Beneficial ownership transparency of trusts in South Africa

Beneficial ownership transparency and trusts in South Africa

National context

South Africa faces a multitude of socio-economic challenges: the most recent official unemployment rate states that 35.2% of working age South Africans were unemployed in the fourth quarter of 2021; [39] it is the most economically unequal country in the world, with a Gini coefficient of 63.0; [40] and more than half of the country lives in poverty, whilst approximately 20% live in extreme poverty. [41] At the same time, public and private corruption is prolific: estimates indicate that South Africa lost approximately ZAR 1.5 trillion (USD 95 billion) between 2014 and 2019, which amounts to a third of South Africa’s gross domestic product (GDP). [42]

According to South Africa’s National Development Plan, which sets out the vision of South Africa in 2030, the eradication of corruption and the establishment of a society that subscribes to the values of integrity, transparency, and accountability is a national priority. [43] In 2021, Cabinet approved the National Anti-Corruption Strategy (NACS), which includes transparent and accountable governance systems as one of its core pillars. One of the key activities for achieving that vision is establishing mechanisms to provide BO information. [44]

In its 2021 Mutual Evaluation Report of South Africa, the FATF identifies the lack of BOT as “an acute vulnerability as companies and trusts are often misused for money laundering or to carry out predicate crimes, making attorneys and trust and company service providers inherently vulnerable to misuse.” [45] Without immediate action on BOT, South Africa is at risk of being grey-listed by the FATF by the end of 2022. According to a study conducted by the IMF, grey-listing may lead to a reduction in capital inflow of up to 7.6% of GDP. [46]

Nonetheless, South Africa also has a range of institutional strengths that are being leveraged to improve its performance on BOT: sophisticated financial institutions; progress on confiscation of criminal proceeds; useful financial intelligence; and sufficient granting of powers and responsibilities for the prosecution of financial crimes to law enforcement and investigative authorities. [47] With its commitment to BOT through adopting the G20 High-Level Principles in 2015, the South African government established an Inter-Departmental Committee on Beneficial Ownership Transparency (IDC), convened by the Department of Public Services and Administration, with the Financial Intelligence Centre (FIC) serving as technical lead. The IDC’s approach demonstrates the South African government’s understanding of the need for a whole-of-government approach to coordinating on the policy, technology, and governance requirements of implementing the BOT of legal entities, trusts, and other legal arrangements. [48]

Additionally, the recent findings from the State Capture Commission inquiry are seen as a significant milestone in South Africa’s fight against corruption, with South Africa’s president, Cyril Ramaphosa, emphasising the importance of establishing mechanisms to curb corruption. [49]

It is clear there is a high level of support for implementing reforms in order to improve the BOT regime for trusts in civil society and government agencies. According to government insiders interviewed for this study, there is a strong understanding of the challenges to reforming South Africa’s BOT regime and commitment to cooperation across government departments. However, the scope of complexity and various bureaucratic challenges have stalled progress on the implementation of the necessary reforms.

Legal landscape

Trusts and beneficial ownership

Upon registration of a trust, the following must be registered with the Master’s Office: the trust deed; a trust application form; acceptance forms by trustees and auditors; the declaration of beneficiaries; certified copies of the identity documents of the trustees; and a bond of security (or proof of exemption from such bond). Should the identity of the beneficiaries be known at the time of registration, copies of their identity documents or proof of identity must also accompany the registration application. [50]

However, there is currently no formal legislative definition of the beneficial ownership of trusts or similar legal arrangements in South African law. Trust law does include some relevant terms for identifying beneficial owners (including “trust beneficiary”; the “ascertained beneficiaries”; and “beneficiaries”), but identifying the beneficial ownership of a trust is complicated by this lack of a legislative definition of beneficial ownership as it relates to trusts.

The BO of a legal person is defined in the Financial Intelligence Centre Act (FICA), amended by the FIC Amendment Act of 2017, as the “natural person who, independently or together with another person, directly or indirectly, – (a) owns the legal person; or (b) exercises effective control of the legal person”. This definition only provides part of the picture of the beneficial ownership of trusts, as the beneficial owners of a trust may include persons who do not have any ownership of or control over the trust property. [51]

In 2016, then Minister of Finance, Pravin Gordhan, promulgated Regulations to the Tax Administration Act of 2011, which implemented the CRS in South Africa. According to these regulations, financial institutions are obliged to determine and report to the South African Revenue Services (SARS) the beneficial owners or controlling persons of an entity account if that individual is a tax resident in a foreign jurisdiction. The beneficial owner of a legal arrangement is the natural person exercising effective ultimate control over that legal arrangement (which includes trusts), as defined by FICA.

