Coverage of corporate vehicles in beneficial ownership disclosure regimes

Defining coverage according to a jurisdiction’s policy aims

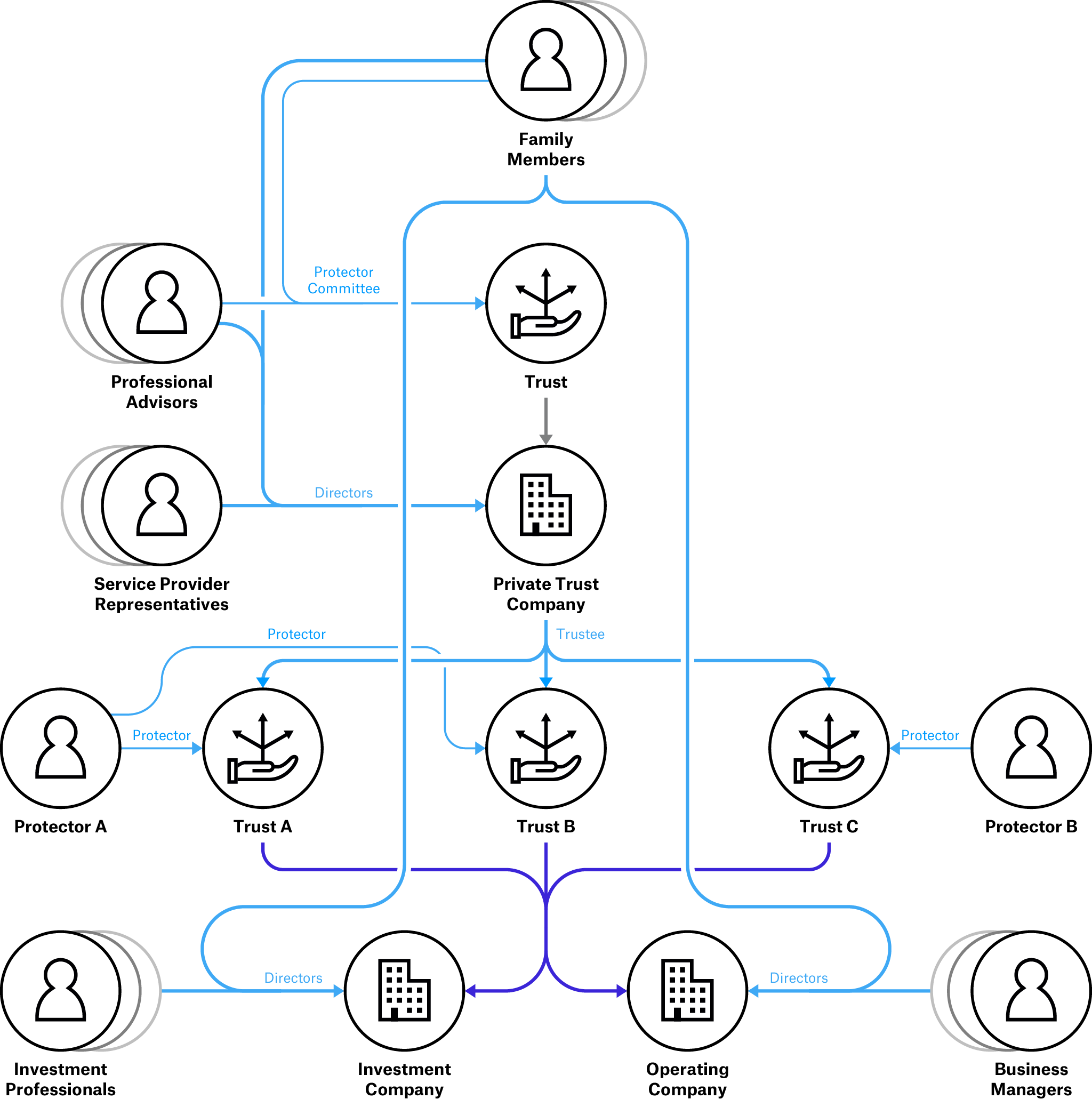

Throughout history, different types of corporate vehicles have emerged in various jurisdictions for a range of purposes, with specific rights and obligations. Corporate vehicles are central to modern society and fundamental to facilitating certain social and commercial activities (see, for example, Figure 2). To enable this, many corporate vehicles have distinct powers, including: the ability to own or control assets, such as bank accounts and other corporate vehicles; enter into contracts; confer the benefits of ownership from one individual to another; or offer natural persons limited liability.

Figure 2. Example of a structure using various corporate vehicles for asset planning and investment

Adapted from: Van der Does de Willebois et al. [3] The original illustration is based on material presented by a member of the Society of Trust and Estate Practitioners (STEP) at the STEP Caribbean Conference CC10 in Bridgetown, Barbados, 25 May, 2010. The information contained in this diagram is compiled on a best efforts basis and may not be not exhaustive or complete.

