Shining a light on company ownership: The role of beneficial ownership transparency in the energy transition

Building transparency and accountability into the energy transition

The shift to clean energy as the primary source of energy globally requires a profound transformation for countries rich in the raw materials on which the world’s energy systems rely — many of which are emerging economies. The movement away from fossil fuels will create risks for countries whose economies rely on oil, gas and coal, such as lost revenue and an erosion of both the quantities and standards of investment. Meanwhile, the anticipated boom in the critical minerals sector could replicate some of the governance risks experienced in fossil fuel extraction.

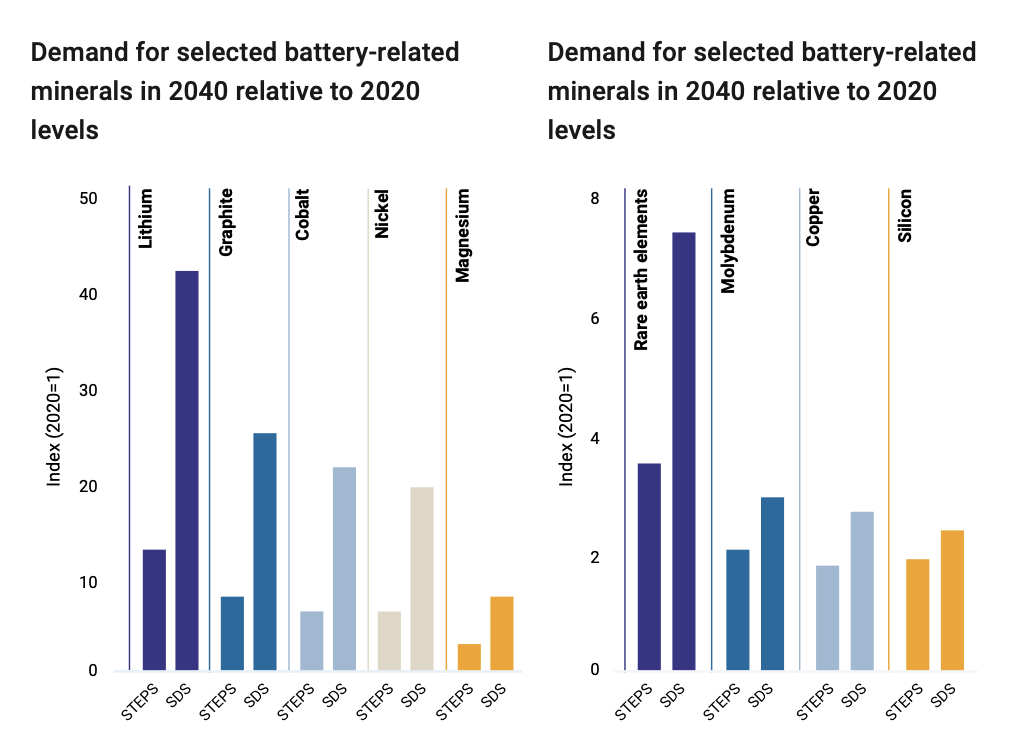

Figure 3. Projected growth in demand for selected renewables and minerals

Source: Reproduced from IEA (2021), The Role of Critical Minerals in Clean Energy Transitions, Overview.

Aggregate mineral demand from a range of clean energy technologies, under the IEA’s Stated Policies Scenario (STEPS) and the Sustainable Development Scenario (SDS). The IEA notes that projected mineral demand is dependent on the stringency of climate policies (reflected in the difference between STEPS and SDS) and technology development pathways.

Political and economic challenges such as illicit financial flows (IFFs) [31] and corruption, conflict and weak governance have historically been associated with reliance on natural resource wealth. Under resource curse theory, these challenges are seen as specific to resource rich countries due to a lack of public monitoring and oversight of government spending.[32] While there is much debate about the nature and causality of the resource curse, it is clear that the anticipated rise in demand for critical minerals means the debate about the potential role of natural resources in development is as relevant as ever. Additional effort and resourcing is needed on the part of governments, companies and civil society to build accountability into the clean energy sector, and will be more effective the earlier it starts.