South African trust law acknowledges the three types of parties to a trust: founder(s), trustee(s), and beneficiaries, but when the need arises due to a dispute about the identity of the beneficial owner, the courts will determine the beneficial owner of a trust based on the type of trust and whether the triggers in the trust have been activated. [52] However, the beneficial owners of a trust are not clearly established at the registration of the trust.

As discussed above, the FATF recommends that the settlor(s), the trustee(s), the beneficiaries or class of beneficiaries, and any other natural person exercising ultimate control over the trust should be viewed as the beneficial owners of a trust. The FATF Recommendation and the FICA definition of beneficial ownership are not currently aligned, as beneficiaries do not own nor exercise effective control of the trusts. Rather, they merely have the right to benefit from the trust property, meaning that beneficiaries might not be seen as beneficial owners under a strict interpretation of the FICA definition of beneficial ownership. As will be discussed below, the potential confusion arising from this lack of clarity is an area of concern for improving the BOT of trusts in South Africa.

Additional relevant legislation

The current South African legislative landscape has provisions in place which can be leveraged and used in the advancement of BOT. The most pertinent legislation, outside of the Trust Property Control Act 57 of 1988 (TPCA), is the FICA 38 of 2001, amended in 2017; the Promotion of Access to Information Act 2 of 2000 (PAIA); and the Protection of Personal Information Act 4 of 2013 (POPIA).

The FIC and the Counter-Money Laundering Advisory Council have been established under FICA. The aim of this council is to fulfil a primary role in protecting the integrity of the South African financial system through the identification of proceeds of crime; combating money laundering; and countering the financing of terrorism. FICA further identifies accountable institutions that are required to obtain and verify certain information regarding beneficial ownership in the event of conducting business transactions with third parties, which includes any person that administers trust property within the meaning of the TPCA. [53] The provisions of the FICA further supplement the Prevention of Organised Crime Act of 2000 and PAIA.

The aim of PAIA is to promote a culture of transparency and accountability by public and private entities through giving people access to information. The constitutional purpose is to ensure an open and participatory democracy. PAIA is balanced through the acknowledgement of certain limitations to access to information, which is further covered by POPIA. The right to privacy is a fundamental human right, [54] and the aim of POPIA is to protect individuals’ personal information and their privacy in order to prevent any harm from occurring, such as identity theft and theft of assets.

The provisions of POPIA [55] set out the creation of an information regulator, which is an independent body and only accountable in accordance with the Constitution of South Africa (Act 108 of 1996), reporting to the National Assembly. The Information Regulator has the responsibility to ensure compliance with the provisions of POPIA, as well as ensuring the rights of protection thereunder are safeguarded. [56] The Information Regulator is also responsible for compliance with PAIA, which means that it has to play a balancing role between protecting the privacy of individuals and ensuring fair access to information.

POPIA establishes a set of conditions for the processing of personal information of non-minors, which includes accountability; processing limitation; purpose specification; information quality; and security safeguards. [57] The provisions of POPIA prohibit the processing of personal information of minors (unless necessary to establish or exercise a right or obligation), and set out regulations as to how their information should be safeguarded if obtained. [58] The Regulator is, however, empowered to grant certain exemptions to process personal information [59] where such processing would be in the public interest, and where the benefit of processing outweighs the individual’s right to privacy of information. Examples of public interest exemptions include (but are not limited to) matters of national security; important economic and financial interest of public bodies; and the prevention, detection, and prosecution of offences. [60] Any offence committed under POPIA attracts a fine, imprisonment not exceeding 10 years, or both. [61]

The range of information to be reported to the FIC under FICA is vast. Accountable institutions are to advise the FIC of their clients; cash transactions over a prescribed limit; property associated with terror or related activities; suspicions of unusual transactions; and conveyance of cash and electronic transfer of funds to or from South Africa. [62] Upon reporting of these transactions, the FIC has the authority to forbid the accountable institution from proceeding with the transaction. [63]

