Making central beneficial ownership registers public

Public beneficial ownership data user groups

Making BO data public gives access to a number of user groups which either do not have access to the data in regimes with non-public registers, or which can only access the data with legal, administrative, or financial barriers. These can broadly be classified in the following main groups:

- government users, including law enforcement and relevant, competent authorities from other jurisdictions, as well as different departments within the publishing government;

- private sector users, including companies that are obliged entities under anti-money laundering (AML) legislation, non-obliged entities, and BO data providers and reusers;

- civil society, including journalists, researchers, and the general public.

The following section outlines potential benefits to the public interest from each of these user groups’ interactions with BO data.

Government users

Law enforcement and other relevant competent authorities

Whilst law enforcement and other competent authorities (e.g. tax agencies) usually have access to national BO data in regimes with closed registers, they are also a key user group of public BO data in other countries. The majority of financial crimes involve more than one jurisdiction.[5] Data on mutual legal assistance (MLA) requests varies, but several Financial Action Task Force (FATF) evaluations and conversations Open Ownership (OO) has had with law enforcement suggest these tend to be long, drawn out processes. A Transparency International (TI) review of FATF mutual evaluation reports found that “competent authorities report greater challenges to identifying the beneficial owner of a company when a foreign company is involved or part of the ownership structure of a domestic company is foreign. In the absence of public BO registers, they usually have to resort to complex and lengthy [MLA] requests” (see Box 1), which cost substantial resources to both submit and respond to.[6] Comparative legal disadvantages between countries can also be a problem to successful MLA requests. For instance, in requests between common law and civil law countries, where judges and lawyers may not understand the offence or case that is being built and the request for information.

Box 1: Mutual legal assistances in Financial Action Task Force mutual evaluations

In 2016, the FATF evaluation of Canada stated that in investigations involving a foreign entity it was often not possible to identify a beneficial owner, and that this was due “mainly to foreign jurisdictions not responding to requests by the Canadian authorities for beneficial ownership information”.[7] In 2018, the Ghana evaluation also quoted delays and the non-cooperative attitude of some countries.[8] A Hong Kong evaluation showed responding to an MLA request could take a year.[9] These evaluations identify several problems for law enforcement when seeking to obtain BO data from a foreign jurisdiction, including: data not being available[10]; data being of questionable quality[11]; data not being internationally shareable[12]; and other legal and bureaucratic barriers[13].

As a result, a number of informal information exchange mechanisms have emerged, such as the Egmont Group. In conversations with OO, law enforcement officers have stated that public BO registers are an incredibly important and valuable resource in investigations. Although BO data from registers may not be evidence that is submissible in court, and even if the data is not 100% accurate, having the name of someone who bears some level of “real responsibility” towards a company is incredibly helpful in transnational investigations, one investigator said.[14] “From the perspective of law enforcement agencies, there is a need to have direct, fast, and easy access to such registers,” an Interpol specialist officer said. “Cross-border police to-police requests or the preparation and processing of judicial letters and requests can be very time and resource consuming.”[15] Additionally, successful MLA requests often require some level of evidence of why accessing that information is necessary. Having direct access to registers enables proactive investigations. In the absence of a perfect global infrastructure for sharing BO data transnationally, public registers can enable direct, fast, and easy access, for not only reactive but also proactive investigations.

Other government users

One of the key consumers of open data made public by governments are governments themselves.[16] There are examples of both demand for and use of BO data by a range of different government agencies. Data sharing between government departments is often marred by technical and legal challenges[17], and making data open is one way to surmount these. The UK, for instance, has proposed the incorporation of BO data into a new procurement system.[18] On the legal basis that BO data serves the public interest, it exists as public data[19], which will allow the UK procurement authority to use this data without needing to establish a new legal basis, and developing technically complex data sharing mechanisms. Some concerns have been voiced about BO data being misused by other government departments. For instance, in Armenia, media companies voiced concerns about BO disclosures facilitating interference and being used to limit press freedom.[20] In this case, public access could allow for public oversight of the use of data.

Box 2: Beneficial ownership data in tax policymaking

In the UK, the Wealth Tax Commission was established in early 2020 to provide in-depth analysis of proposals for a UK wealth tax. The commission studied whether a UK wealth tax is desirable and deliverable, and worked with economists, lawyers, and accountants to study all aspects of a wealth tax. As one of the authors states, “[BO] data are critical for policy making. At the Wealth Tax Commission we made use of these data as part of our measurement of taxable top wealth in the UK.”[21] The report provides recommendations to governments on the merits and practicalities of different types of wealth tax, and models and estimates of how much a wealth tax could raise.[22]

Private sector users

Obliged entities

Under many disclosure regimes with closed central registers, obliged entities such as financial institutions (FIs) and designated non-financial businesses and professions (DNFBPs) (e.g. accountants and lawyers) that fall under know your customer (KYC) legislation are able to access BO data.[b] However, not all countries include access for FIs and DNFBPs in regimes with closed registers[c], and in countries that do, access to BO data for entities outside the jurisdiction can still be very challenging. Therefore, until a system works perfectly, public registers offer better access for obliged entities than closed registers.