As countries wind-down the production of fossil fuels, beneficial ownership transparency can continue to help prevent corruption and IFFs, and can help strengthen revenue generation and build citizens’ trust. Building on lessons learned in non-renewables, beneficial ownership transparency should also be part of the architecture of clean energy value chains, from critical minerals production to electricity distribution, and as one means of supporting effective natural resource governance. Finally, beneficial ownership information can be an asset to companies and investors seeking to contribute to a just energy transition through ESG commitments and emissions standards.

The role of beneficial ownership transparency in the shift away from fossil fuels

Combating corruption in resource-rich countries

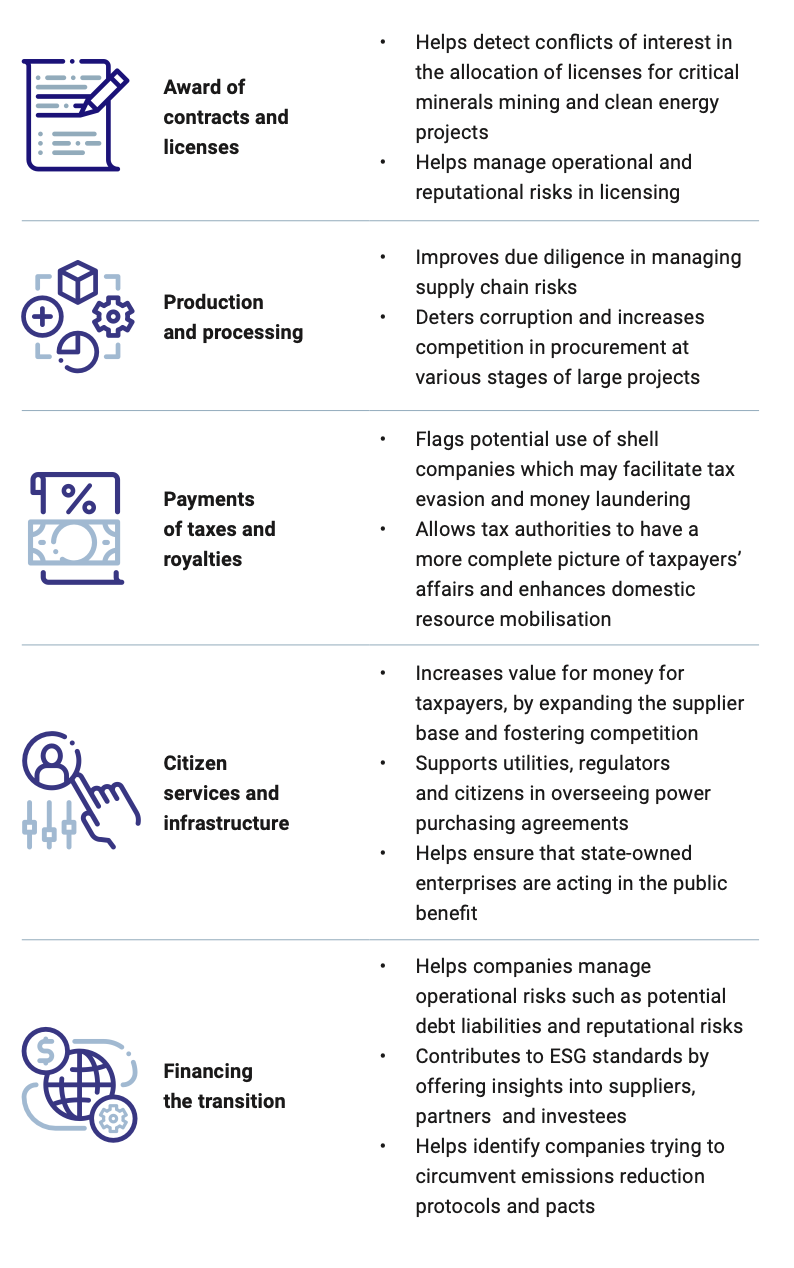

Tackling corruption is critical to ensuring natural resources are used responsibly, and in a way that promotes sustainable development.[33] Corruption risks exist along non-renewable energy value chains, from the awarding of mineral, oil and gas rights, to the regulation and management of operations.[34] To help combat corruption, beneficial ownership information should be made available at each stage. For instance, transparency in the beneficial owners of companies awarded mining rights helps deter bribery and detect conflicts of interest.[35] Experience reveals that to be effective, anti-corruption efforts need to go beyond transparency, to include active measures to ensure information is deployed to increase accountability.[36] Measures are most impactful when they are supported by public officials and cultivate broad civic participation. Interventions like the Opening Extractives programme have taken such lessons on board and embedded them in both objectives and methodology.

