Bridging the gap for effective asset transparency: Analysing land registers and beneficial ownership data for legal vehicles

Beneficial ownership transparency of assets

Globally, there is increasing focus on extending BOT beyond legal vehicles to include assets such as land and real estate, vessels, and other movable or financial assets. This shift reflects a broad recognition that knowing who ultimately owns, controls, or benefits from assets is essential for a number of policy objectives, including addressing tax evasion, enforcing sanctions, and countering money laundering and illicit financial flows.

For taxation purposes, land, real estate, and property (hereinafter collectively referred to as land) have become a blind spot. While advances in the exchange of BO information under the Organisation for Economic Co-operation and Development’s (OECD) tax transparency standards have increased scrutiny of financial assets, evidence suggests that some forms of tax evasion have shifted towards real estate markets, positioning land as the next frontier for effective tax transparency. [1] The OECD’s Framework for the Automatic Exchange of Readily Available Information on Immovable Property for Tax Purposes and other recent analysis reinforce this trend, pointing to persistent opacity in cross-border property ownership; the use of legal vehicles to obscure ownership; and limited systematic access to information on property owners and transactions. [2] In this context, understanding how individuals own, control, or benefit from land assets is critical for detecting evasion and mapping cross-border ownership networks. [3]

These concerns are increasingly reflected in global policy debates on international tax cooperation. Proposals from the Independent Commission for the Reform of International Corporate Taxation (ICRICT) and commitments in the 2025 Financing for Development Compromiso de Sevilla call for a global register covering assets, companies, and their ultimate owners. [4] Civil society organisations such as the Tax Justice Network likewise argue that BOT for assets is essential for effective wealth taxation. [5]

Many of these proposals envisage national registers – including asset registers and BO registers for legal vehicles – as the foundational building blocks of any global system. [6] This implies that such registers must contain high-quality, well-structured information and rely on consistent identifiers to join information sources to understand transnational BO networks. [7] While policy debates increasingly emphasise the need to strengthen national information systems, there has been limited empirical assessment of which information should be collected, by which institutions, and at which point in time, and how close existing registers are to meeting these expectations. [8]

In practice, some jurisdictions have introduced new asset-specific registers to collect BO information for transparency purposes, often alongside existing reporting regimes. While these initiatives expand data availability, they can also introduce duplicate reporting requirements. This can result in a fragmented information landscape in which different authorities capture overlapping or partial pieces of the same ownership puzzle, frequently using divergent definitions, data formats, and verification processes. [9] Such fragmentation risks producing inconsistent or conflicting records, increasing compliance burdens for businesses and administrative pressures for governments without delivering a coherent or integrated view of ownership networks.

An alternative approach is to leverage existing asset ownership registers which are primarily designed to provide legal certainty and record specific rights and entitlements, and link them to BO registers for legal vehicles. While this can reduce duplication and build on established systems, limitations remain. Asset registers may not comprehensively capture all relevant interests, and access to BO information for non-domestic legal vehicles is often limited or absent. As a result, significant gaps in visibility may persist, particularly in relation to forms of control over an asset, or the ability to use or benefit from one. These trade-offs highlight the importance of understanding how different registration models shape the feasibility and effectiveness of BOT of assets.

