Shining a light on company ownership: The role of beneficial ownership transparency in the energy transition

Changing context for beneficial ownership transparency reform

The speed and scale of government spending to tackle the pandemic increased the risks of fraud and corruption and the demand for transparency in the beneficial ownership of companies – at the minimum those receiving taxpayer money. The pandemic highlighted the dependence of private companies on government, as well as their role in dealing with and solving crises. The impacts of the climate crisis and climate-related policies could be even more profound, and will change the context for beneficial ownership transparency reforms. A focus on transparency in the COVID-19 recovery and beyond is critical, as it coincides with the period in which countries are laying the groundwork to achieve energy transitions that promote both economic prosperity and social equity.

Increased attention to risk and resilience during the COVID-19 pandemic

The profound social, economic and political effects of the COVID-19 pandemic altered the landscape in which beneficial ownership transparency reform is taking place, creating both risks and opportunities. From the start of the pandemic, international bodies such as the United Nations highlighted the heightened risks of corruption, [11] and of financial crimes such as embezzlement of recovery funds, money laundering, terrorist financing and fraud.[12]

“The amount of resources necessary to ensure public health and safety coupled with the need to respond quickly to rapidly evolving challenges has increased opportunities for corruption.” - Evaluation of G20 countries by the United Nations Office on Drugs and Crime (UNODC) [13]

At the same time, international institutions have noted that the recovery from the COVID-19 crisis offers an opportunity to build greater societal resilience and strengthen countries’ ability to tackle future challenges, including the need to reduce greenhouse gas emissions by accelerating the energy transition. Beneficial ownership transparency is one among a set of policy reforms that can help safeguard against good governance failures and opportunistic crime, by making it clear – to government, business and the public – who is on the receiving end of financial flows within both the public and private sectors. Such a measure is most effective when it is in place in advance of a crisis, and can help maintain citizens’ trust that resources are being well spent; for example, in public procurement.

Beneficial ownership transparency is a priority for the international community

The United Nations Office on Drugs and Crime (UNODC) recommends that countries integrate beneficial ownership transparency requirements into their crisis response, recommending countries “develop and implement clear guidelines that manage potential conflicts of interest and help to ensure beneficial ownership transparency.”[14] Meanwhile the G20 Anti-Corruption Action Plan 2022-2024, includes beneficial ownership transparency in its “substantive priorities,” pointing to the linkage between beneficial ownership transparency and procurement transparency. The Action Plan seeks to build on lessons learned in the COVID-19 crisis to increase societal resilience going forward, and notes that:

“...the international community is experiencing a major health crisis with devastating effects on the global economy. With recovery comes the opportunity to lay the foundation for a sustainable, transparent and inclusive recovery.”[15]

The G20 also cites recommendations from the Financial Action Task Force (FATF), the anti-money laundering standard-setting body for the international community.[16] In early 2022, FATF strengthened its Recommendation 24 relating to the transparency of beneficial ownership of legal persons after a two-year review. The revisions mark a significant shift, requiring that beneficial ownership information is verified, and is made available through a central register or alternative mechanism that also ensures adequate, accurate and up-to-date information.[17]

The ongoing threats caused by COVID-19

As the COVID-19 crisis and recovery continue, heightened risks for corruption persist, especially in the energy sector. For example, the UNODC anticipates that professional money launderers will increase their activities in the recovery phase of the pandemic.[18] Some countries also stressed that a potential increase in the use of businesses and shell companies based in offshore jurisdictions with weak anti-money laundering policies is a long-term trend.[19]