Prioritising beneficial ownership in extractives

Opening Extractives is an ambitious global programme aiming to transform the availability and use of beneficial ownership data for effective governance in the extractive sector.

The programme provides sustained, multi-year support to around 10 partner countries to disclose the ownership of extractive companies. It aims to catalyse the use of this data to improve natural resource governance.

The programme combines political and technical engagement, to support countries implementing beneficial ownership reforms and to enable the use of the data by governments, civil society and companies. It is run jointly by the EITI and Open Ownership.

Findings and evidence from the programme will be communicated globally, leveraging the tools and knowledge developed to drive impact beyond the focus countries.

By the end of 2025, the programme aims to deliver clear improvements to domestic resource mobilisation from the extractive sector in partner countries. It targets three key outcomes:

- Ensure government, industry and civil society actors have greater access to comprehensive and reliable information on the ultimate owners of extractive industry companies.

- Enable government, industry and civil society actors to more easily identify and address the risks related to hidden ownership, which may include corruption and mismanagement.

- Advance beneficial ownership transparency in the extractive industries and beyond in a world altered by COVID-19, by documenting and communicating the impact and outcomes of the programme.

Stemming illicit financial flows

Corruption siphons away natural resource revenues, while IFFs represent the movement of these funds across borders. The long-term structural decline of the fossil fuel industry in the energy transition is anticipated to carry a high risk of IFFs.[37] Actors involved in extractives have long employed practices that create opacity in their ownership, as a means of evading taxes and hiding ties to government officials.[38] This includes reporting nominal or proxy owners rather than beneficial owners, and setting up complex ownership structures [39] spanning offshore financial centres (OFCs) with little or no transparency requirements.[40] According to the OECD, large independent oil traders’ use of OFCs is both exceptional and largely unexplained:

“While OFCs are a controversial though established feature of globalisation, among the top 100 global corporations, an average of just 18% of their group subsidiaries are owned via OFC-based holding companies. By contrast, 97% of independent [oil] trading companies’ subsidiaries are owned via OFC-based holding companies.” - Organisation for Economic Co-operation and Development [41]

Beneficial ownership transparency can help stem IFFs related to fossil fuel extraction through shell companies posing as legitimate corporate vehicles, even as the production of these resources decreases. Beyond disclosure, there is also a need for verification systems that can confirm the identity of individuals named as beneficial owners on a register, [42] since mis-reporting is still common practice in some resource-rich countries.[43]

Strengthening domestic resource mobilisation

Reducing global demand for fossil fuels is central to the energy transition, but emerging economies with large fossil fuel deposits still need the opportunity to grow and invest in human development.[44] This requires effective domestic resource mobilisation, including to help ensure that countries can manage their energy transition fairly, such as supporting vulnerable groups like those working in extractives who face a loss of livelihood. For countries with lucrative extractive industries and a high degree of dependence on fossil fuels, lost revenue in the transition presents an enormous challenge.

For example, in Nigeria about 65% of government revenues come from the oil and gas sector, with the total revenue flow from all sources coming to USD 32.6 billion in 2018.[45] As the energy shift takes place, beneficial ownership transparency can support effective domestic resource mobilisation from remaining fossil fuel activities.

For example, the OECD notes that beneficial ownership is key to tax transparency:

“ The availability of legal and beneficial ownership information, accounting and banking information, the access to that information and its effective exchange with foreign partners… allows tax authorities to have a complete picture of taxpayers’ affairs to address the issue of tax evasion and enhance domestic resource mobilisation (DRM). Beyond tax evasion, tax transparency is also a powerful weapon against other forms of IFFs such as corruption and money laundering.”[46]

Ensuring state-owned enterprises operate for public benefit

Finally, particular attention should be paid to state-owned enterprises (SOEs), such as national oil companies. The beneficial ownership of an SOE like a national oil company can be highly complex, but is important, for it offers citizens an assurance that the enterprise is being run for public benefit, and also gives companies the market information they need for effective planning.[47] The OECD anticipates that national oil companies will increasingly play a role in raising the capital to respond to macro-fiscal crises that arise in fossil fuel-producing countries, including as a result of the pandemic.[48] The Natural Resource Governance Institute (NRGI) recommends governments take an active role in directing their national oil companies to manage economic risks associated with the energy transition.[49] NRGI also recommends that SOEs disclose their beneficial owners[50]:

“...the SOE should report their beneficial owners, including the legal name of the state body, agency or office that holds the interest. It should also identify its subsidiaries and joint ventures, and work toward disclosing the names and beneficial owners of the entities that hold shares in these entities.” - Natural Resource Governance Institute [51]

They also note that beneficial ownership data can be combined with other data, such as information about politically exposed persons, to identify potential conflicts of interest, including vested interests which may capture policy processes related to the transition.[52]

The role of beneficial ownership transparency in the shift toward clean energy

Further development of clean energy is essential to reducing greenhouse gas emissions, but it also carries social and governance risks. Some of these are similar to those that have been historically encountered in oil, gas and mining. Whilst a broad base of governance strategies are necessary to account for such risks, beneficial ownership information has a role to play in shoring up transparency and accountability mechanisms along clean energy value chains.

Table 1. The potential role of beneficial ownership transparency in clean energy value chains

Mitigating risks and pitfalls for critical minerals producers

Critical minerals sit at the base of the clean energy supply chains. These include resources such as lithium, graphite, nickel, cobalt and manganese for battery storage, copper and aluminium for electricity networks, and rare earth elements for wind turbines.[53] Developing and emerging economies are likely sources of a significant proportion of these minerals, some of which have weak governance environments. For example, the Democratic Republic of the Congo (DRC) produces around 70% of the world’s cobalt, and copper reserves are expected to be sourced from places such as the DRC, Indonesia, Mongolia and Peru.[54] The growing emphasis on this sector means there will be new entrants to the market (e.g. producers and suppliers), and foretells fresh risks in new producer countries. Where mining sector governance is already weak, countries with large critical mineral deposits may be vulnerable to corruption and political instability.[55]

The rise in demand for critical minerals could lead to a boom in mining investment. Past experience shows that mining booms can increase the incentives for corruption, rent-seeking behaviour and economic mismanagement.[56] It is important that this experience is not replicated for countries supplying critical minerals to clean energy value chains, as some warn of the possibility of a ‘green resource curse’.[57] An investment boom could also create incentives to mine in environmentally and socially sensitive areas.[58] This could make processes like environmental and social impact assessments, land acquisition and community consultations more contested, and potentially result in harm to people and the environment.

Producer and consumer countries and companies can mitigate these risks by prioritising good governance in their mineral supply chains.[59] This includes enabling the provision of and access to reliable information about the individuals investing in and benefiting from these resources’ development. Given the globalisation of energy value chains, having robust beneficial ownership reporting requirements and central, public registers in both producer and consumer countries will offer better visibility of transnational company structures and supply chains.[60] The adoption of an open data standard for the publication of beneficial ownership information, such as the Beneficial Ownership Data Standard, can help ensure national datasets are well-structured, interoperable with other (beneficial ownership) datasets, and can be easily understood by domestic and international investigators, as well as civil society, researchers and journalists.[61]

Strengthening transparency along clean energy value chains

The energy transition will lead to an increase in the deployment of clean energy projects. These could likewise face many of the same environmental, social and governance challenges that are already well documented in the oil, gas and mining sectors. Lessons learned from extractives energy governance can help anticipate and address risks in the clean energy sector, and to define standards and governance measures needed to secure a just transition.

The risk is greatest for new producer countries, where there may be less awareness of governance reforms such as beneficial ownership transparency. Countries with critical minerals may be eager to develop midstream industries, such as minerals processing and the manufacturing of battery plants, and could lower standards to attract investors. Large capital flows into such industries may attract unscrupulous actors who can influence licensing deals, such as the award of wind and solar licenses, to benefit vested interests.[62] Beneficial ownership transparency can help to mitigate the risk of politically exposed people gaining access to business opportunities in emerging clean energy industries, and can also help detect the use of shell companies for illicit purposes.

