Beneficial ownership transparency and data protection in South Africa

Beneficial ownership transparency

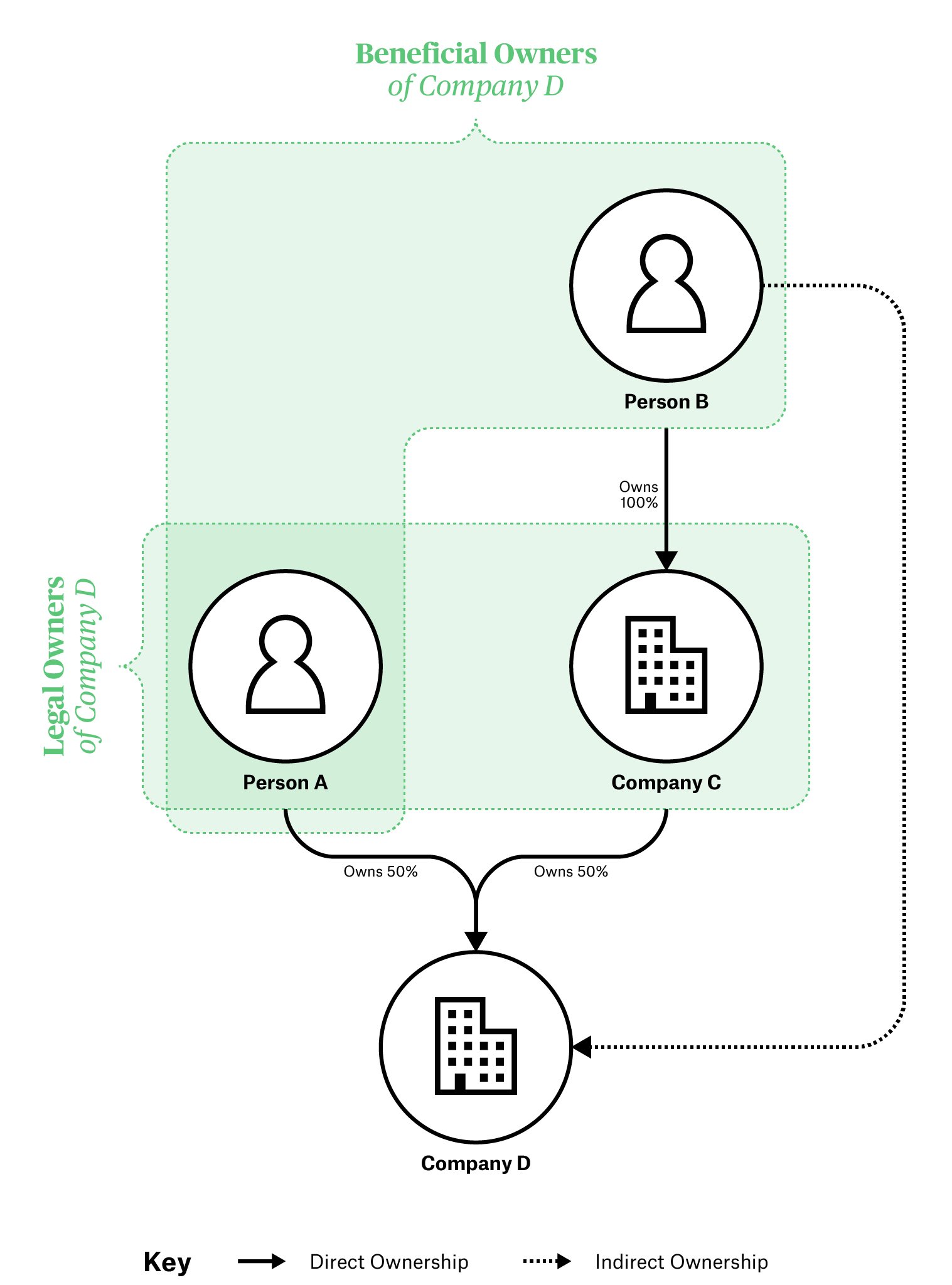

Abuse and misuse of corporate vehicles has led to an increasing number of countries implementing reforms to gain visibility on the individuals who ultimately own and control companies. BOT reveals the beneficial owners of corporate entities; [8] FATF defines a beneficial owner as a “natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement”. [9] Most countries have implemented BOT measures by requiring corporate entities to disclose their beneficial owners to a central government register. [10] BOT is one of the measures being used to combat financial crimes such as the financing of terrorism, money laundering, and tax evasion.

