Beneficial ownership transparency in Indonesia: scoping study

Open Ownership Principles in use in Indonesia

Below is a short analysis of how Indonesia’s disclosure regime compares against the nine Open Ownership Principles.

Principle one: A central register

Indonesia’s Presidential Decree No.13/2018 is the primary legislation for beneficial ownership in the country and provides for a central register to be implemented and maintained by the MLHR. This ministry has successfully created the register and continues to gather BO information, primarily as an integral part of new company formation procedures.

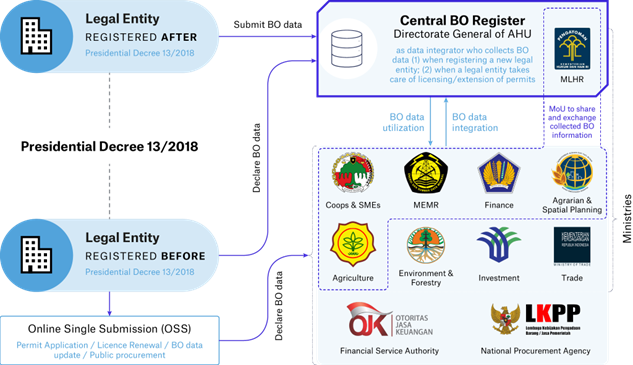

In addition to the MLHR register, several other ministries and agencies collect BO data on subsets of firms during other points of interaction with state institutions, including as part of capital market operations, taxation, banking, electronic transactions, permit applications and mining licence renewals. The MLHR is seeking to bolster the data in its register, and to create a single centralised register, through its cooperation with the various other institutions that hold their own registers (see below).

Diagram showing the various agencies in Indonesia which are engaged in the collection and use of BO data

Six ministries have signed a memorandum of understanding to accelerate the process of BO data exchange and interoperability with the MLHR register. Of these, the Ministry of Energy and Mineral Resources (MEMR) has made most progress to date and, since late 2021, its BO data structure has been mapped to that of the MLHR. The MLHR register is now also able to call on the BO data held by the MEMR via an application programming interface (API). Other ministries and agencies are working to similar objectives, but notable challenges remain in terms of capacity, policy harmonisation and technology. This is likely to slow the pace of progress, and major new advances in data sharing do not appear to be imminent. In addition to data sharing efforts, the government is working towards data integration through the establishment of a single online submission portal that is planned to include BO data.

Recommendations

- Continue work to facilitate data sharing between the various government agencies that hold beneficial ownership data; in particular, by providing the MLHR access to data in other registers in order to create a unified central register.

- Establish a clear mechanism for intra-governmental coordination regarding data integration and consider using the Beneficial Ownership Data Standard (BODS) maintained by Open Ownership and Open Data Services.

Principle two: Comprehensive coverage

Indonesia’s beneficial ownership disclosure legislation, the 2018 Presidential Decree, applies to a comprehensive range of domestic entities: all companies and entities that are registered in the jurisdiction are legally required to make BO declarations. There are, however, no provisions for collecting beneficial ownership information of foreign-owned companies, foreign natural persons, or non-residents. Given that foreign entities and beneficial owners are often associated with higher financial crime risks, this could represent a potentially significant loophole.

In addition, detailed information on the reporting requirements for all the entity types mentioned in the 2018 decree has not been subsequently included in the implementing regulations. Specifically, while the primary legislation refers to obligations for “limited liability companies, foundations, associations, cooperatives, limited partnerships, firm partnerships and other types of corporations”, this last category is not included in the secondary regulations. The category of “other types of corporations” could include a broad range of entity types, including publicly-listed companies, municipal or state-owned enterprises (MOEs and SOEs) and joint ventures. At the international level, many countries have applied differentiated reporting requirements to reflect the different ownership structures of SOEs, for example, or to allow entities that have already reported their beneficial owners elsewhere to apply for exemptions.[4] There is also a debate on how to record the beneficial ownership of cooperatives, as in Indonesia many cooperatives give all members the same shares and voting rights.

Recommendations

- The disclosure requirement should be extended beyond domestically-registered entities to include foreign entities with a sufficient link to Indonesia. This would also be in-line with the new FATF requirements on the beneficial ownership of foreign-owned entities.

