement of the policy of exempting listed companies from beneficial ownership disclosure. Rather, the aim is to create actionable advice that can reduce the impact of policy loopholes and produce high quality data about listed companies in contexts where exemptions remain a reality.

This technical note covers:

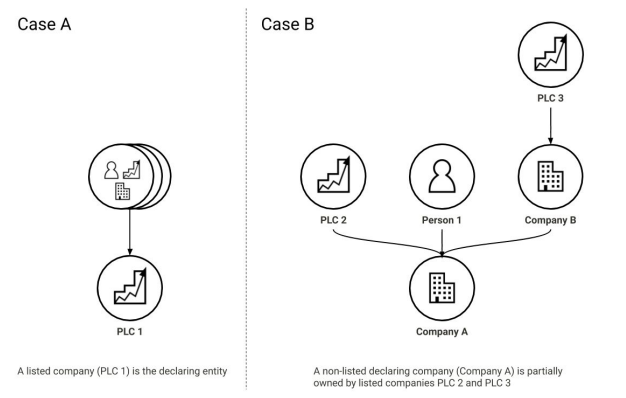

- Case A: Potential exemptions from beneficial ownership (BO) disclosure where a listed company is the declaring entity.

- Case B: Where a declaring company is owned or controlled by a listed company to any degree (directly or indirectly).

In both cases, the implementation note covers recommendations and considerations for deciding when an exemption should be granted, and outlines the information that should be provided in any exemption declaration. BO disclosures by publicly listed companies are relatively recent, and good practice is still emerging. The information and recommendations in this note are based on Open Ownership (OO)’s work supporting almost 40 countries globally to implement beneficial ownership transparency (BOT), and relevant academic and practitioner research.

Beneficial ownership transparency requirements for listed companies are important due to the scale of assets traded on regulated exchanges. Transparency is fundamental for fair and well-functioning markets. Many stock exchanges have their own well developed transparency and disclosure requirements, but not all. This technical note aims to help governments decide what information to collect from listed companies in order to grant exemptions from full beneficial ownership disclosure and to reach market filings relevant to beneficial ownership.

OO recommends that:

- blanket exemptions from BO disclosure requirements to companies listed on any stock exchange should not be granted. This is because transparency and disclosure requirements differ widely between stock exchanges;

- listed companies should only be exempted from BO disclosure requirements if adequate and enforced BO disclosure requirements exist for the stock exchange(s) on which the declaring company is listed;

- all companies that are exempt from BO disclosure requirements due to their listed status should have to declare, and periodically confirm, that they are exempt due to their listed status;

- in published BO data, listed companies should be identifiable as such; sufficient data should be collected to connect them to relevant stock exchange listings.

In implementing these recommendations, the following actions may be considered:

- creating a list of stock exchanges with adequate (or inadequate) levels of ownership transparency; granting exemption from BO disclosure to companies only when they are listed on stock exchanges that have an adequate level of ownership transparency;

- requiring listed or non-listed companies to disclose all up-chain listed companies that hold significant* ownership or control interests in the declaring company, including sufficient data to be able to connect them to stock market filings.

These points are expanded upon in the following section.

Defining publicly listed companies

For the purposes of this technical note:

- A listed company means any company that has equity publicly traded on a regulated market.

- A declaring entity or declaring company is a company that is making a BO declaration.

- A BO declaration may be a statement of who the beneficial owners of the declaring company are, a statement about ownership and control relating to the declaring company, or a confirmation that the declaring company is not required to disclose its beneficial owners (for example, due to its listed status). A declaration may be made periodically or triggered by one or more conditions.

- An up-chain company is one that either directly or indirectly has any amount of control or ownership of a declaring company.