For example in Europe, midstream industries are still being developed to enable lithium production, and companies are shoring up investment to fully exploit these industries.[63] Countries such as Portugal and Serbia can provide critical sources of lithium for the emerging pan-European battery industry.[64] Continued progress will need to be made on effectively implementing beneficial ownership registers to safeguard such industries, in line with European Union Anti-Money Laundering Directives.[65]

Uncovering power purchasing agreements

Finally, the energy transition must include not just a shift to clean energy, but also the expansion of electricity access. Contracts called Power Purchase Agreements (PPAs) sit at the centre of electricity generation projects. They are decisive for effective power distribution arrangements, and poor terms can lead to damaging outcomes, such as overpayment to the supplier, overcapacity, debt and grid instability.[66] PPAs often include public sector actors and investments, but their conditions are not always disclosed.[67]

The Energy for Growth Hub, a research network of leading universities and think tanks, includes beneficial ownership data in the information that should be disclosed in PPAs because it is “essential for utilities/regulators to maintain their oversight ability and manage issues such as taxation or tort liability.”[68] Beneficial ownership information serves a similar function for PPAs as it does in procurement: mitigating against conflicts of interest, increasing value for money for taxpayers, fostering competition, and increasing accountability to the public.

Some countries have begun to take this recommendation on board. For example, in late 2021, Kenya Power began requiring suppliers to disclose their beneficial owners, to help “expose insider dealings and other potential conflicts of interest.”[69] This followed the launch of a presidential task force to review some of the country’s PPAs, and a report from the Auditor General that pointed to conflicts of interest in contracts awarded by Kenya Power and the Ministry of Energy.[70]

Monitoring private finance in the transition

Vast financial resources are being committed to the energy transition. COP26 resulted in new just transition initiatives that include government pledges [71] and voluntary commitments in the finance, industry and business sectors.[72] Beneficial ownership transparency can make private financing for the transition more transparent and accountable to the public good by supporting commitments to environmental, social, and governance standards. It can also help account for emissions attached to business activities.

New investment targets and reporting standards around sustainability are being developed for the private sector alongside countries’ commitments to reduce greenhouse gas emissions. These aim to ensure that private finance reinforces national policies, and that investors have reliable information on climate risks.

Environmental, social and governance standards

Research on the use of beneficial ownership data by the private sector shows a growing trend in voluntary standards around companies’ ESG performance, and ESG standards and frameworks can reinforce incentives to disclose and use beneficial ownership data.[73] Beneficial ownership information is used by the private sector to gain better insights into suppliers, partners, and investees.[74] This can help with managing operational risks such as potential debt liabilities, as well as reputational risks.[75]

Publicly accessible, high quality beneficial ownership data allows any investor or company to determine the true owners of companies and visualise complex transnational ownership structures, such as those that characterise energy value chains.[76] Beneficial ownership disclosure requirements offer a clear key performance indicator that could be incorporated into ESG frameworks being developed to support the energy transition, [77] as a governance standard to complement social and environmental standards. For example, beneficial ownership disclosure is included in the Global Reporting Initiative’s Oil and Gas Standard, which was launched in 2021 to help position companies to “demonstrate accountability for their impacts and how they are transitioning to a low-carbon future.” [78]

Emissions and accounting

There are rising public expectations and industry standards for companies to be held accountable for the emissions and social impacts of their value chains. Beneficial ownership transparency can help with monitoring and due diligence of company activities, and making information about who owns and benefits from business activities public can foster greater accountability and trust.

For example, under the Greenhouse Gas Protocol, companies must report three types of emissions:

- Direct emissions from sources owned or controlled by the company;

- Indirect emissions from energy that is purchased; and

- All other emissions associated with a company’s activities.[79]

Beneficial ownership information can help identify those trying to circumvent such a protocol. For example, a company could incorporate additional entities and obscure common ownership to disguise high-emission activities from a single entity. Knowing who truly owns and controls companies used in subcontracting is especially important for enabling governments and civil society groups to hold companies accountable for their commitments.[80] A similar approach should be taken for climate-related statements and pacts such as the 2021 Global Coal To Clean Power Transition Statement.[81] In this case, beneficial ownership transparency can be used to track the investments of signatory financial institutions to ensure that they are actively diversifying their portfolios away from coal and towards clean energy.