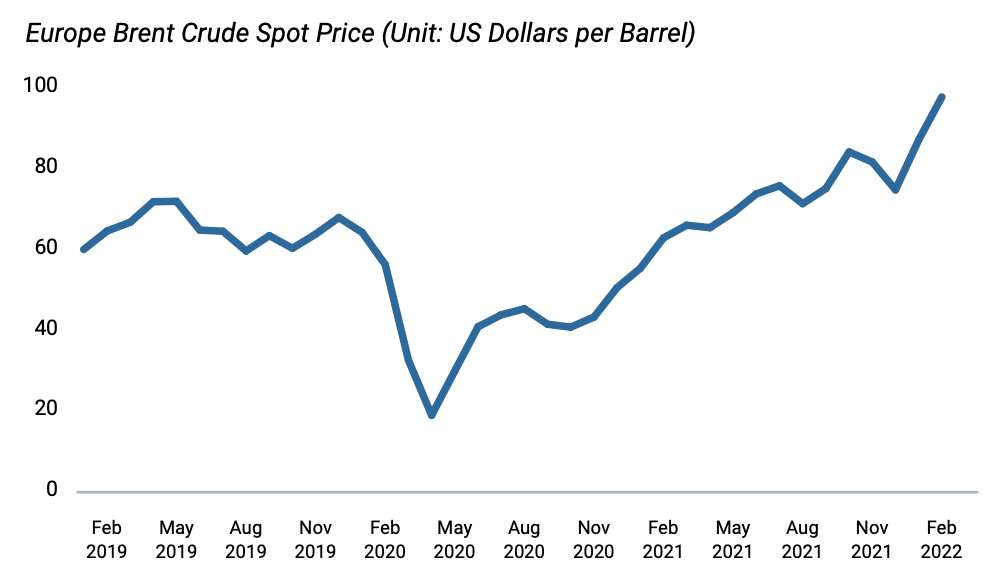

Rapid oil price collapse and large capital outflows from oil-producing countries during the pandemic also heightened the risk of illicit financial flows. For example, capital outflows from a selected number of African oil-producers reached the record level of USD 100 billion in the early months of the pandemic, as banks sought to de-risk.[20] Fiscal measures were adopted with expediency to deal with the economic and social crisis in contexts where administrative oversight, and audit functions were already overstretched.[21] The picture is complicated and varies by context — in some cases, the fall in oil prices appears to have constrained patronage and corruption possibilities in kleptocratic regimes.[22]

However, the rebound in oil and gas prices and the energy crisis that is unfolding around the Russia-Ukraine conflict has again put questions of company ownership in the energy sector firmly into public focus. The pressures of pandemic recovery may be further exacerbated by the emerging energy crisis resulting from the conflict, as well as continued volatility in commodity prices – not only oil and gas but also grain and other food stuffs. This creates a challenging context in which to mobilise resources to accelerate the energy transition.

While outside the scope of this brief, sanctions targeting Russian interests in the wake of the Ukraine invasion have further highlighted the need for transparent ownership around energy companies and their investments. As many investors seek to address near term pressures and pivot to the renewable energy sector, it is important that beneficial ownership transparency features as a key instrument in curbing illicit financial flows.

Figure 2. Crude oil price, 2019-2022

Source: US Energy Information Administration (March 2022), “Petroleum & Other Liquids: Spot Prices.”

In mining operations, the COVID-19 pandemic introduced greater complexity into the opportunities for, and monitoring of, corruption. For example, in Madagascar air travel restrictions led to the delinking of global and local prices for some minerals. Gold prices plummeted locally even as they reached global highs. This had the effect of undermining community-based anti-corruption initiatives, as some local producers were forced into illicit activities and unsustainable extraction practices due to extreme economic hardship.[23] Mobility limitations related to government lockdowns and air travel restrictions also limited observers’ access to mining sites.[24] Competition for critical minerals related to the energy transition is now intensifying, with a sustained growth in global demand. This raises the risk of short-term contracts being granted by governments, without adequate public oversight or beneficial ownership information being required, recorded or stored.