From an anti-corruption, transparency, and accountability perspective, BOT reforms call for making BO data accessible. In other jurisdictions, this has been done through publicly accessible BO registers or providing access to the information upon request by authorised personnel. Notably, registers in some countries are not public and only accessible by specific government departments or upon request; to protect the privacy of the beneficial owners, it is only provided in instances where the request meets specified requirements to protect the privacy of the beneficial owners and when it is necessary for such the beneficial ownership information to be shared.

Figure 1. BOT reveals the beneficial owners of corporate entities

International standards

FATF has the mandate to be “the global standard-setter for combatting money laundering, terrorist financing and the financing of proliferation of weapons of mass destruction,” and to hold their members to account in the implementation of these standards. [a] It published BOT Recommendations [11] calling on countries to, amongst other things, ensure that adequate, accurate, and timely information on the beneficial ownership of corporate vehicles is available and can be accessed by the competent authorities in a timely manner. Building on these recommendations, in 2013, the G8 countries endorsed core principles on beneficial ownership, consistent with the FATF standards, and published action plans setting out the steps they will take to enhance BOT. FATF's recommendations state that countries should ensure adequate, accurate, and timely access to information by authorities using a multi-pronged approach. It requires that countries create a register of the beneficial owners of legal persons as part of this approach, or provide an alternative mechanism, but allows flexibility for countries to design the reforms according to their context. As such, it states that countries "could consider facilitating public access".

Experience from countries implementing BO registers shows that in order to be effective, registers must cover all types of legal entities and arrangements. [12] They should also include entities registered in foreign jurisdictions that operate within the jurisdiction of the register. To provide usable and actionable data, registers should be fully searchable, regularly updated, and contain all historical changes in ownership. Establishing a public register ensures that all bodies, including law enforcement agencies, tax authorities, and civic organisations from domestic and foreign jurisdictions, have free, immediate access to information. [13] When BO data is published as structured and interoperable data, this allows data to be linked and compared across jurisdictions, which enables transnational investigations. [14] It is also recommended that countries ensure that regulations clearly and robustly define beneficial owners; provide for the collection and verification of appropriate information; and effectively sanction those who do not comply. These standards and recommendations have been supported by FATF, the G7, the G20, the International Monetary Fund, the United Nations (UN), and the World Bank.

Further, the Global Forum Secretariat and the InterAmerican Development Bank jointly published a Beneficial Ownership Implementation Toolkit [15] aimed at creating an understanding of BO as contained in international transparency standards. The Toolkit presents different approaches to ensuring the availability of BO information that is in line with the exchange of information standards. It aims to provide jurisdictions with relevant inputs to carry out their own internal assessment of the best-suited methods for implementation, taking into account their unique legal, policy, and operational frameworks.