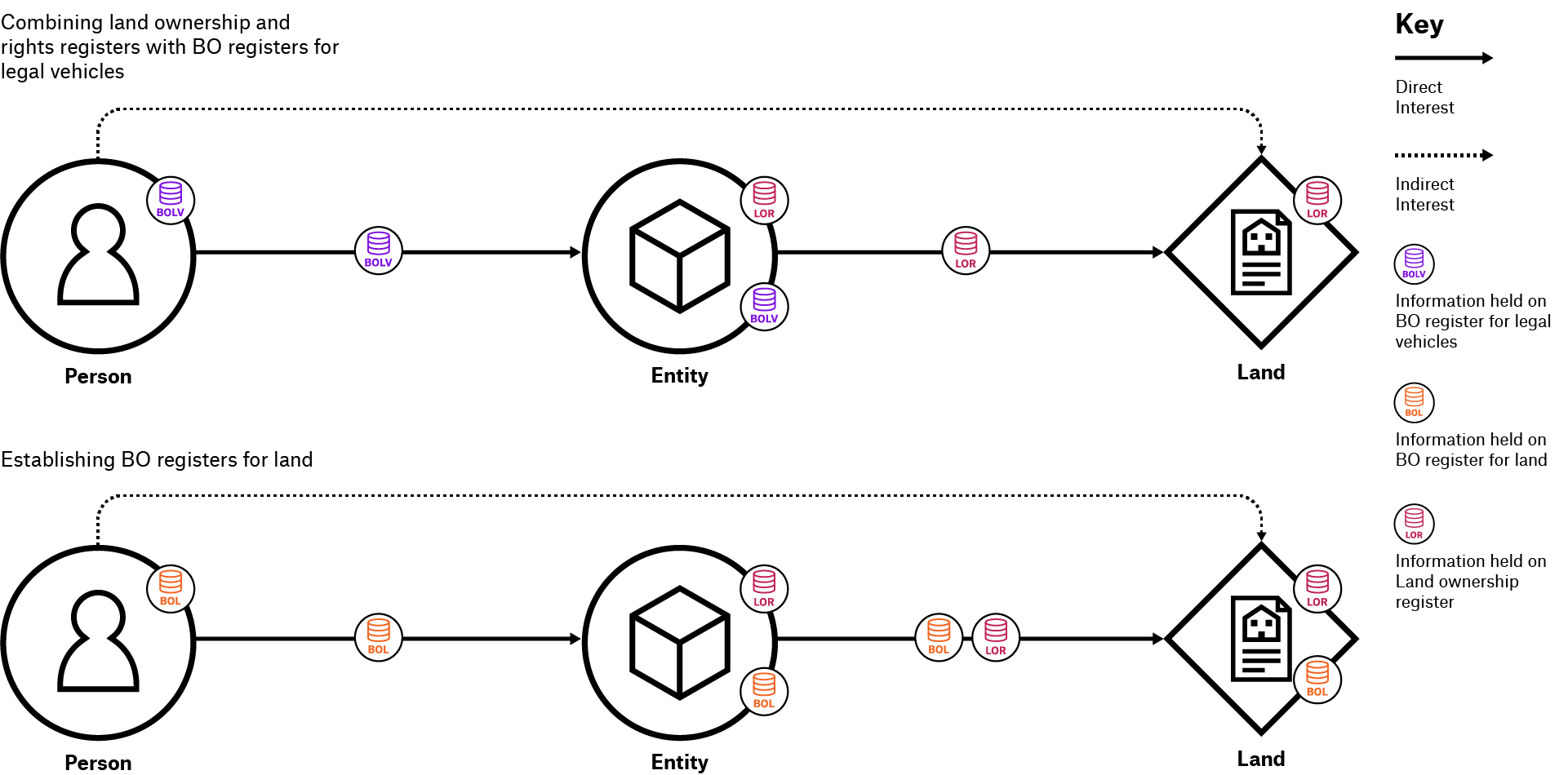

Building on this context, this research examines the practicality and proportionality of alternative registration models, with a particular focus on land. Two approaches are identified and illustrated in Figure 1:

- Combining land ownership and rights registers with BO registers for legal vehicles: These “traditional” asset registers provide information about the asset itself, recording ownership interests and other restricted rights and entitlements, such as easements, restrictive covenants, charges, and, in the case of HMLR, certain equitable rights. These registers are primarily designed to provide legal certainty rather than transparency. Enhancing visibility over ownership and control therefore depends on the use of reliable identifiers and structured rights data to connect land records with BO registers for legal vehicles.