Information held by the FIC may be accessed by an investigative authority of South Africa, SARS, and the South African intelligence services. [64] Competent authorities situated outside of South Africa may apply to the FIC to access such information, which the FIC may grant if it reasonably believes it would be relevant to the identification of unlawful activities or combating financial crimes in the country where the entity is established. [65] Minor offences committed under FICA attract a five-year prison sentence or a fine not exceeding ZAR 10 million [66] and for any other offences, a 15-year prison sentence or a fine not exceeding ZAR 100 million. [67]

In relation to trusts, FICA Regulation 15 sets out the information to be obtained of all natural persons, by an accountable institution, once a transaction is concluded. The information includes:

- the name of the trust and its assigned trust deed number;

- the address of the Master’s Office where the trust is registered;

- the income tax registration number;

- trustees’ full names, dates of birth, identity numbers, and residential addresses;

- beneficiaries’ full names, dates of birth, identity numbers, and residential addresses or particulars of how beneficiaries in the trust are to be determined; and

- the founder’s full name, date of birth, identity number, and residential address.

Therefore, accountable institutions already collect and hold BO information for some trusts. The accountable institutions are also liable to verify the information obtained under Regulation 15. [68] For local trusts, verification has to be made against the letter of authority issued by the Master’s Office as well as the trust deed. For foreign trusts, verification has to be made against the official document which reflects the information, issued by the authority of the country in which the trust was created and is regulated.

Trusts in the disclosure regime for legal entities

Trusts are often used to hold ownership in legal entities. A trust can, for example, hold shares in a listed or private company, the benefits (dividends, income) of which will then either accrue to the trust as trust property or be passed on to the beneficiaries. The Companies Act requires that for-profit legal entities, whether public or private, must keep an up-to-date securities register. This securities register should reflect the number of certificated securities issued and the names and addresses of the persons to whom they were issued. Additionally, the number of uncertificated securities must also be reflected in the register. [69]

When securities in a public company are held by one person (A) on behalf of another (B), that person (B) is regarded to have a beneficial interest in those securities. The registered holder of the securities must disclose the identity of the person on whose behalf the security is held as well as the identity of each person that holds a beneficial interest in those securities. Where a company has reasonable cause to believe that any of their securities are held by one person on behalf of another, they may require the holder of the securities to confirm or deny such holding of securities and provide details of the extent of any beneficial interest held in those securities. [70]

According to the Companies Act, “person” includes juristic persons, and “juristic persons” include trusts, irrespective of whether such was established within or outside of South Africa. Beneficial interest therefore captures limited aspects of beneficial ownership. Effectively, companies are only required to maintain records of all persons that own securities in that company, which means the company only has to indicate the name of a trust that owns securities, and not the details of the parties to the trust. The details of the trusts’ representative, as registered with the Master’s Office (a trustee), will have to be registered with the name of the trust on the securities register.

The above legislative requirements illustrate the complexity that trusts introduce to identifying beneficial owners of legal entities. It is possible to know that a trust owns shares in a company and the name of that trust, but the identities of the parties to the trust will not be immediately apparent. This challenge is not unique to trusts, as complex ownership structures used in private companies also obfuscate which natural persons effectively control companies, but the additional protections provided to trusts further complicate matters.

