Coverage of corporate vehicles in beneficial ownership disclosure regimes

Overview

Policymakers and agencies involved in designing and implementing beneficial ownership transparency (BOT) reforms must set out which corporate vehicles are covered by the disclosure requirements to report information on their beneficial ownership (BO) to a government register. The term corporate vehicles refers to entities and arrangements through which commercial activities are conducted and assets are held, including different types of corporations, limited liability companies (LLCs), partnerships, associations, foundations, trusts, and national variations of these. [1]

In any BO disclosure regime, its scope – or coverage – plays a central role in its potential impact. To implement BOT reforms effectively, the coverage of a regime must be broad enough to meet a jurisdiction’s policy aims. Therefore, those designing reforms should first establish which corporate vehicles are relevant to a jurisdiction’s policy aims, and include these in the scope of disclosure requirements. All corporate vehicles through or by which assets can be owned, benefitted from, and controlled can be used in ways that potentially undermine the achievement of policy aims associated with BOT, including combating money laundering.

To generate actionable and usable data across the widest set of policy aims, BO disclosure requirements should apply to all corporate vehicles, whilst allowing for reasonable and narrowly applied exemptions. Those implementing reforms should pay specific attention to:

- considering coverage jointly with the definition of beneficial ownership;

- corporate vehicles both with and without distinct legal personalities;

- potentially shifting risk to exempt corporate vehicles through the risk-based approach;

- foreign corporate vehicles, the risks they pose outside their home jurisdictions, and the disclosure requirements in and availability of information from their jurisdictions of incorporation;

- rarely-used and unique entity types that can be misused in a manner that undermines the achievement of policy aims; and

- specific challenges posed by state-owned enterprises and not-for-profit organisations.

After determining which corporate vehicles are in the scope of BO disclosures, policymakers designing BOT reforms should consider creating limited and narrowly interpreted exemptions from disclosing beneficial ownership, which may be reasonable in cases where:

- certain corporate vehicles are already disclosing adequate and up-to-date information on ownership and control to a third-party body that is regulated or subject to supervision, and that maintains and performs reporting and oversight;

- the information that is being disclosed to this third-party body is as easily accessible to all relevant data user groups as it would be through a government register; and

- complying with the disclosure requirements is impossible or excessively difficult for certain corporate vehicles.

A regime’s coverage should be set out in law using primary and secondary legislation. Policymakers designing BOT reforms should consider:

- establishing a robust legal definition of beneficial ownership covering current and potential future ways in which ownership and control can be exercised over corporate vehicles;

- placing an unambiguous requirement using broad language on corporate vehicles to disclose beneficial ownership in primary legislation;

- future-proofing legislation for changes in the ways in which ownership and control can be exercised through corporate vehicles; and

- providing additional details and enabling an iterative approach through secondary legislation.

Any exemptions should be set out in law. The following are key considerations:

- making exemptions explicit and specific;

- creating a legal obligation on exempt corporate vehicles to declare the basis for their exemption and provide minimum information;

- balancing the level of detail to include in primary versus secondary legislation and regularly reassessing exemptions; and

- harmonising exemptions with any complementary policies to ensure clarity, legibility, and coherence of the BO disclosure regime.

Policymakers should consider developing clear guidance based on legislation and regulations to help those responsible for disclosing information understand the requirements and comply with reporting obligations, keeping in mind:

- separate guidance may be required for different categories of corporate vehicles, especially where the application of the definition of beneficial ownership is more complex or unique;

- differentiated reporting requirements may be needed for corporate vehicles with less common ownership and control mechanisms.

Finally, those implementing reforms can consider the following to ensure the data system is fit for purpose, meaning that it can completely and accurately capture and store BO information for all relevant corporate vehicles:

- making information interoperable and accessible through a central location and using a whole-of-government approach to verification;

- allowing for sufficient detail to be captured on corporate vehicles that are both covered by and exempt from reporting requirements; and

- collecting the minimum information necessary about exempt entities, both those operating in the country and where they are part of an ownership chain, to ensure they are identifiable and information on ownership and control held by a third party can be found.

The coverage of corporate vehicles is a core tenet of the Open Ownership Principles for effective beneficial ownership disclosure (OO Principles), as it ensures all relevant corporate vehicles are included within the scope of disclosure requirements. [2] The OO Principles are a framework for considering the elements that influence whether the implementation of reforms to improve the BOT of corporate vehicles will lead to effective BO disclosure by generating high-quality and reliable data, maximising usability.