Non-obliged entities

BO data does not only have value for obliged entities, but also helps any company manage risk by establishing with whom they are conducting business. In 2016, 91% of executives surveyed agreed that it is important to know the BO of the company with which they do business.[23] A survey of Chief Supply Chain Officers found that 84% cite lack of visibility across the supply chain as their biggest challenge, and found that “most companies are virtually blind to the 80% of data that is dark or unstructured”.[24] Upstream supply chain visibility, including the BO of companies throughout the supply chain, is key to reducing financial and reputational risk posed[25], for example, by counterfeit goods, and facilitated by anonymously owned companies.[26]

Some companies are currently purchasing this information but often cite issues with the data, including coverage and quality.[27] Additionally, these costs are disproportionately higher for smaller companies.[28] Publicly accessible BO data enables all companies to access the same information, decreasing the cost of due diligence and enabling companies to better reduce risk. This helps level the playing field [29] and contributes to “preserving trust in the integrity of business transactions and of the financial system”, as recognised by AMLD5 (see Box 10).

Box 3: Use of public beneficial ownership data by companies in the UK

In a review of the UK BO register, the majority of searches by businesses “were looking up information on clients and customers (64%), and businesses with a simple ownership structure were more likely to search for this information than businesses with a complex ownership structure (65%)”.[30] 64% of surveyed businesses found the data useful or very useful.[31]

At a societal level, removing information asymmetries between large companies able to pay for enhanced access to data and smaller companies relying on public data can increase market competition and foster a business culture of transparency and trust.[32] It is therefore unsurprising that an increasing number of companies are now calling for governments to make BO information accessible to them.[33] As Chris Robinson, Chief Compliance Officer at mining multinational BHP said: “Public BO registers are the best tool against corruption. [Public registers are] better than just holding this information with governments. This levels the playing field for ethical companies who are committed to operating cleanly and makes it harder for corrupt companies to be corrupt. It improves the investment environment and level of certainty when investing in a country. As a company, BHP seeks beneficial ownership information about companies it deals with and its suppliers. This is often difficult to verify. Making the information public opens more resources to verify it. It makes it much easier for BHP to complete due diligence on suppliers”.[34]

The use of BO information is increasingly being recognised as best practice in environmental, social governance (ESG).[35] At Davos 2021, the World Economic Forum concluded that BO data is necessary to gain oversight of the activities of a company’s third parties and suppliers and their potentially environmentally or socially damaging actions.[36] ESG principles are becoming increasingly important in investment decision-making, even when companies are not directly liable themselves, “in light of mounting evidence, activism and regulation”.[37] As the Head of Sustainability of a global investment firm said, “if you feel uncomfortable about your production process or supply chain, there’s probably a reason why. In a time of radical transparency, look at your products, practices and your value chain.” [38]

Beneficial ownership data providers and reusers

Private third-party BO data providers are increasingly calling for governments to make BO data public.[39] BO data providers ingest BO data from government registers as their primary sources of data. Their services often include making the data available as structured data, using standardised formatting in a digital and often machine-readable format. They usually offer the data cleaned and note where it may have errors (such as unusual entries for given fields) or may be outdated. The more advanced services offer cross-checking information against data in other systems, government registers, and other publicly available information, augmenting data with costly open source research.[40] In short, BO providers are offering services which in some BOT regimes governments are doing themselves: verifying data and making it available in a structured format. As governments can use additional non-public sources to verify BO data, they can be better placed to verify data. Unfortunately, many governments provide barriers to access, ranging from identification and registration requirements to paywalls, making it difficult for BO data providers to ingest and augment the data.[41]

Box 4: YouControl: Beneficial ownership data reuse in Ukraine

YouControl is a Ukrainian company committed to business transparency in Ukraine.[43] It draws on data from Ukraine’s public BO register – the Unified State Register – to enable reduced corruption in Ukraine’s business sector. YouControl has developed an “analytical system for compliance, market analysis, business intelligence, and investigation”. It pulls data from 87 government registers, including the Unified State Register for BO, as well as some of its own analysis to provide company profiles with a substantial amount of information, including anything that should raise red flags: unpaid taxes, pending lawsuits, and failure to file returns.[42] YouControl charges the private sector for its services, but provides information for free to non-governmental organisations (NGOs), civil society organisations (CSOs), and universities.

Publication of open data on YouControl’s website has been useful in the fight against fraud and unfair business in Ukraine. A number of case studies on the website provide examples where companies have saved hundreds of thousands of dollars by using YouControl to identify fraudulent operations before entering into business with them.[44] Additionally, YouControl customers report irregularities to the authorities, and YouControl also provides advice and input to the government about the register as a member of its verification working group.