Whilst specific rights attached to corporate vehicles enable them to meet their purpose, these rights can also be misused, for example, to evade taxes or conceal a conflict of interest between a political figure and a company bidding for a government contract. Requiring corporate vehicles to disclose information about their ultimate beneficial owners helps ensure that jurisdictions collect the information they need in order to increase oversight and accountability.

The policy aims a jurisdiction is pursuing through BOT reforms should directly inform the scope of disclosure requirements. Whilst they benefit a wide range of potential aims, all BOT reforms fundamentally relate to the acquisition, possession, and movement of assets, the ownership and control of which confers material benefits to individuals and creates opportunities to exercise influence. The ability to privately benefit from assets is connected to various public interests and obligations, such as generating economic growth and tax revenue.

A key policy driver of BOT reforms in many jurisdictions is anti-money laundering and countering the financing of terrorism (AML/CFT). Many lessons from the effective implementation of BOT for AML/CFT are also relevant to other policy areas, including extractive industries governance; [4] improving public procurement; [5] protecting national security; [6] creating an enabling business environment; [7] and increasing domestic revenue collection. [8]

This briefing outlines the considerations for ensuring the coverage of corporate vehicles in a BO disclosure regime allows it to meet the widest range of policy aims. Effective implementation of BOT generates high-quality, reliable BO information that is actionable, auditable and usable, for instance for enforcing and complying with financial sanctions, investigating financial crime and onboarding suppliers as part of automated business processes. The briefing takes into account global standards, including the recommendations of the Extractive Industries Transparency Initiative (EITI) and the Financial Action Task Force (FATF).

Notes

[3] Van der Does de Willebois et al.,The Puppet Masters, 56.

[4] Over 50 resource-rich countries committed to the EITI Standard are required to implement BOT in their extractive sectors. See: EITI, The EITI Standard 2019: The global standard for the good governance of oil, gas and mineral resources (Oslo: EITI, 2019), https://eiti.org/sites/default/files/2022-03/EITI%20Standard%202019%20EN.pdf.

[5] Countries such as Kenya, Slovakia, and Ukraine use BOT to detect conflicts of interest and fraud in public procurement, and to increase public oversight and accountability. Recognising the link between procurement corruption as a predicate crime to money laundering, the international anti-money laundering standard setting body, the Financial Action Task Force (FATF), states “countries should ensure public authorities [...] have timely access to basic and beneficial ownership information [...] in the course of public procurement”. See: Tymon Kiepe and Eva Okunbor, Beneficial ownership data in procurement (s.l.: Open Ownership, 2021), https://www.openownership.org/en/publications/beneficial-ownership-data-in-procurement/ and FATF, The FATF Recommendations: International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation (Paris: FATF, 2023), 94, https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Fatf-recommendations.html.

[6] See: Tymon Kiepe, Using beneficial ownership data for national security (s.l.: Open Ownership, 2021), https://www.openownership.org/en/publications/using-beneficial-ownership-data-for-national-security/.

[7] For example, Latvia’s BO register “is equally important for ensuring a safe and transparent business environment, allowing entrepreneurs to check business partners [...]”. See: Ministry of Justice, “Latvija vērtēs uzņēmumu faktisko īpašnieku publiskas pieejamības regulējumu”, LV portāla, 25 November 2022, https://lvportals.lv/dienaskartiba/346829-latvija-vertes-uznemumu-faktisko-ipasnieku-publiskas-pieejamibas-regulejumu-2022 and Sadaf Lakhani, The use of beneficial ownership data by private entities (s.l.: Open Ownership, 2022), https://www.openownership.org/en/publications/the-use-of-beneficial-ownership-data-by-private-entities/.

[8] For resources on anti-corruption, see: Alanna Markle, Early impacts of public beneficial ownership registers: Ukraine (s.l.: Open Ownership, 2022), https://www.openownership.org/en/publications/early-impacts-of-public-beneficial-ownership-registers-ukraine/ and Tymon Kiepe and Alanna Markle, Who benefits? How company ownership data is used to detect and prevent corruption (s.l.: EITI and Open Ownership, 2022), https://www.openownership.org/en/publications/who-benefits-how-company-ownership-data-is-used-to-detect-and-prevent-corruption/. For resources on tax, see: Inter-American Development Bank (IDB) and OECD, Building Effective Beneficial Ownership Frameworks: A joint Global Forum and IDB Toolkit (s.l.: IDB and OECD, 2021), 4, https://www.oecd.org/tax/transparency/documents/effective-beneficial-ownership-frameworks-toolkit_en.pdf.