The world turns its attention to the climate crisis

Even as the economic effects of the pandemic endure, and despite the impact of the Russia-Ukraine conflict, attention is increasingly turning to addressing the climate crisis. Opportunities for reform have emerged from the COVID-19 context that are closely related to the global agenda of tackling climate change and financing the energy transition. Some policymakers and investors experienced the COVID-19 crisis as a wake-up call that highlighted the urgent need for a different approach to investing, and parallels have been drawn between the unforeseen risks of a pandemic and the risks of climate change.[25] For example, investors such as those involved in initiatives like the Glasgow Financial Alliance for Net Zero [26] and the Council for Inclusive Capitalism [27] have increased their focus on pushing for companies worldwide to commit to corporate social responsibility and environmental, social and governance (ESG) standards.

A just energy transition requires beneficial ownership transparency

The energy transition represents a new policy context in which future beneficial ownership transparency reforms will take place. This context is especially relevant for countries with large industries linked to energy value chains because the transition refers to a movement away from the primary use of non-renewable resources such as fossil fuels, to clean energy sources, such as wind and solar power.[28] While often referred to as a single change, in practice it will comprise a complex series of shifts occurring in parallel around the world through a combination of policy interventions and market forces.

Numerous national commitments and guidance documents address the techno- economic features of the energy transition, and international bodies such as the United Nations (UN) and International Energy Agency (IEA) [29] also increasingly point to the need to address social and governance aspects of the transition.

“Based on the concept of ‘leaving no one behind’, a just and inclusive energy transition will enhance human well-being, health, and capabilities, increase resilience, and drive innovation towards a sustainable society at all levels, while also driving huge investments.” - United Nations: Theme Report on Enabling SDGs through Inclusive, Just Energy Transitions.[30]

Reliable and easily accessible company ownership information is a resource which governments can use to help ensure citizens’ trust is maintained through the energy transition, and that the huge investments involved in the transition are accompanied by robust oversight. Governance failures such as corruption and tax evasion undermine governments’ ability to ensure that the benefits of the transition will be fairly distributed. A lack of transparency risks the diversion of benefits from the transition away from communities, and towards politically exposed persons and bad actors, due to the interference of vested interests. For these reasons, measures to ensure transparency and accountability are a prerequisite to delivering a just transition.

Endnotes

11. The International Monetary Fund, the Organisation for Economic Co-operation and Development, the World Economic Forum, the World Health Organization, the World Bank, the Council of Europe’s Group of States against Corruption, the European Ombudsman, and the United Nations Office on Drugs and Crime all made calls in 2020 for countries to increase vigilance and the integration of anti- corruption programming. Please refer to https://www.unodc.org/pdf/corruption/G20_Compendium_COVID-19_FINAL.pdf for more information. Page accessed on 10 February 2022.

12. Examples of vulnerabilities in systems to counter money laundering, terrorist financing and fraud include work from home orders limiting financial intelligence units’ access to intelligence systems and would-be criminals’ perception of impunity. Please refer to https://www.unodc.org/documents/Advocacy-Section/EN_-_UNODC_-_MONEY_LAUNDERING_AND_COVID19_-_Profit_and_Loss_v1.1_-_14-04-2020_-_CMLS-COVID19-GPML1_-_UNCLASSIFIED_-_BRANDED.pdf for more information. Page accessed on 12 February 2022.

13. UNODC (October 2020), Good Practices Compendium on Combating Corruption in the Response to COVID-19, p. 8. Retrieved from https://www.unodc.org/pdf/corruption/G20_Compendium_COVID-19_FINAL.pdf on 10 February 2022.

14. UNODC (no date), Corruption and COVID-19: Challenges in Crisis Response and Recovery, p. 12. Retrieved from https://www.unodc.org/documents/Advocacy-Section/COVID-19-Crisis-responserecovery-WEB.pdf on 11 February 2022.

15. G20 Anti-Corruption Working Group (no date), “Anti-Corruption Action Plan 2022- 2024”, Retrieved from https://www.unodc.org/documents/corruption/G20-Anti-Corruption-Resources/Action-Plans-and-Implementation-Plans/2021_G20_Anti-Corruption_Plan_2022-2024.pdf on 11 February 2022.