When governments make verified BO data publicly accessible, the disruptive market effect moves BO data providers up the value chain from providing a data cleaning service. Put simply, the better the structured data these companies can ingest, the more they can target human resources at more complex aspects of open source research. BO data service providers are offering increasingly sophisticated tools that can add even greater value to BO data. For instance, some offer a greater customisation of offerings for specific types of users within the private sector, outside of the primary regulatory uses, such as for investors, or for sustainability departments who wish to better understand the relationships of BO to other entities.[45]

There is emerging evidence that open company and BO data hold significant economic value. A PwC study shows that in Italy, company ownership information forms 10% of the total Italian information sector’s economic value.[46] And a Deloitte impact assessment for the European Commission concluded: “The experience of the frontrunner countries clearly show the exponential increase in the value of the information which emerged as a consequence of greater availability of company data and there is no reason to doubt that this anticipatory examples could not be indicative of what would happen in all other countries”.[47]

Box 5: The economic value of BO data in the UK

A 2019 Companies House (CH) study estimates the value of UK company data to be an average of GBP 1,100 per reuser, with an estimated total benefit between GBP 1 billion and GBP 3 billion per year [48] – of which BO data constituted between GBP 40 million and GBP 120 million [49] – for Companies House Service (CHS) users alone. The study explains that “more than half of the smaller intermediaries that access CH bulk data products have only been accessing these products since they became available free of charge. This suggests that access to free data has stimulated the development of new business opportunities”.[50]

Civil society

Civil society, including whistleblowers, investigative journalists, researchers, and the general public, is a key user group for public BO data. Civil society actors, using a combination of publicly accessible data and data from leaks – such as the Panama and Paradise Papers, and the Luanda Leaks – play a significant role in bringing cases of corruption and financial crime to light. For instance, the Organized Crime and Corruption Reporting Project (OCCRP) – an investigative reporting platform for a worldwide network of independent media centers and journalists – has contributed to over USD 7.3 billion in fines being levied and assets being seized, and over 500 arrests, indictments, and sentences.[51]

Box 6: Public data used to expose conflicts of interest in the EU [d]

Before entering politics in 2011 on an anti-corruption platform [52], current Czech Prime Minister Andrej Babiš worked in the private sector and founded the Agrofert Group in 1993. Agrofert now has more than 250 subsidiaries, including two of the largest Czech newspapers, MF DNES and Lidové noviny, as well as the Mafra media group, which owns iDnes, the most visited Czech news server.[53]

Following the introduction of Czech conflict of interest legislation, which prevents members of government and other public officials from having a controlling interest in news media, Babiš transferred his sole ownership of the Agrofert Group to two trust funds: AB private trust I, owning 565 shares (89.97%); and AB private trust II, owning 63 shares (10.03%).[54] Agrofert is currently active in 18 countries in 4 continents [55], and as such is registered in both the Czech Republic as well as Slovakia, where it is a market leader in agriculture and food processing.[56]

Following research on the Slovak public BO register in 2018, TI Slovakia uncovered that Babiš was disclosed as one of five beneficial owners by Agrofert Slovakia.[57] In response, Agrofert claimed that TI had misinterpreted the law and that “Mr. Babiš is not the controlling entity of the Slovak companies of the Agrofert Group.” [58] This was contested by TI Slovakia, drawing attention to the fact that Babiš is the only beneficial owner who has the power to remove all other listed beneficial owners – the trustees.[59] Additionally, he is listed as a beneficiary in the certified disclosure document; the trust funds are set up so that the shares will return to him when he terminates his public office.[60] Besides potentially violating the Czech Conflict of Interests Act, Babiš could have violated EU laws regarding firms being owned by politicians not being eligible to receive EU funding [61], as Agrofert subsidiary companies received EU subsidies both before and after Babiš transferred his ownership to the two trusts in 2017.

A recent EU audit found that: “Considering […] that Mr Babiš has defined the objectives of the Trust Funds […], set them up and appointed all their actors, whom he can also dismiss, it can be assessed that he has a direct, as well as an indirect decisive influence over the Trust Funds. Based on this assessment, the Commission services consider that, through these Trust Funds, Mr Babiš indirectly controls the parent company AGROFERT group […]”. He was found to be in violation of the EU’s Conflict of Interests Act.[62]

In a hypothetical world where financial investigative units (FIUs) and other competent authorities are sufficiently resourced, information sharing systems would work seamlessly, and justice systems would always be independent and effective, the need for journalists to investigate financial crime would be minimal. However, reality is some distance removed from this idea, as highlighted by recent journalistic exposés. The FinCEN Files – named after the US Treasury’s Financial Crimes Enforcement Network – were published on 20 September 2020 and contained leaked suspicious activity reports (SARs) made by banks to the United States’ FIU. The leaks revealed substantial deficiencies in the current international AML architecture, for instance, major FIs had a continued role in moving illicit funds, despite warnings and fines, operating in what a former senior US Justice Department official and financial crimes prosecutor called “a system that is largely toothless”. “Everyone is doing badly,” concluded the FATF executive secretary.[63] Some argue that fighting financial crime should be left to governments alone.[64] Given the situation, however, whilst governments should not absolve themselves of this core responsibility, public registers allow civil society to fulfil a critical investigative role and provide public oversight of the government function of fighting financial crime.