Beneficial ownership transparency in South Africa

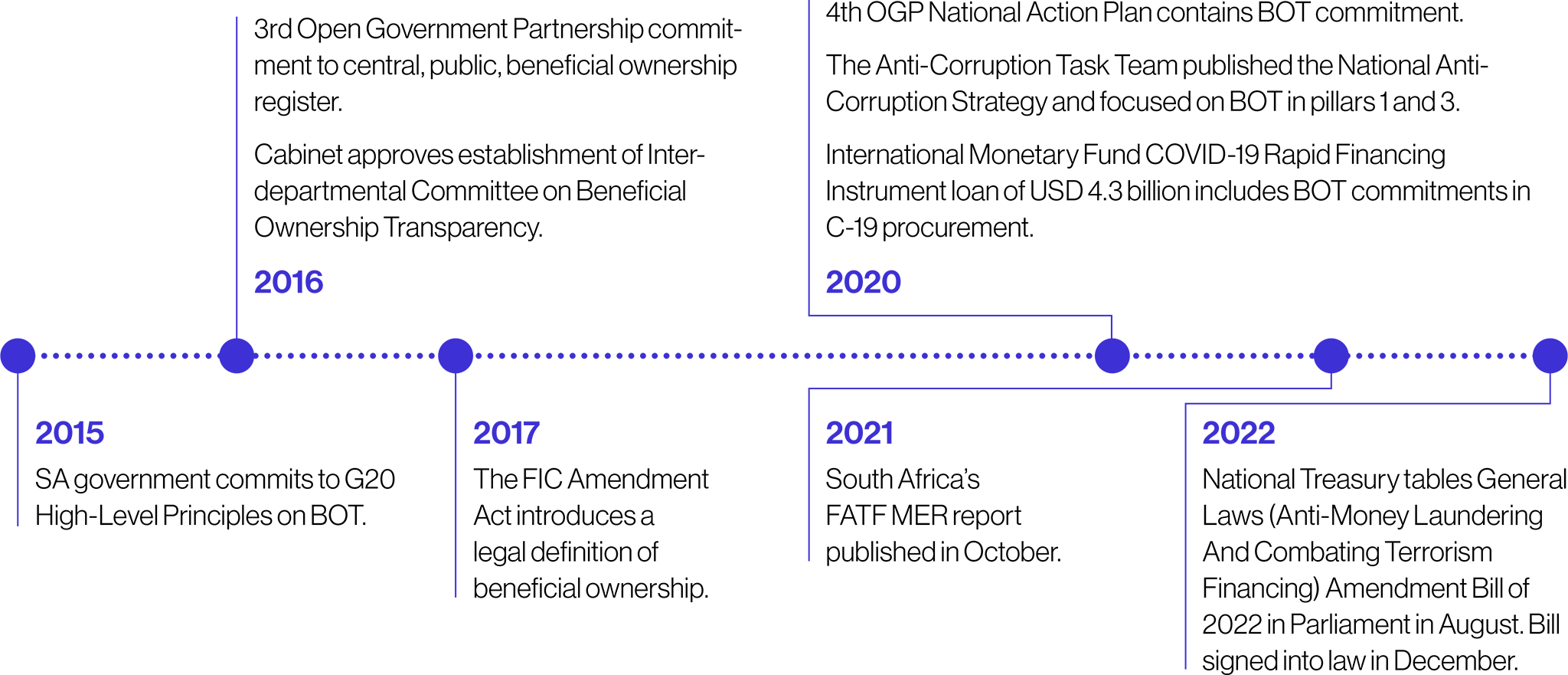

Figure 2. Timeline of BOT in South Africa

South Africa has requirements to implement BOT under FATF Recommendations, and also has commitments through the G20, the Open Government Partnership, the UN Convention Against Corruption, and the National Anti-Corruption Strategy. [16] South Africa has made some strides to meet these recommendations and international standards. For instance, it has several laws that provide for access to databases like trust registers and company registers. In particular, the Promotion of Access to Information Act, 2000 (PAIA) provides for the constitutional right to access to information [17] in the form of records held by both public and private bodies. [18]

In 2016, the Cabinet of South Africa approved the setting up of the Inter-departmental Committee on Beneficial Ownership Transparency, made up of about 18 members [19] to, amongst other things, develop and carry out a National Implementation and Action Plan to ensure the realisation of the G20 High-Level Principles; provide progress reports; and develop a definition of “beneficial owner”. The latter has since been achieved.

In 2019, the amendment to the definition of a beneficial owner came into effect as part of the amended FICA. The FICA was enacted to, amongst other things, combat money laundering activities, the financing of terrorism, and related activities, and to provide for customer due diligence measures to be undertaken by the relevant accountable institution, including with respect to beneficial ownership and persons in prominent positions. The FICA has been amended to define “beneficial owner in respect of a legal person, which means a natural person who, independently or together with another person, directly or indirectly: (a) owns the legal person; [20] or (b) exercises effective control of the legal person”. [21] To identify a beneficial owner, Section 21A states that to “obtain information to reasonably enable the accountable institution to determine whether future transactions that will be performed in the course of the business relationship concerned are consistent with the institution’s knowledge of that prospective client, including information describing — (a) the nature of the business relationship concerned; (b) the intended purpose of the business relationship concerned; and (c) the source of the funds which that prospective client expects to use in concluding transactions in the course of the business relationship concerned”.

The FATF mutual evaluation report provided that South Africa needs to address certain areas of technical compliance, the beneficial ownership of legal persons, and reporting of and transparency around suspicious transactions. [22] Furthermore, the FATF standard, revised in March 2022, requires BO information that is collected to be verified for accuracy and placed in a centralised register or an alternative mechanism that allows for a similar degree of access to information by competent authorities. At the time of writing, South Africa does not yet have a BO register or an alternative mechanism.

BO information contains personal information and needs to be shared between different government departments to be verified and used effectively. This sharing, in particular the localisation of data between different government agencies, such as the Department of Trade, Industry and Competition through the Companies and Intellectual Property Commission (CIPC) and the National Intellectual Property Management Office, is one of the reasons for the proposed Draft National Policy on Data and Cloud. [23] Furtherto, the Inter-departmental Committee is creating an integrated, national registry of beneficial ownership. [24] These initiatives may, amongst other things, aid in the governing and sharing of BO data between government departments and agencies.