16. G20 Anti-Corruption Working Group (no date), “Anti-Corruption Action Plan 2022- 2024”, p. 2.

17. FATF (March 2022), “Public Statement on revisions to R.24”, FATF Recommendations. Retrieved from https://www.fatf-gafi.org/publications/fatfrecommendations/documents/r24-statement-march-2022.html on 5 March 2022.

18. UNODC (April 2020), “Money Laundering and COVID-19: Profit and Loss.” Retrieved from https://www.unodc.org/documents/Advocacy-Section/UNODC_-_MONEY_LAUNDERING_AND_COVID19_-_Profit_and_Loss_v1.1_-_14-04-2020_-_CMLS-COVID19-GPML1_-_UNCLASSIFIED_-_BRANDED.pdf on 11.02.2022.

19. UNODC (October 2020), Good Practices Compendium on Combating Corruption in the Response to COVID-19, p. 49.

20. Angola, Ghana, Kenya, Nigeria, South Africa and Zambia. Source: Porter, D. and C. Anderson (2021), Illicit Financial Flows in Oil and Gas Commodity Trade: Experience, Lessons, and Proposals, IFFs and Oil Commodity Trading Series, OECD, p. 12. Retrieved from https://www.oecd.org/development/accountable-effective-institutions/illicit-financial-flows-oil-gas-commodity-trade-experience.pdf on 24 February 2022.

21. Ibid.

22. GIllies, A. (March 2021), A Pandemic and a Price Plunge: Oil-Rich Kleptocracies in Uncertain Times, Global Insights Series. Retrieved from https://www.ned.org/wp-content/uploads/2021/03/Pandemic-Price-Plunge-Oil-Rich-Kleptocracies-Uncertain-Times-Gillies-March-2021.pdf on 1 March 2022.

23. Klein, B. and S. Mullard (September 2021), “The unusual impacts of Covid: Reflections on the links between demand, extraction, conservation, and corruption”, World Wildlife Fund. Retrieved from https://www.worldwildlife.org/pages/tnrc-blog-the-unusual-impacts-of-COVID-reflections-on-the-links-between-demand-extraction-conservation-and-corruption on 22 February 2022.

24. Bainton, N., Owen, J.R. and D. Kemp (2020), Invisibility and the extractive-pandemic nexus, The Extractive Industries and Society, vol. 7, issue 3, pp. 841-843. Retrieved from https://www.sciencedirect.com/science/article/pii/S2214790X20301490 on 22.02.2022.

25. J.P. Morgan (July 20202), “Why COVID-19 Could Prove to Be a Major Turning Point for ESG Investing”. Retrieved from https://www.jpmorgan.com/insights/research/covid-19-esg-investing on 10 February 2022.

26. Please refer to https://www.gfanzero.com for more information. Page accessed 10 February 2022.

27. Please refer to https://www.inclusivecapitalism.com/just-energy-transition-company-framework/ for more information. Page accessed 10 February 2022.

28. Energy transitions have taken place multiple times over the course of history, and are defined as “a change in the primary form of energy consumption of a given society. E.g., the historic transition from wood to coal and then to oil and gas in industrial Europe.” Source: Cleveland C.J. and Morris, C (2015), Dictionary of Energy (Second Edition). Retrieved from https://www.sciencedirect.com/topics/engineering/energy-transition on 4 February 2022.

29. Please refer to https://www.iea.org/reports/recommendations-of-the-global-commission-on-people-centred-clean-energy-transitions for more information. Page accessed 10 February 2022.

30. United Nations (2021), Theme Report on Enabling SDGs through Inclusive, Just Energy Transitions, Executive Summary, p. 1. Retrieved from https://www.un.org/sites/un2.un.org/files/2021-twg_3-exesummarie-062321.pdf on 10 February 2022.

Next page: Building transparency and accountability into the energy transition