The evidence that even comparatively well-resourced FIUs in high-income countries are failing to prevent crimes can undermine citizens’ trust in their governments to perform its duties, perhaps even more so in countries with more modest resources. Public registers also help governments to be accountable to their citizens and allow for public oversight of not only fighting financial crime, but also other key functions such as knowing who receives public funds, contracts, and licences.[65] Research suggests transparency can, under certain circumstances, lead to better performance of government, and can ensure greater accountability and trust.[66] Accountability is a key use case for public BO data. As mentioned, many countries are pursuing BOT in public procurement; publishing BO information of recipients of public funds – in combination with open contracting and spending data – allows governments to account for their spending of taxpayer money, [67] particularly in emergency responses.[68]

Box 7: Investigating the Beirut blast

On 4 August 2020, an explosion in a warehouse in the port of Beirut resulted in the deaths of 211 people [69], injuring 5,000 people, temporarily displacing over 300,000 people, and incurring an estimated loss of USD 10-15 billion.[70] The explosion was caused by the detonation of 2,750 tonnes of ammonium nitrate that was stored, unsafely, at the warehouse in the port of Beirut.

The ammonium nitrate had arrived in Beirut on 23 September 2013 on the MV Rhosus, a Moldavian flagged ship, sailing from Batumi, Georgia and heading to Biera, Mozambique.[71] The ship was forced to stop in Beirut after experiencing technical problems following an inspection from the Beirut Port authorities.[72] Given ammonium nitrate is used for making bombs [73], there have been speculations about the reason for shipping the chemicals and an investigation into the potential culprits of the disaster in Beirut and their motives.[74]

Financial crime investigators Graham Barrow and Ray Blake used UK and Ukrainian data on the Global Open Ownership Register to gather information, tracing the ownership of the Moldovan ship to the management of a web of different British shell companies. Their investigation found a direct link between the ship that docked in Beirut and a UK registered company, whose listed beneficial owner revealed ties to other UK and Ukrainian registered companies and a number of sanctions, individuals, and companies.[e]

Barrow and Blake summarised: “We have a network of UK companies which appear to be involved in the purchase of dangerous chemicals which blew up much of Beirut, which are or were allegedly involved in facilitating the sale of oil on behalf of ISIS, which were, or are still, being owned or controlled by globally sanctioned individuals.

“The only reason we are able to bring this story to the general public, the only way we are able to shine this particular light into a very murky world, is because the UK operates a fully open, free to access, corporate and BO registry.”[75]

Verification

Some have suggested that a closed register ensures higher data quality compared to open registers.[76] This premise misses the point that BO data quality is dependent on having comprehensive verification mechanisms. Who subsequently has access is a secondary point. In fact, making BO registers open and public is also a complementary, non-technically intensive mechanism to help verify BO data. Making registers public allows for checking by the private sector, civil society, and the general public, both for accidental error and deliberate falsehoods.[77] Research suggests that publishing data publicly can drive up data quality, as increased data use drives up the likelihood of inconsistencies or potential wrongdoing being identified, provided reporting mechanisms are in place and subsequent action is taken.[78] Registers should not rely on making data public as the only means of verification, but should include checks both at the point of and after the submission of data.[79]

Box 8: Civil society data use leads to innovations to strengthen data quality in the UK

In the largest-ever analysis of the data on beneficial owners of UK companies, Global Witness and DataKind UK examined more than 10 million corporate records from Companies House in 2018.[80] Combining persons of significant control (PSC) data with datasets about politicians and company officers, they developed algorithms to identify suspicious and erroneous filings. The analysis revealed that thousands of companies had filed suspicious entries that appeared not to comply with the rules. They highlighted methods for apparently avoiding disclosure of real owners, including naming an (ineligible) foreign company as the beneficial owner and creating circular ownership structures. Based on their research, the analysts developed a red-flagging system to help uncover higher-risk entries and identify companies that should be subject to further scrutiny.

The results of this research formed the basis of civil society advocacy to improve data in the UK’s BO register, and the findings were cited multiple times in the UK Government’s subsequent public consultation on proposed improvements.[81] Several of the recommendations have been incorporated into the UK Government’s proposed reforms.[82]

Whilst the UK Government could have undertaken this research itself, public access to the data in machine-readable format enabled data scientists in civil society to swiftly identify weaknesses and loopholes, and propose evidence-based solutions direct to policymakers, acting as a de facto verification mechanism to drive up data quality.