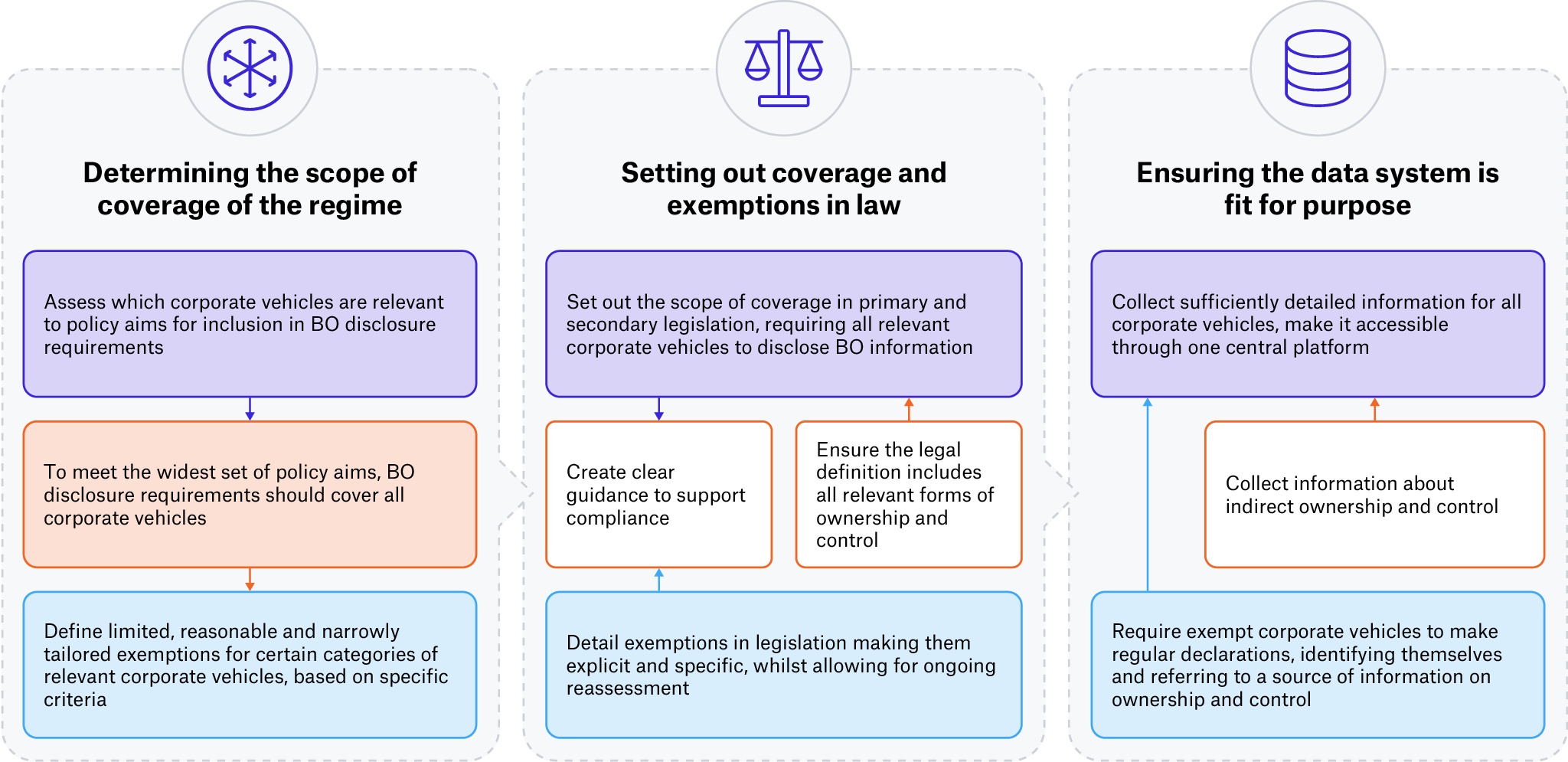

Figure 1. Setting out the coverage of corporate vehicles in a BO disclosure regime

This diagram summarises the main stages involved in setting out the scope of coverage of a BO disclosure regime. It includes key elements that policymakers and agencies with implementation responsibilities should consider at each stage. This illustration focuses on implementing comprehensive coverage to generate actionable and usable data on beneficial ownership across the widest set of policy aims. Further considerations are detailed in this briefing.

Notes

[1] “Corporate vehicles” is a policy term with varying definitions. The definition used here combines elements from the Organisation for Economic Co-operation and Development (OECD) and the World Bank. Sources: Emile van der Does de Willebois, Emily M. Halter, Robert A. Harrison, Ji Won Park, and J.C. Sharman, The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About It (Washington D.C.: The World Bank, 2011), 11, https://star.worldbank.org/sites/star/files/puppetmastersv1.pdf; OECD, Behind the Corporate Veil: Using Corporate Entities for Illicit Purpose (Paris: OECD, 2002), 12-13, https://www.oecd.org/corporate/ca/43703185.pdf.

[2] For more information, see: Open Ownership, Principles for effective beneficial ownership disclosure (s.l.: Open Ownership, 2023), https://www.openownership.org/en/principles/.

Next page: Defining coverage according to a jurisdiction’s policy aims