- Develop more detailed regulations on reporting obligations for SOEs, MOEs and PLCs, including when these entities appear in the ownership chain of other declaring entities. If any of these are to be exempted from reporting obligations, the exemptions should be carefully considered and narrowly defined in order to avoid creating potential loopholes.

- Clarify how the definition of beneficial ownership applies to cooperatives when the members have the same level of ownership and the same voting rights.

Principle three: Robust definitions

The criteria by which an individual qualifies as a beneficial owner of a legal entity are outlined in Indonesia’s Presidential Decree No.13/2018, Article 4. This includes individuals who possess:

| Point | Means of ownership or control | Presidential Decree (2018) |

|---|---|---|

| (a) | Shareholding | More than 25% |

| (b) | Voting rights | More than 25% |

| (c) | Profits | More than 25% of annual profits |

| (d) | Decision making |

Has the authority to appoint, replace, or dismiss members of the board of directors and members of the board of commissioners |

| (e) | Control |

Has the authority or power to influence or control the company without having to obtain authorisation from any party |

| (f) | Benefit | Receives benefits from the corporation |

| (g) | Ultimate ownership |

Is the actual owner of the funds used to buy the company’s share (this criterion only applies to individuals whose identity is not stated in the deed) |

Indonesia’s definition captures the majority of relevant forms of control and ownership included in the Open Ownership Principles, and includes the exercise of both direct and indirect means of ownership and control. Its 25% disclosure threshold for share ownership and profit share is within the range recommended by the Financial Action Task Force, but is at the maximum level advocated by that body. Globally, many countries are adopting more stringent threshold levels, [5] especially for certain classes of individuals and firms which are domestically assessed to be associated with higher financial crime risks.

To make the BO definition more comprehensive, additional forms of ownership or control could be covered, such as rights to surplus assets, or profits on the dissolution of the company. An explicit prohibition on the inclusion of nominees, agents, custodians, or other intermediaries as the named beneficial owners could also be added to close a potential loophole. [6]

Recommendations

- Further strengthen the BO definition by including other forms of ownership and control, such as rights to surplus assets or income upon company dissolution.

- Explicitly prohibit nominees or other intermediaries being named on disclosure forms instead of the beneficial owner.

- Consider introducing lower thresholds for higher-risk sectors or individuals; and conduct periodic reassessments of the BO definition and thresholds, in order to address any potential emerging loopholes in the disclosure regime.

Principle four: Sufficient detail

Indonesia’s Presidential Decree clearly states that a corporation should define at least one natural person as its beneficial owner.[7] It requires that the following information be declared for each beneficial owner: their full name, personal identity number, driver’s licence or passport, place and date of birth, citizenship status, address, tax identification number, and the relationship between the corporation and the beneficial owner.[8] This list covers many of the data points recommended under the Principle. Under requirement 2.5 of the EITI standard, beneficial owners with interests in the extractives sector also need to highlight whether or not they are a politically exposed person.

Nevertheless, data collection processes and form design could be further strengthened to ensure that the full range of relevant details are collected, which would enable Indonesia to meet the policy aims of the register. Some potential issues in this regard include:

● Unique identifiers for companies are not currently being collected in declarations. The forms appear to verify company information in other systems by name and company type, but the collection of a tax identification number (Nomor Pokok Wajib Pajak or NPWP), for example, would greatly assist linking BO data with other datasets.

● As noted in the Comprehensive Coverage section, no provisions have been made for collecting the ownership information of foreign-owned companies.

● Information on ownership stakes lacks precision in some areas. For example, users need only confirm that they possess a shareholding of over 25%, rather than the exact percentage. Moreover, information on the dates on which an individual acquired or disposed of their ownership interest in the declaring entities does not appear to be gathered. This would be useful for investigative and audit purposes, as shown in the recent technical guidance on building an auditable record of beneficial ownership published by the OE programme.

● Restrictions on data entry in nationality and residency fields do not allow for dual nationality or mixed nationality and residencies. Decoupling the citizenship and address fields (so that foreign nationals can enter Indonesia addresses and Indonesian nationals can enter foreign residential addresses) and allowing people to enter more than one nationality is recommended.