Deterrence

Because deterrence is inherently difficult to measure, it is difficult to establish a link between transparency and deterring the misuse of legal entities. There is some evidence, however, that under certain circumstances the publication of data can lead to a change in behaviour.[83] Anecdotal evidence from the UK also suggests a deterrence effect of the publication of data (see Box 9).

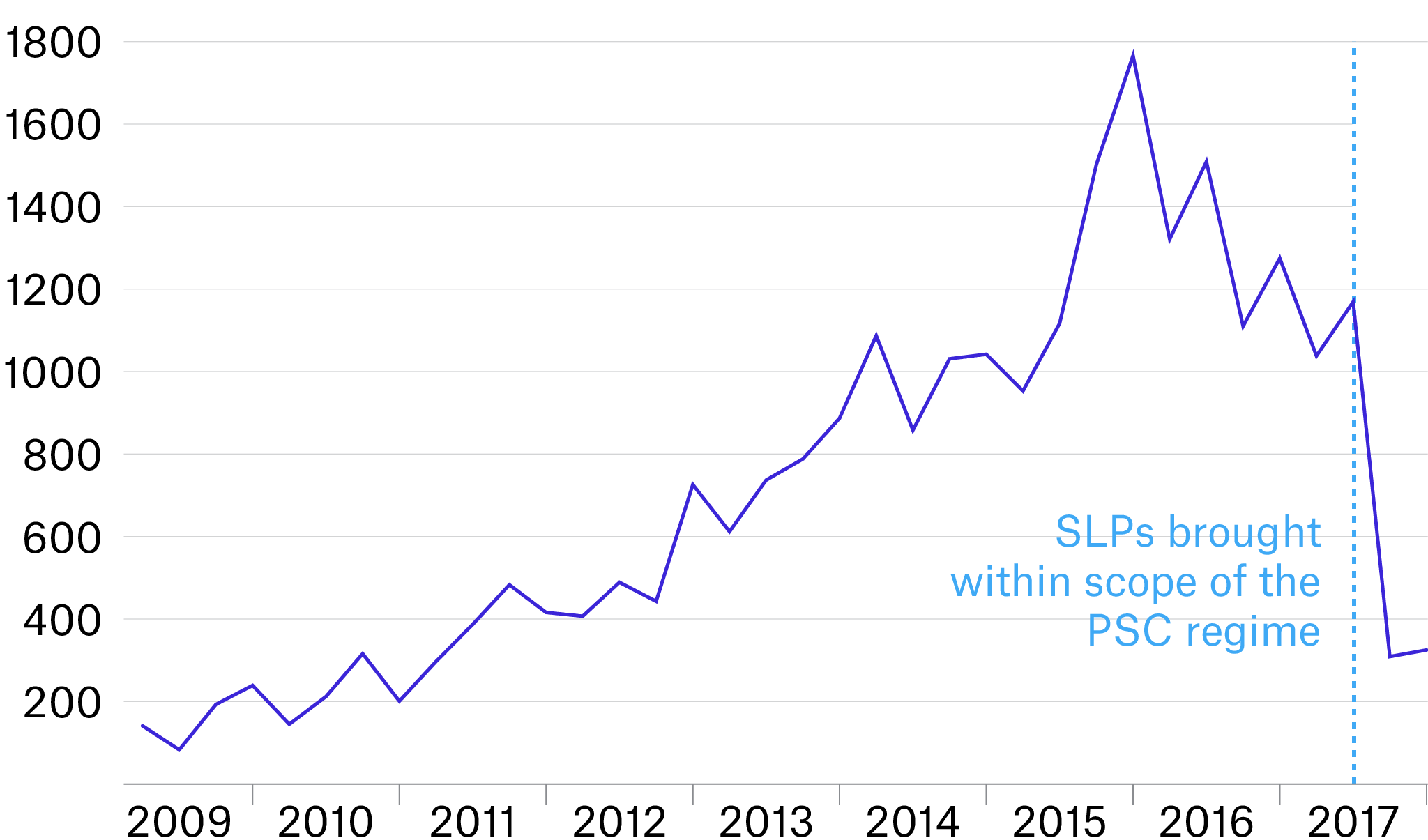

Box 9: Transparency and deterrence: Scottish Limited Partnerships

Due to having limited statutory filing requirements, Scottish Limited Partnerships (SLPs) have been described as the getaway vehicle of choice for money launderers.[84] When the UK launched its public BO register in 2016, SLPs were one of a small number of corporate forms that were exempt from the disclosure requirements. Although SLPs have legitimate uses, Global Witness analysis revealed their number almost doubled between 2015 and 2016, coinciding with the launch of BOT in the UK, which raised concerns that SLPs were being used to avoid transparency.

