Insights from the United Kingdom’s People with Significant Control register

Help us understand how you are making use of resources from the Open Ownership website by filling out this short survey

Publication type

Research report

Publication

Country focus

United Kingdom of Great Britain and Northern Ireland

Sections

Research

Summary

Ensuring the accuracy and reliability of beneficial ownership (BO) information is essential for it to serve its intended purposes, whether in tackling corruption, preventing money laundering, or supporting fair taxation. International standards and national regulations provide a range of verification mechanisms, yet while these measures are effective in identifying inconsistencies within individual company records, they are primarily limited to detecting internal or self-contained errors. Identifying systemic anomalies requires a broader analytical approach.

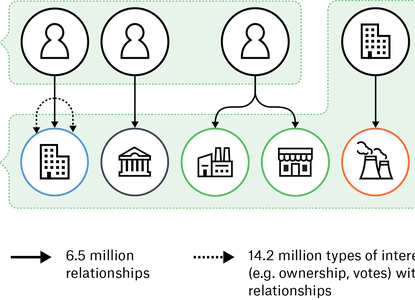

With this in mind, Maria Jofre, Data Analyst at Open Ownership, and Andres Knobel, Beneficial Ownership Lead Researcher at the Tax Justice Network, collaborated to explore and analyse the ownership structures of United Kingdom legal entities. This report presents the findings of that effort. It outlines methodological challenges and best practices, and includes a reproducible Python notebook to support future analysis using BO data.