- Establishing BO registers for land: This approach involves the direct collection of BO information through declarations linked to land assets. Such registers are typically designed with transparency as their primary objective. They often operate alongside land ownership registers, which continue to capture legal and technical information about the land itself.

Figure 1. Representation of two approaches to BOT of assets

In the approach involving combining land ownership and rights registers with BO registers for legal vehicles, information about land, its legal ownership, and other rights is held in the land ownership register. This information is connected to information about beneficial owners of legal vehicles, held in the BO register for legal vehicles, to understand BO networks involving land. In the approach involving establishing BO registers for land, information about land, and its legal owners and their beneficial owners would be held in the BO register for land. Additional information about the land held is in the land ownership register.

Footnotes

[1] Jeanne Bomare and Ségal Le Guern Herry, Will We Ever Be Able to Track Offshore Wealth? Evidence from the Offshore Real Estate Market in the UK (EU Tax Observatory, 2022), https://www.taxobservatory.eu//www-site/uploads/2022/06/BLGH_June2022.pdf.

[2] OECD, Enhancing International Tax Transparency on Real Estate: OECD Report to the G20 Finance Ministers and Central Bank Governors (OECD, 2023), https://www.oecd.org/content/dam/oecd/en/publications/reports/2023/07/enhancing-international-tax-transparency-on-real-estate_4567c0aa/37292361-en.pdf; OECD, Strengthening International Tax Transparency on Real Estate – From Concept to Reality: OECD Report to G20 Finance Ministers and Central Bank Governors (OECD, 2024), https://www.oecd.org/content/dam/oecd/en/publications/reports/2024/07/strengthening-international-tax-transparency-on-real-estate-from-concept-to-reality_abb45622/fa2db2a4-en.pdf; OECD, Framework for the Automatic Exchange of Readily Available Information on Immovable Property for Tax Purposes (OECD, 2025), https://www.oecd.org/content/dam/oecd/en/topics/policy-issues/tax-transparency-and-international-co-operation/framework-for-the-automatic-exchange-of-readily-available-information-on-immovable-property-for-tax-purposes.pdf.

[3] Tymon Kiepe, Leveraging information about ownership networks to improve taxation (Open Ownership, 2025), https://www.openownership.org/en/publications/leveraging-information-about-ownership-networks-to-improve-taxation/.

[4] ICRICT, It is Time for a Global Asset Registry to Tackle Hidden Wealth (ICRICT, 2022), https://www.icrict.com/wp-content/uploads/2022/04/ICRICTGARreportEN.pdf; UN Department of Economic and Social Affairs (DESA), Outcome document of the Fourth International Conference on Financing for Development (DESA, 2025), https://financing.desa.un.org/sites/default/files/ffd4-documents/2025/Compromiso%20de%20Sevilla%20for%20action%2016%20June.pdf.

[5] Andres Knobel and Markus Meinzer, Asset beneficial ownership – Enforcing wealth tax & other positive spillover effects (Tax Justice Network, 2025), https://taxjustice.net/reports/asset-beneficial-ownership-enforcing-wealth-tax-other-positive-spillover-effects/.

[6] Alejandro Rodriguez Llach, “From shadows to light: Why a global asset register is essential to combat financial secrecy”, Transparency International, 11 October 2024, https://www.transparency.org/en/blog/global-asset-register-essential-to-combat-financial-secrecy.

[7] Tymon Kiepe, “Considerations for creating a global register to support better international tax cooperation”, Open Ownership, 10 November 2025, https://www.openownership.org/en/blog/considerations-for-creating-a-global-register-to-support-better-international-tax-cooperation/.

[8] Knobel and Meinzer, Asset beneficial ownership.

[9] Tymon Kiepe, “Solving the international information puzzle of beneficial ownership transparency”, Open Ownership, 17 June 2024, https://www.openownership.org/en/blog/solving-the-international-information-puzzle-of-beneficial-ownership-transparency/.