This suspicion was underscored by investigative journalists who uncovered that SLPs were used to move at least GBP 4 billion out of the former Soviet Union as part of the Russian Laundromat over a four-year period, one of the world’s biggest and most elaborate money-laundering schemes.[85] In addition, reports show that 70% of the SLPs that were incorporated between 2007 and 2016 were registered at 10 addresses, and in 2014, 20 SLPs were used to move over USD 1 billion from Moldovan banks.[86]

In June 2017, the UK Government bought SLPs within the scope of its BOT regime, requiring owners to register and disclose PSC data to Companies House.[87] “Almost immediately their rates of incorporation plummeted to the lowest in 7 years, 80% lower in the last quarter of 2017 than at its peak at the end of 2015,” noted Global Witness.[88]

The fact that this dramatic shift in the use of SLPs coincides so clearly with them being brought within the scope of the UK BOT regime suggests a deterrence effect of making BO information public. Whilst this finding is a correlation, and we cannot rule out the influence of other factors, this provides strong initial evidence for the role of BOT in changing the behaviour of individuals who use corporate vehicles.[f]

Rate of SLP incorporation per quarter

Adapted from: Global Witness (2018), Three ways the UK’s Register of the real owners of companies is already proving its worth. [89]

Footnotes

[b] For example, access for FIs and DNFBPs is a provision under AMLD5.

[c] For example, trends in Asia, Africa, Middle East, and Latin America appear to be to limit non-government access.

[d] For the full story, see: Tymon Kiepe, Victor Ponsford, and Louise Russell-Prywata, “Early impacts of public registers of beneficial ownership: Slovakia”, Open Ownership, September 2020, https://www.openownership.org/uploads/slovakia-impact-story.pdf.

[e] For the full story, see: Chinwe Ekene Ezeigbo, Tymon Kiepe, and Louise Russell-Prywata, “Early impacts of public registers of beneficial ownership: United Kingdom”, Open Ownership, April 2021, https://www.openownership.org/uploads/OO%20Impact%20Story%20UK.pdf.

[f] For the full story, see: Ezeigbo, Kiepe, and Russell-Prywata, “Early impacts: United Kingdom”.

Endnotes

[5] Concealment of Beneficial Ownership”, Egmont Group and FATF, Paris, July 2018, 32, https://egmontgroup.org/sites/default/files/filedepot/Concealment_of_BO/FATF-Egmont-Concealment-beneficial-ownership.pdf.

[6] Maíra Martini, “Who is behind the wheel? Fixing the global standards on company ownership”, Transparency International, 2019, 20, https://images.transparencycdn.org/images/2019_Who_is_behind_the_wheel_EN.pdf.

[7] “Anti-money laundering and counter-terrorist financing measures – Canada”, Fourth Round Mutual Evaluation Report, FATF, Paris, September 2016, https://www.fatf-gafi.org/media/fatf/documents/reports/mer4/MER-Canada-2016.pdf.

[8] “Anti-money laundering and counter-terrorist financing measures – Ghana”, Second Round Mutual Evaluation Report, GIABA, Dakar, 2018, https://www.fatf-gafi.org/media/fatf/documents/reports/mer-fsrb/GIABAGhana-MER-2018.pdf.

[9] “Anti-money laundering and counter-terrorist financing measures – Hong Kong, China”, Fourth Round Mutual Evaluation Report, FATF, Paris, 2019, https://www.fatf-gafi.org/media/fatf/documents/reports/mer4/MER-HongKong-2019.pdf.

[10] “Anti-money laundering and counter-terrorist financing measures – Australia”, Fourth Round Mutual Evaluation Report, FATF, Paris and APG, Sydney, April 2015, https://www.fatf-gafi.org/media/fatf/documents/reports/mer4/Mutual-Evaluation-Report-Australia-2015.pdf.

[11] “Anti-money laundering and counter-terrorist financing measures – Latvia”, Fifth Round Mutual Evaluation Report, MONEYVAL, Strasbourg, July 2018, https://www.fatf-gafi.org/media/fatf/documents/reports/mer-fsrb/Moneyval-Mutual-Evaluation-Report-Latvia-2018.pdf.

[12] “Anti-money laundering and counter-terrorist financing measures – Australia”, Fourth Round Mutual Evaluation Report, FATF, Paris and APG, Sydney, April 2015, https://www.fatf-gafi.org/media/fatf/documents/reports/mer4/Mutual-Evaluation-Report-Australia-2015.pdf.

[13] “Anti-money laundering and counter-terrorist financing measures – Hong Kong, China”, Fourth Round Mutual Evaluation Report, FATF, Paris, 2019, www.fatfgafi.org/publications/mutualevaluations/documents/mer-hong-kongchina2019.html.

[14] Interview with Open Ownership, Law Enforcement Officer, 21 May 2020.

[15] Response to the Open Ownership Principles consultation via https://www.openownership.org/events/the-open-ownership-principles-consultation, 2 March 2021.