● At the point of submission, all names are assumed to be transliterated into the Indonesian alphabet. It would be helpful if the form allowed for the entry of names in their original alphabets as well as transliterated versions. This is particularly relevant and useful for foreign owners and foreign companies, as having the original version will aid cross-border investigations.

● Finally, Indonesia’s BO register does not have any provisions for declaring that information is unknown or missing. This can be valuable to collect in the absence of any other data, particularly when an explanatory reason is captured.

Recommendations

- Collect and publish companies’ NPWP/tax identification numbers, along with their names.

- Provide form options to enable

1. the collection of information on foreign-owned companies;

2. declarations that ownership is unknown, or that there are no owners who meet the criteria, and – crucially – provide the reason in both cases

3. the input of more than one nationality and of mixed residencies and nationalities; and

4. the entry of names of beneficial owners in their original alphabet, as well as the transliterated Latin/Indonesian alphabet. - Collect and publish more detailed information about the nature of beneficial ownership. For example, the exact values of shares, voting rights, or rights to profits, and the start and end date of the ownership interest.

Principle five: Public access

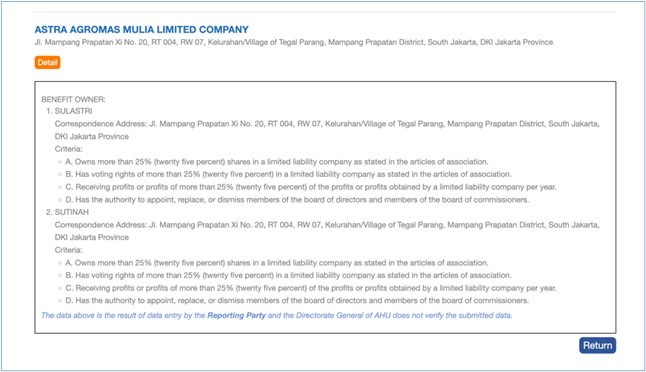

After years of reform, as of July 1, 2022, Indonesia’s BO data has been made publicly accessible through the Directorate General of General Legal Administration (AHU) platform. The publicly accessible data comprises a subset of the full beneficial ownership information held by authorities. Government agencies in foreign jurisdictions are required to request full access to an individual record via mechanisms such as mutual legal assistance requests, or information exchange between financial intelligence units (FIU). Local legislation provides for these requests to be processed by the MLHR and the Ministry of Foreign Affairs.[9] In practice however, the MLHR is still working on the implementation of these regulations.

The recent publication of BO data is a notable advance, with information on beneficial owners’ names, correspondence addresses and the nature of beneficial interest now publicly available. However, there is scope to further improve data accessibility as records are not currently searchable by the name of the beneficial owner. Records can only be accessed if the user enters the full company name. Moreover, including other fields into the public records, such as company identifiers, the dates when the beneficial interest began and the month and year of birth of the beneficial owner, would further increase the potential uses of the published data.

Example of published beneficial ownership information

Companies’ legal ownership data, which is maintained in a separate MLHR database from the beneficial ownership data, is available for a fee. To obtain this data for an Indonesia-registered company, users have to pay between IDR50,000 (USD3.44) and IDR500,000 (USD34.38) for access. Data on legal owners is currently available on a per-record basis, meaning that users can only download information on one company at a time, rather than being able to access the full dataset, which would allow for greater data use and analysis.

Recommendations

- Increase the use and accessibility of BO data by increasing the number of fields on which users can search.

- Consider reducing or removing fees for access to companies’ legal ownership data.

- Ensure data publication complies with Indonesia’s data protection legislation (when enacted) and enable high risk individuals to apply for publication exemptions in some circumstances.

Principle six: Structured data

Indonesia’s BO data only became publicly available after the research for this report was completed, so a full assessment against the structured data Principle has not been possible. However, a previous review of data from the Directorate General of General Legal Administration in 2020 suggested that the data was well structured, albeit missing information in places, as the caveats at the base of this short report by Open Ownership show.