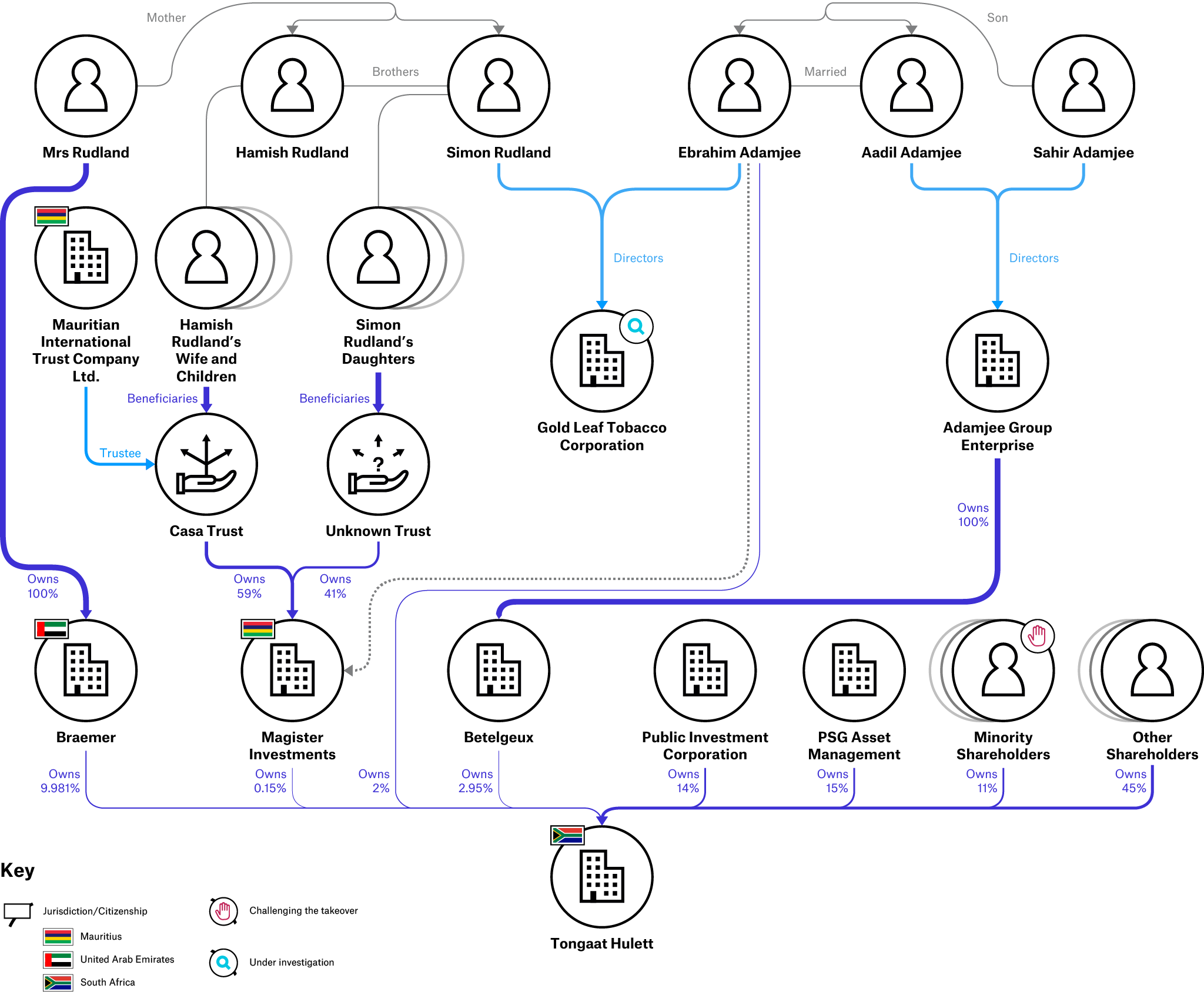

As the Tongaat Hulett case study below indicates, trusts can be used in an attempt to hide the beneficial interest that individuals have in legal entities. In other words, the ability to identify the beneficial ownership of trusts is critical to the BO regime in general, as trusts can currently be used to obscure BO information effectively.

Sources: The diagram above has been compiled from a number of public sources to illustrate the complexity in understanding ownership structures based on limited publicly available information, including reporting from the amaBhungane Centre for Investigative Journalism and BusinessLIVE. These sources contain allegations which have been denied by the individuals in question, and some of the legal persons depicted have stated that the information on which it is based contains inaccuracies. The information contained in this diagram is compiled on a best efforts basis and is not exhaustive or complete. Aspects of the ownership structure may have been left out where the information is not available, not relevant to illustrate the story, or challenging to visually represent. The diagram covers a period of time, rather than a snapshot. Some of the entities and officers shown may no longer be active.