[16] “Open data: Matt Hancock speech”, GOV.UK, 10 December 2015, https://www.gov.uk/government/speeches/open-data-matt-hancock-speech.

[17] See, for example: Gareth Davies, “Challenges in using data across government”, National Audit Office, 21 June 2019, https://www.nao.org.uk/wp-content/uploads/2019/06/Challenges-in-using-data-across-government.pdf.

[18] “Green Paper: Transforming public procurement”, GOV.UK, 15 December 2020, https://www.gov.uk/government/consultations/green-paper-transforming-public-procurement.

[19] “Summary of GDPR derogations in the Data Protection Bill”, Department for Digital, Culture, Media and Sport, 7 August 2017, https://iapp.org/media/pdf/resource_center/UK-GDPR-derogations.pdf; “Data Protection Act 2018”, Legislation.gov.uk, Section 8, 2018, https://www.legislation.gov.uk/ukpga/2018/12/section/8/enacted.

[20] Shushan Doydoyan, “Beneficial ownership progress in Armenia”, Freedom of Information Centre of Armenia, 6 April 2021, http://www.foi.am/en/news/item/2011/.

[21] Comments made during an Anti-Corruption and Responsible Tax APPG event on Companies House Reform, Online, 25 February 2021.

[22] Arun Advani, Emma Chamberlain, and Andy Summers, “A wealth tax for the UK”, Wealth Tax Commission, 2020, https://www.wealthandpolicy.com/wp/WealthTaxFinalReport.pdf.

[23] Rob Haden, “EY’s Global Fraud Survey”, LinkedIn, 21 April 2016, https://www.linkedin.com/pulse/eys-global-fraud-survey-2016-rob-haden?articleId=6128943671413923841.

[24] “Building a Smarter Supply Chain: The power of AI and Blockchain to drive greater supply chain visibility and mitigate disruptions”, IBM, October 2019, https://www.ibm.com/downloads/cas/EYZ5BG4R.

[25] Paul May, “Inception Report: Use of beneficial ownership data by private sector”, Open Ownership, June 2020 (Unpublished).

[26] David M. Luna, “Anonymous Companies Help Finance Illicit Commerce and Harm American Businesses and Citizens”, FACT Coalition, May 2019, https://thefactcoalition.org/anonymous-companies-help-finance-illicitcommerce-and-harm-american-businesses-and-citizens.

[27] “The use of beneficial ownership data by private entities”, Cognitiks and Open Ownership, 2021 (Forthcoming).

[28] Petrus van Duyne, Jackie Harvey, and Liliya Gelemerova, The Critical Handbook of Money Laundering (London: Palgrave Macmillan, 2018), 254.

[29] “Ending anonymous companies: Tackling corruption and promoting stability through beneficial ownership transparency”, The B Team, January 2015, 8-9, https://bteam.org/assets/reports/B-Team-BusinessCase-Ending-Anonymous-Companies-Report.pdf.

[30] “Review of the implementation of the PSC Register”, Department for Business, Energy and Industrial Strategy, March 2019, 30, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/822823/review-implementation-psc-register.pdf.

[31] Ibid, 31.

[32] Tymon Kiepe and Eva Okunbor, “Beneficial ownership data in procurement”, Open Ownership, March 2021, 16, https://www.openownership.org/uploads/OO%20BO%20Data%20in%20Procurement.pdf.

[33] “The use of beneficial ownership data by private entities”, Cognitiks and Open Ownership, 2021 (Forthcoming).

[34] Chris Robinson, quote from online event “EITI Debates : Why the pushback? Barriers to public disclosure of beneficial ownership in Latin America and the Caribbean”, 11 March 2021, https://eiti.org/event/eitidebates-why-pushback-barriers-to-public-disclosure-of-beneficial-ownershipin-latin.

[35] “The ESG Due Diligence and Transparency Report on Extractive Commodity Trading”, RMF, 2021, https://www.responsibleminingfoundation.org/app/uploads/EN_RMF_DDAT_TRADING_2021_WEB.pdf; “The use of beneficial ownership data by private entities”, Cognitiks and Open Ownership, 2021 (Forthcoming).

[36] “Companies at Davos Urged to Meet ESG Expectations after the Pandemic”, LexisNexis, 21 January 2021, https://internationalsales.lexisnexis.com/sg/news-and-events/companies-at-davos-urged-to-meet-esg-expectations-after-the-pandemic.

[37] “Embracing the New Age of Materiality: Harnessing the Pace of Change in ESG”, March 2020, World Economic Forum, 5, http://www3.weforum.org/docs/WEF_Embracing_the_New_Age_of_Materiality_2020.pdf.

[38] Ibid, 9.

[39] See, for instance: Che Sidanius, “Why firms want more company ownership data”, LinkedIn, 13 May 2020, https://www.linkedin.com/pulse/why-firms-want-more-company-ownership-data-che-sidanius.