However, this leaves questions of whether this information should be publicly accessible for free, as in Nigeria and the United Kingdom; accessible to the public for a fee, as has been the stance taken by Ghana, New Zealand, and Zambia; only accessible to authorised personnel but with a subset of data being accessible to the public, as has been legislated in Kenya for BO information only for companies from which the government procures; or whether a more conservative approach should be taken, such as making the information only accessible to authorised personnel, as has been the approach in Egypt.

Footnotes

[a] “Mandate,” Financial Action Task Force, 12 April 2019, p 1,3, https://www.fatf-gafi.org/media/fatf/content/images/FATF-Ministerial-Declaration-Mandate.pdf.

Endnotes

[8] “Beneficial ownership transparency”, UNCAC Coalition, n.d., https://uncaccoalition.org/learn-more/beneficial-ownership-transparency/.

[9] FATF Guidance: Transparency and Beneficial Ownership (Paris: FATF, 2014), 8, https://www.fatf-gafi.org/media/fatf/documents/reports/Guidance-transparency-beneficial-ownership.pdf.

[10] “What is beneficial ownership transparency?”, Open Ownership, n.d., https://www.openownership.org/en/about/what-is-beneficial-ownership-transparency/.

[11] International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation: The FATF Recommendations, FATF.

[12] A Beneficial Ownership Implementation Toolkit, Inter-American Development Bank (IDB) and the Organisation for Economic Cooperation and Development (OECD), March 2019, https://oe.cd/41V.

[13] Tymon Kiepe, Making central beneficial ownership registers public, Open Ownership, 25 May 2021, https://www.openownership.org/en/publications/making-central-beneficial-ownership-registers-public/.

[14] Tymon Kiepe and Jack Lord, Structured and interoperable beneficial ownership data, Open Ownership, 12 August 2022, https://www.openownership.org/en/publications/structured-and-interoperable-beneficial-ownership-data/.

[15] A Beneficial Ownership Implementation Toolkit, IDB and OECD.

[16] Mashudu Masutha and Karabo Rajuili, “New company ownership regulation in South Africa is step in right direction”, Open Ownership, 25 April 2021, https://www.openownership.org/en/blog/New-company-ownership-regulation-in-South-Africa-is-step-in-right-direction/.

[17] Section 32 of the Constitution of the Republic of South Africa, 1996.

[18] Section 3 of PAIA.

[19] Members included: Department of Justice and Constitutional Development (Master’s Office); Companies and Intellectual Property Commission; Department of Public Service and Administration (Convener); Department of Social Development; Directorate for Priority Crime Investigation; Legal Practice Council; South African Revenue Service; National Intelligence Coordinating Council; Financial Intelligence Centre; Johannesburg Stock Exchange; National Gambling Board; National Prosecuting Authority; Financial Sector Conduct Authority; Department of Trade and Industry; Department of Small Business Development; Estate Agencies’ Affairs Board; Independent Regulatory Board of Auditors; National Treasury.

[20] Section 1(1) of the FICA defines a legal person as “... any person, other than a natural person that establishes a business relationship or enters into a single transaction with an accountable institution and includes a person incorporated as a company, close corporation, foreign company or any other form of corporate arrangement or association, but excludes a trust, partnership or sole proprietor”.

[21] FICA, 2017, https://www.fic.gov.za/Documents/FICA_Act%201%20of%202017.pdf; https://www.fic.gov.za/Documents/FIC%20Act%20with%202017%20amendments%20(1)%20(1).pdf.

[22] “SA should implement FATF recommendations to avoid greylisting, says Kganyago”, SA Government News Agency, 17 August 2022, https://www.sanews.gov.za/south-africa/sa-should-implement-fatf-recommendations-avoid-greylisting-says-kganyago.

[23] Draft National Policy on Data and Cloud, Republic of South Africa, Department of Communications and Digital Technologies, 1 April 2021, https://www.gov.za/sites/default/files/gcis_document/202104/44389gon206.pdf.

[24] Linda Ensor, “State wants integrated data system on beneficial ownership”, Business Day, October 2022, https://www.businesslive.co.za/bd/national/2022-10-24-state-wants-integrated-data-system-on-beneficial-ownership/.

Next page: Data protection and beneficial ownership transparency