Endnotes

31. Illicit financial flows are defined as, “the movement of money across borders that is illegal in its source (e.g. corruption, smuggling), its transfer (e.g. tax evasion), or its use (e.g. terrorist financing).” Source: IMF (March 2021), “The IMF and the Fight Against Illicit and Tax Avoidance related Financial Flows”. Retrieved from https://www.imf.org/en/About/Factsheets/Sheets/2018/10/07/imf-and-the-fight-against-illicit-financial-flows on 25 February 2022.

32. More broadly, the resource curse (also known as the paradox of plenty) is the failure of many resource-rich countries to benefit fully from their natural resource wealth, and for governments in these countries to respond effectively to public welfare needs. Please refer to https://resourcegovernance.org/sites/default/files/nrgi_Resource-Curse.pdf for a brief overview. Page accessed on 24 February 2022.

33. EITI (November 2021), “Navigating the energy transition: search for common ground”. Retrieved from https://eiti.org/blog/navigating-energy-transition-search-for-common-ground on 11 February 2022.

34. OECD Development Centre (August 2016), Corruption in the Extractive Value Chain: Typology of Risks, Mitigation Measures and Incentives, Executive Summary. Retrieved from https://www.oecd-ilibrary.org/sites/9789264256569-2-en/index.html?itemId=/content/component/9789264256569-2-en on 11.02.2022.

35. EITI (June 2019), Transparency in the First Trade, p. 5. Retrieved from https://eiti.org/files/documents/eiti_commodity_trading_transparency_may2019_web_0.pdf on 11 February 2022.

36. Eisen, N. et al. (2020), The TAP-Plus Approach to Anti-corruption in the Natural Resource Value Chain, Brookings Institution. Retrieved from https://www.brookings.edu/research/the-tap-plus-approach-to-anti-corruption-in-the-natural-resource-value-chain/ on 24 February 2022.

37. Porter, D. and C. Anderson (2021), Illicit Financial Flows in Oil and Gas Commodity Trade: Experience, Lessons, and Proposals, IFFs and Oil Commodity Trading Series, OECD, p. 13.

38. Open Government Partnership Openness in Natural Resources Working Group (February 2016), “Disclosing beneficial ownership information in the natural resource sector”. Retrieved from https://opengovpartnership.org/wp-content/uploads/2019/05/FIN20OGP20Issue20Brief20BO20Disc1.pdf on 24 February 2022.

39. Ibid.

40. Tax havens are jurisdictions that allow companies and individuals to escape taxation and other financial regulation in one jurisdiction by moving their money from elsewhere, to an offshore location with fewer regulations. Tax havens are estimated to collectively cost governments at least USD 500 billion a year in lost corporate tax revenue. Source: Shaxon, N. (September 2019), Tackling Tax Havens, IMF: Finance and Development, p. 7. Retrieved from https://www.imf.org/external/pubs/ft/fandd/2019/09/pdf/tackling-global-tax-havens-shaxon.pdf on 23 February 2022.

41. Porter, D. and C. Anderson (2021), Illicit Financial Flows in Oil and Gas Commodity Trade: Experience, Lessons, and Proposals, IFFs and Oil Commodity Trading Series, OECD, pp. 14-15.

42. Please refer to https://www.openownership.org/uploads/oo-briefing-verification-briefing-2020-05.pdf for more information. Page accessed 8 March 2022.

43. Please refer to https://www.openownership.org/resources/early-impacts-of-public-beneficial-ownership-registers-ukraine/ for an example. Page accessed 8 March 2022.

44. The Glasgow Climate Pact that resulted from the 2021 Conference of Parties (COP26) made this explicit by including the first reference to a phasing-down of fossil fuel use and phase-out of subsidies in a UN Framework Convention on Climate Change agreement. Please refer to https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2021/12/Lessons-from-COP26-for-financing-the-just-transition.pdf for more information. Page accessed 25 February 2022.

45. EITI (January 2022), Nigeria: Revenue Collection. Retrieved from https://eiti.org/ nigeria on 25 February 2022.

46. OECD (2021), Tax Transparency in Africa: Africa Initiative Progress Report, Global Forum on Transparency and Exchange of Information for Tax Purposes, p. 16. Retrieved from https://www.oecd.org/tax/transparency/documents/Tax-Transparency-in-Africa-2021.pdf on 28 February 2022.