Box 3. Tongaat Hulett’s controversial takeover transaction [71]

Tongaat Hulett Ltd. is facing financial pressure due to alleged fraudulent conduct by top executives, causing losses of approximately ZAR 12 billion. As a result of the losses, the company’s share price fell from ZAR 135 per share in 2018 to ZAR 5.29 in January 2022. [72] The shareholders were presented with a takeover bid from a minority shareholder, Magister Investments, to obtain additional shares. To gain control of the company, Magister Investments proposed a ZAR 2 billion share issue. The approval consequently diluted the holdings of shareholders who could not exercise their pre-emptive rights. A complex structure that included a number of trusts was used by two individuals, Hamish Rudland and Ebraham Adamjee, to obscure the true ownership of Magister Investments.

The structure appears to attempt to hide the involvement of Hamish’s brother, Simon Rudland, part owner of Gold Leaf Tobacco Corporation (GLTC). GLTC is currently being investigated for its involvement in illicit tobacco trade, evading excise duties in South Africa, as well as being investigated for its links to Rappa, the gold refinery targeted by SARS for an alleged multi-billion-rand gold value-added tax scam.

Therefore, shareholders have strong reason to oppose the takeover, as it not only poses a danger for reputational harm, resulting in a further decrease in the share price, but it will also effectively dilute shareholders who are not able to exercise their pre-emptive rights, as they will not be able to pay the inflated share price set by the offer. Moreover, three shareholders associated with Magister Investments may have failed to disclose their conflict of interest as interrelated persons. The parties denied they acted in concert in any way. The matter was referred to the Takeover Regulation Panel to overrule the approval of Magister Investments’ takeover bid, and on 3 June 2022, the Panel overruled the approval due to Magister Investments’ attempt to, together with Ebrahim Adamjee, sway the vote in favour of the takeover.

Recent developments

As this briefing was written, the Minister of Finance introduced the General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill to the National Assembly of South Africa’s Parliament on 18 August 2022. Its signing into law in December 2022 amends various pieces of legislation, including the TPCA and FICA.

The initial Bill introduced to Parliament proposes an amendment of the TPCA that will insert a formal definition of the “beneficial owner” of a trust. Should the Bill be accepted in its current format, it will link the definition of the beneficial ownership of a trust to the meaning defined in FICA, and it will expand that definition to include “a natural person who directly or indirectly ultimately owns the relevant trust property or exercises effective control of the administration of the trust”. [73]

Endnotes

[39] According to the expanded definition of unemployment, which includes those who have not searched for work in the four weeks preceding the quarterly labour force survey, 46.2% of working age South Africans are unemployed. See: “Quarterly Labour Force Survey – Quarter 2: 2022”, Statistics South Africa, 2022, https://www.statssa.gov.za/publications/P0211/P02112ndQuarter2022.pdf.

[40] “Gini Index - South Africa”, World Bank, n.d., https://data.worldbank.org/indicator/SI.POV.GINI?locations=ZA. A higher Gini coefficient equates to higher inequality.

[41] This means that 18.9% of South Africans live on less than USD 1.90 (ZAR 28) per day. These figures were estimated before the economic lockdowns caused by the COVID-19 pandemic, and have likely worsened. See: “Human Development Index”, United Nations, 2020, https://hdr.undp.org/data-center/human-development-index#/indicies/HDI.

[42] Marianne Merten, “State Capture wipes out third of SA’s R4.9-trillion GDP – never mind lost trust, confidence, opportunity”, Daily Maverick, 1 March 2019, https://www.dailymaverick.co.za/article/2019-03-01-state-capture-wipes-out-third-of-sas-r4-9-trillion-gdp-never-mind-lost-trust-confidence-opportunity/.

[43] “National Development 2030: Our future – make it work”, Government of South Africa, 2012, https://www.gov.za/sites/default/files/gcis_document/201409/ndp-2030-our-future-make-it-workr.pdf.

[44] “National Anti-Corruption Strategy 2020-2030”, Government of South Africa, 2017, 77, https://www.gov.za/sites/default/files/gcis_document/202105/national-anti-corruption-strategy-2020-2030.pdf.

[45] Anti-money laundering and counter-terrorist financing measures: South Africa, Fourth Round Mutual Evaluation Report (Paris: FATF, 2021), https://www.fatf-gafi.org/media/fatf/documents/reports/mer4/Mutual-Evaluation-Report-South-Africa.pdf.