Stranas PK (the National Strategy for Corruption Prevention) reports that several ministries are trying to align their separate sources of BO data to the MLHR’s preferred format, and to improve interoperability within Indonesia. Early data disclosures should ideally be used as test data to help assess whether the system is adequately equipped to deal with complex and unusual BO structures.

Recommendations

- Continue to harmonise the structure of BO data schemas between different government agencies, using BODS as a reference and potential implementation model.

Principle seven: Verification

Indonesia is yet to develop a comprehensive verification system that includes both automated and manual checks for its BO data submissions. Based on the Presidential Decree, the submitting company has an obligation to verify its beneficial ownership by checking the validity of the BO information with their supporting documents.[10] There is potential for state agencies to also perform verification checks, but full plans are yet to be confirmed, and the government is currently prioritising its efforts to improve data collection and compliance. Where BO information is submitted via notaries, Indonesian law requires these officials to request and retain documentation (e.g. company formation documents and records of official share registration) that confirms an individual’s status as a beneficial owner. These documents could later be requested by state officials as part of enhanced manual verification checks. In the meantime, improvements in the quality of BO data submitted could be improved by implementing the recommended changes to form design and data collection outlined in the Sufficient Detail section of this report.

The country is advancing with other tasks that will eventually assist its verification efforts. For example, performing automated cross-checks on BO data submissions will become significantly more feasible as the country advances its efforts to standardise BO data schemas across government agencies. If successfully implemented, data standardisation would enable automated checks on BO information and related data, for example, by validating company numbers (for domestic entities) against those held at the State Registry.

For foreign companies, it will be more challenging to check company numbers against foreign registries, due to the legal and technical difficulties associated with establishing systems for automatic data sharing between countries. Indonesia plans to advance the verification of foreign entities via the Badan Koordinasi Penanaman Modal (BKPM), the Capital Investment Coordinating Board. This is the government agency that hosts the Open Single Submission platform (oss.go.id), an initiative that seeks to eventually integrate all the permit and licensing processes among different agencies.

By coordinating with BKPM, MLHR expects to exchange the BO data of foreign entities. Any such checks would still very likely need to be complemented by periodic manual enhanced checks on a sample of high-risk submissions. Determining which foreign and domestic entities should be considered high-risk will require a thorough analysis of the country’s anti money-laundering (AML) national risk assessment, combined with an analysis of submissions already received, to help identify particular areas of poor data quality and red flags. Lessons from the international context suggest that some factors to consider would be firms submitting declarations with no qualifying beneficial owners or ownership relationships with overseas entities, especially with those from higher-risk AML jurisdictions.

Recommendations

- Implement the suggested form design improvements from the Sufficient Detail section of this report to improve data quality, and lay the groundwork for future verification systems.

- Adopt an iterative approach to the implementation of a more comprehensive verification system. This would involve developing better systems for selecting and conducting enhanced manual checks of higher-risk submissions, and working towards automated checks of more fields in the BO register against those in other state registers.

- Consider adding the requirement to submit supporting documents (e.g. passport photocopy or scan) as part of the declaration process.

Principle eight: Up-to-date and auditable data

Under MLHR regulation of 2019, new firms are required to report their beneficial owners as part of company formation procedures in Indonesia.[11] Firms already operational at the time the regulations were passed in mid-2019 were obliged to provide this information to authorities within one year.[12] This legal mandate also requires companies to update their data at least once a year. However, there is no explicit requirement for them to report all changes to company and ownership information that have occurred throughout the year (rather just the current information at the time of making the declaration). Compiling and retaining a full record of all changes to company details and beneficial owners is important for investigation and audit purposes, as efforts to disguise misuse of corporate structures for illicit ends can involve rapid changes of ownership structure.

It appears that historical BO data is due to be kept in Indonesia’s register. This would follow the same procedure as historical data on the legal owners of firms, where the Central Registry publishes the names of all current shareholders and directors, alongside those of previous owners. BO information on companies should also be retained after a company’s dissolution, as this information is key for investigators. In the UK, for instance, company records are kept for a minimum of 20 years after dissolution. MLHR Regulation No. 15 of 2019 appears to make provisions for amendments to the BO information of companies to be recorded, and that the details of such changes should be available in the beneficial ownership API. To make a full assessment of this Principle, more information is needed about whether, and how, dates on which BO arrangements begin and cease are captured and stored.