47. Beneficial ownership information can also help with auditing SOEs’ use of resources, with monitoring their impact on the economy and the sectors in which they operate, and can shed light on these enterprises’ cross-border activities and make government influence over business affairs more apparent. Source: Lord, J. (January 2021), “State-owned enterprises: a new frontier”, Open Ownership. Retrieved from https://www.openownership.org/blogs/state-owned-enterprises-a-new-frontier/ on 3 March 2022.

48. Porter, D. and C. Anderson (2021), Illicit Financial Flows in Oil and Gas Commodity Trade: Experience, Lessons, and Proposals, IFFs and Oil Commodity Trading Series, OECD.

49. Manley, D. and P. Heller (February 2021), Risky Bet: National Oil Companies in the Energy Transition, Summary, NRGI. Retrieved from https://resourcegovernance.org/sites/default/files/documents/risky-bet-national-oil-companies-in-the-energy-transition-summary.pdf on 25 February 2022.

50. This aligns with Open Ownership’s recommendations for effective beneficial ownership disclosure in SOEs, which are being integrated into a forthcoming update to the Beneficial Ownership Data Standard. Please refer to https://www.openownership.org/blogs/state-owned-enterprises-and-beneficial-ownership-disclosures/ for more information. Page accessed 9 March 2022.

51. NRGI (January 2022), Anticorruption Guidance for Partners of State-Owned Enterprises: Full guidance, p. 63. Retrieved from https://soe-anticorruption.resourcegovernance.org/files/anticorruption_guidance_for_partners_state_owned_enterprises.pdf on 3 March 2022.

52. Sayne, A. (May 2020), The Proof is in the Politics: Fossil Fuel Interests and Domestic Energy Transitions, NRGI. Retrieved from https://resourcegovernance.org/blog/proof-politics-fossil-fuel-interests-and-domestic-energy-transitions on 24 February 2022.

53. IEA (May 2021), World Energy Outlook: The Role of Critical Minerals in Clean Energy Transitions. Retrieved from https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions on 1 March 2022.

54. Gillies, A., Shafaie, A., and P. Heller (June 2021), “G7 Countries Cannot Secure Critical Minerals Without Tackling Governance and Corruption”, NRGI. Retrieved from https://resourcegovernance.org/blog/g7-countries-cannot-secure-critical-minerals-without-tackling-governance-and-corruption on 1 March 2022.

55. Ibid.

56. Knutsen, C. H., Kotsadam, A., Olsen, E. H. and T. Wig (2017), Mining and Local Corruption in Africa, American Journal of Political Science, Vol. 61, no. 2, pp. 320– 334. Retrieved from http://www.jstor.org/stable/26384734 on 4 March 2022.

57. Please refer to https://www.environmentalpeacebuilding.org/conferences/2nd-international-conference-on-environmental-peacebuilding/agenda/show/1845 for examples. Page accessed on 28 February 2022.

58. Miranda, M. et al. (2003), Mining and Critical Ecosystems: Mapping the Risks, World Resources Institute. Retrieved from http://pdf.wri.org/mining_critical_ecosystems_full.pdf on 4 March 2022.

59. OECD (2021), How to address bribery and corruption risks in mineral supply chains. Retrieved from https://mneguidelines.oecd.org/faq-how-to-address-bribery-and-corruption-risks-in-mineral-supply-chains.pdf on 1 March 2022.

60. Cross-border investigations can help countries guard against the interference of politically exposed persons and bad actors. Source: OECD (2021), How to address bribery and corruption risks in mineral supply chains.

61. The Beneficial Ownership Data Standard was developed by Open Ownership and the Open Data Services Co-operative. Please refer to https://standard.openownership.org/en/0.2.0/ for more information. Page accessed 8 March 2022.

62. EITI (November 2021), “Navigating the energy transition: search for common ground”.

63. Karunaratne, N. (January 2021), “Picking the winners of the electric vehicle revolution”, Investors’ Chronicle. Retrieved from https://www.investorschronicle.co.uk/news/2021/01/28/race-to-riches/ on 24 February 2022.

64. Peel, M. and H. Sanderson (August2020), “EU sounds alarm on critical raw materials shortages”. Retrieved from https://www.ft.com/content/8f153358-810e-42b3-a529-a5a6d0f2077f on 24.02.2022.