[46] Mizuho Kida and Simon Paetzold, “The Impact of Gray-Listing on Capital Flows: An Analysis Using Machine Learning”, IMF, 27 May 2021, https://www.imf.org/en/Publications/WP/Issues/2021/05/27/The-Impact-of-Gray-Listing-on-Capital-Flows-An-Analysis-Using-Machine-Learning-50289.

[47] Anti-money laundering and counter-terrorist financing measures: South Africa, FATF.

[48] The IDC consists of representatives from the Companies and Intellectual Property Commission; the Department of Public Service and Administration; the Master’s Office; the Department of Trade and Industry; the Department of Social Development; the Directorate for Priority Crime Investigations; the Estate Agencies’ Affairs Board; the FIC; the Financial Services Board; the Independent Regulatory Board of Auditors; the Law Society of South Africa; the National Gambling Board; the National Intelligence Coordinating Council; the National Treasury; the National Prosecuting Authority; and the South African Revenue Service.

[49] “President Cyril Ramaphosa: 2022 State of the Nation Address”, Government of South Africa, 10 February 2022, https://www.gov.za/speeches/president-cyril-ramaphosa-2022-state-nation-address-10-feb-2022-0000.

[50] “Administration of Trusts”, the Master of the High Court, the Department of Justice and Constitutional Development, Republic of South Africa, 2013, https://www.justice.gov.za/master/trust.html.

[51] For a detailed discussion of the BO considerations of trusts, please see: Krige and Wolmarans, An introduction to trusts in South Africa: A beneficial ownership perspective.

[52] Olivier et al., Trust Law and Practice.

[53] FICA lists all accountable institutions in Schedule 1. See: “Financial Intelligence Centre Amendment Act (FICA) No.1 of 2017”, https://www.fic.gov.za/Documents/FICA_Act%201%20of%202017.pdf.

[54] “The Constitution of the Republic of South Africa, 1996”, Section 14, https://www.justice.gov.za/legislation/constitution/saconstitution-web-eng.pdf.

[55] “Protection of Personal Information Act (POPIA) No. 4 of 2013”, Section 39, https://www.gov.za/sites/default/files/gcis_document/201409/3706726-11act4of2013protectionofpersonalinforcorrect.pdf.

[56] “POPIA”, Section 2.

[57] For a more extensive analysis of the privacy and data protection implications of BOT in South Africa, please see: Amanda Manyame, “Beneficial ownership transparency and data protection in South Africa”, Open Ownership, December 2022, https://www.openownership.org/en/publications/beneficial-ownership-transparency-and-data-protection-in-south-africa.

[58] “POPIA”, Sections 34 and 35.

[59] “POPIA”, Section 37.

[60] “POPIA”, Section 37(2).

[61] “POPIA”, Section 107.

[62] “FICA”, Sections 27 to 31.

[63] “FICA”, Section 33.

[64] “FICA”, Section 40 (1)(a).

[65] “FICA”, Section 40(1)(b).

[66] “FICA”, Section 68(2).

[67] “FICA”, Section 68 (1).

[68] “FICA”, Regulation 16.

[69] “Companies Act No. 71 of 2008”, Section 50, https://www.justice.gov.za/legislation/acts/2008-071amended.pdf.

[70] “Companies Act”, Section 56.

[71] Dewald van Rensburg, “Who is really behind the R2-billion Tongaat Hulett bid?”, amaBhungane, 13 April 2022, https://amabhungane.org/stories/220413-who-is-really-behind-the-r2-billion-tongaat-hulett-bid/; Dewald van Rensburg, “Update: Regulator fed ‘incorrect or incomplete’ information in RudlandTongaat takeover”, 3 June 2022, amaBhungane, https://amabhungane.org/stories/220603-regulator-fed-incorrect-or-incomplete-information-in-rudland-tongaat-takeover/.

[72] Rob Rose, “ROB ROSE: Behind Tongaat’s stormy vote”, 20 January 2022, BusinessLIVE, https://www.businesslive.co.za/fm/opinion/editors-note/2022-01-20-rob-rose-inside-tongaats-stormy-vote/.

[73] See: “General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Act No. 22 of 2022”, https://www.gov.za/sites/default/files/gcis_document/202212/47815anti-moneylaunderingact22of2022.pdf.

Next page: Considerations for implementing beneficial ownership transparency of trusts reform