Recommendations

- To further strengthen reporting requirements, regulations should make explicit that all changes to company and ownership information throughout the year should be reported to authorities. This means, for example, that if a company changes its name twice within a year, the firm would have to report all three names and not just the one it was operating under at the time of reporting.

- The dates on which BO arrangements begin and cease should be included in future declarations, and this field should be made mandatory in Indonesia’s BO submission forms.

- Indonesia should collect, retain, and publish information regarding changes in a company’s beneficial owners.

Principle nine: Sanctions and enforcement

Indonesia’s primary legislation provides for a limited range of administrative sanctions for non-compliance with BO disclosure legislation. An example of this is the power to block the company’s access to the central register. This will prevent a company from making any changes to their existing registration and articles of association, which ultimately affects business activities. There is also legal provision for the MLHR to be able to submit a recommendation to another government agency or ministry that the non-compliant company’s operating license be suspended, revoked or cancelled.[13] This system is yet to be implemented in practice, however.

As criminal sanctions for non-compliance with BO legislation are yet to be introduced in law, various government agencies can apply other types of sanction.[14] Thus far, the relevant agencies, such as the Ministry of Energy and Mineral Resources, have largely focused on refusing to issue mining license (or other relevant licenses) to companies that have not submitted their BO information. This appears broadly effective in encouraging firms to submit BO declarations, but additional measures would be required to deter the submission of incorrect information, or failing to update authorities about changes to ownership structures.

Despite some success in government efforts to drive up compliance with BO disclosure requirements, the absence of robust sanctions has likely served to keep rates fairly low by international standards. According to government statistics, only around 29% (or 665,088 out of 2,269,790 entities) of companies that are required to do so had reported their beneficial owners by August 2022; up from around 8% in 2021.[15]

Recommendations

- Indonesia should develop an effective sanctions regime for companies which fail to comply with BO disclosure requirements. This would include complementing the existing licensing restrictions with other monetary and non-monetary penalties, as well as administrative and criminal sanctions for not submitting a beneficial ownership declaration, late submission, incomplete submission, or falsifying information.

Footnotes

[4] For guidance on issues to consider when creating reporting obligations for SOEs and PLCs respectively see: https://www.openownership.org/en/blog/state-owned-enterprises-and-beneficial-ownership-disclosures and https://www.openownership.org/en/publications/beneficial-ownership-transparency-and-listed-companies/

[5] Tymon Kiepe and Peter Low, “Beneficial ownership in law: Definitions and thresholds”, Open Ownership, October 2020, https://www.openownership.org/uploads/definitions-briefing.pdf.

[6] Though such nominee arrangements are technically prohibited in Indonesia, in practice, they remain fairly common.

[7] Presidential Decree No.13/2018, Article 3, https://jdih.setkab.go.id/PUUdoc/175456/Perpres%20Nomor%2013%20Tahun%202018.pdf.

[8] Hamalatul Qur'ani, “Rambu-rambu yang Harus Diperhatikan Korporasi dalam Perpres Beneficial Ownership”.

[9] Ministerial Regulation of MLHR No.15/2019, Article 11, Paragraph 3.

[10] Presidential Decree No.13/2018, Chapter 17, Verse 1.

[11] Regulation of the Minister of Law and Human Rights of the Republic of Indonesia, Number 15 of 2019, Article 2, paragraph 3.

[12] Ibid.

[13] Ministerial Regulation of MLHR No.12/2019, Article 12, https://peraturan.go.id/common/dokumen/bn/2019/BN1112-2019.pdf.

[14] This includes agencies such as: the Otoritas Jasa Keuangan (OJK), the Financial Services Authority; Pusat Pelaporan dan Analisis Transaksi Keuangan (PPATK), the Indonesian Financial Transaction Reports and Analysis Centre; and Komisi Pemberantasan Korupsi (KPK), the Corruption Eradication Commission.

[15] Stranas PK, https://stranaspk.id/webservice/uploads/documents/279640-laporan-triwulan-vi-2022.pdf.