65. Fraiha Granjo, A. and M. Martini (2021), Access Denied? Availability and accessibility of beneficial ownership data in the European Union, Transparency International. Retrieved from https://images.transparencycdn.org/images/2021-Report-Access-denied-Availability-and-accessibility-of-beneficial-ownership-data-in-the-European-Union.pdf on 18 February 2022.

66. Rali Badissy, M., Kenny, C., and T. Moss (September 2021), “The Case for Transparency in Power Project Contracts: A proposal for the creation of global disclosure standards and PPA Watch”, Energy for Growth Hub and Center for Global Development. Retrieved from https://www.energyforgrowth.org/wp-content/uploads/2021/08/The-Case-for-Transparency-in-Power-Project-Contracts_-A-proposal-for-the-creation-of-global-disclosure-standards-and-PPA-Watch.pdf on 24 February 2022.

67. Ibid.

68. Rali Badissy, M., Kenny, C., and T. Moss (September 2021), The Case for Transparency in Power Project Contracts: A proposal for the creation of global disclosure standards and PPA Watch, p. 11.

69. Juma, V. (November 2021), “Owners of firms supplying Kenya Power to be revealed”, Business Daily. Retrieved from https://www.businessdailyafrica.com/bd/corporate/companies/owners-firms-supplying-kenya-power-revealed-3615894 on 24 February 2022.

70. Energy for Growth Hub and EED Advisory (October 2021), Enhancing Public Participation in Kenya’s Power Purchase Agreement Process, p. 8. Retrieved from https://www.energyforgrowth.org/wp-content/uploads/2021/10/Enhancing-Public-Participation-in-Kenyas-Power-Purchase-Agreement-Process.pdf on 25 February 2022.

71. At COP26, high-income countries recommitted to the goal of contributing USD 100 billion per annum in climate finance to developing economies between 2020 and 2025. Source: Kaya, A. (November 2021), “The 100 Billion Dollar Question: COP26 Glasgow and Climate Finance”, Global Policy Opinion, Durham University. Retrieved from https://www.globalpolicyjournal.com/blog/16/11/2021/100-billion-dollar-question-cop26-glasgow-and-climate-finance on 28 February 2022.

72. For example, the 450 firms in the Glasgow Financial Alliance for Net Zero promised over USD 130 trillion following COP26. Please refer to https://www.gfanzero.com/press/amount-of-finance-committed-to-achieving-1-5c-now-at-scale-needed-to-deliver-the-transition/ for more information. Page accessed 28 February 2022.

73. Cognitiks and Open Ownership (forthcoming), The use of beneficial ownership data by private entities.

74. For example, it can help companies identify and raise red flags about individual owners of companies in their value chain, such as unpaid taxes, pending lawsuits, or failure to file returns. Numerous private companies add value to beneficial ownership data by providing business insights and company verification as a service to other companies. Please refer to https://youcontrol.com.ua/en/ for an example. Page accessed 8 March 2022.

75. Cognitiks and Open Ownership (forthcoming), The use of beneficial ownership data by private entities.

76. Please refer to https://www.openownership.org/visualisation/ for more information. Page accessed 4 March 2022.

77. For example, the framework being developed by the Task Force on Climate-related Financial Disclosures. Please refer to https://www.fsb-tcfd.org/recommendations/ for more information. Page accessed 4 March 2022.

78. Global Reporting Initiative (October 2021), “Oil and gas transparency standard for the low-carbon transition”. Retrieved from https://www.globalreporting.org/about-gri/news-center/oil-and-gas-transparency-standard-for-the-low-carbon-transition/ on 4 March 2022.

79. Greenhouse Gas Protocol (no date), “Standards”. Retrieved from https://ghgprotocol.org/standards on 22 February 2022.

80. Transparency in subcontracting is also relevant from a human rights perspective. Some companies may use this model in part to reduce costs, limit liability for workers’ safety, and prevent workers from joining unions. Source: RAID-UK (November 2021), The Road to Ruin? Electric vehicles and workers’ rights abuses at DR Congo’s industrial cobalt mines. Retrieved from https://www.raid-uk.org/sites/default/files/report_road_to_ruin_evs_cobalt_workers_nov_2021.pdf on 1 March 2022.

81. Please refer to https://ukcop26.org/global-coal-to-clean-power-transition-statement/ for more information. Page accessed 3 March 2022.