[40] “The use of beneficial ownership data by private entities”, Cognitiks and Open Ownership, 2021 (Forthcoming).

[41] Dominic Kavakeb, “Patchy progress in setting up beneficial ownership registers in the EU”, Global Witness, 20 March 2020, https://www.globalwitness.org/en/campaigns/corruption-and-money-laundering/anonymous-company-owners/5amld-patchy-progress/.

[42] “Information about all Ukrainian businesses”, YouControl, n.d., https://youcontrol.com.ua/sources/.

[43] “Don’t Even Try: the Court Refused to Remove Data from YouControl at the Request of the Ukrainian Data-Center”, YouControl, 6 December 2019, https://youcontrol.com.ua/en/news/i-ne-namahaytes-sud-vidmovyv-uvydalenni-danykh-z-youcontrol-na-vymohu-ukrayinskoho-data-tsentru/.

[44] “Case Studies”, YouControl, n.d., https://youcontrol.com.ua/en/cases/.

[45] “The use of beneficial ownership data by private entities”, Cognitiks and Open Ownership, 2021 (Forthcoming).

[46] The study is not publicly available but quoted in: Deloitte, “Impact Assessment study on the list of High Value Datasets to be made available by the Member States under the Open Data Directive”, European Commission, 7 January 2021, 136.

[47] Ibid, 138.

[48] “Valuing the User Benefits of Companies House Data”, Companies House and the Department for Business, Energy and Industrial Strategy, September 2019, 4, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/833764/valuing-benefitscompanies-house-data-policy-summary.pdf.

[49] Ibid, 16.

[50] Ibid, 5.

[51] Nkirote Koome, “OCCRP: Using investigative journalism and big data in the fight against corruption”, Luminate, 18 February 2021, https://luminategroup.com/posts/blog/occrp-using-investigative-journalism-and-bigdata-in-the-fight-against-corruption.

[52] “Czech prosecutors drop fraud probe into PM Andrej Babis”, DW, 2 September 2019, https://www.dw.com/en/czech-prosecutors-drop-fraud-probe-into-pm-andrej-babis/a-50255477.

[53] “About Agrofert”, Agrofert, https://www.agrofert.cz/en/about-agrofert; Yveta Kasalická, “The new Czech media owners”, Progetto Repubblica Ceca, 28 July 2014, http://www.progetto.cz/i-nuovi-padroni-dei-mediacechi/?lang=en; Michal Černý, “Reporters on the Czech website: an overview of news servers”, Lupa, 13 February 2008, https://www.lupa.cz/clanky/zpravodajci-na-ceskem-webu-prehled/; “About the company”, MAFRA, https://www.mafra.cz/english.aspx.

[54] Daniel Morávek, “Babiš transferred Agrofert to trust funds, but the company will return to him”, Podnikatel, 3 February 2017, https://www.podnikatel.cz/clanky/babis-prevedl-agrofert-do-sverenskych-fondu-firma-semu-ale-vrati/; “Shareholder informed the management of the companies AGROFERT and SynBiol on the transfer of shares into Trusts”, Agrofert, 3 February 2017, https://www.agrofert.cz/en/events-and-news/shareholderinformed-the-management-of-the-companies-agrofert-and-synbiol-on-the.

[55] “About Agrofert”, Agrofert, https://www.agrofert.cz/en/about-agrofert.

[56] Ibid.

[57] David Ondráčka, “Andrej Babiš is our controlling person (beneficial owner), says Agrofert”, Transparency International, 22 June 2018, https://www.transparency.org/en/press/andrej-babish-is-our-controlling-personczech-republic; “Register of public sector partners”, Ministry of Justice of the Slovak Republic, 1 February 2017, https://rpvs.gov.sk/rpvs/Partner/Partner/HistorickyDetail/7859.

[58] “Rebuttal of misinformation from Transparency International”, Agrofert, 19 June 2018, https://www.agrofert.cz/en/events-and-news/rebuttal-of-misinformation-from-transparency-international.

[59] David Ondráčka, “Andrej Babiš is our controlling person (beneficial owner), says Agrofert”, Transparency International, 22 June 2018, https://www.transparency.org/en/press/andrej-babish-is-our-controlling-person-czech-republic.

[60] Daniel Morávek, “Babiš transferred Agrofert to trust funds, but the company will return to him”, Podnikatel, 3 February 2017, https://www.podnikatel.cz/clanky/babis-prevedl-agrofert-do-sverenskych-fondu-firma-se-mu-ale-vrati/.

[61] Specifically, Article 57 of Regulation (EU, Euratom) No 966/2012 and Article 61 of Regulation (EU, Euratom) 2018/1046: “European Parliament resolution of 14 September 2017 on transparency, accountability and integrity in the EU institutions”, European Parliament, 14 September 2017, https://www.europarl.europa.eu/doceo/document/TA-8-2017-0358_EN.html..

[62] Jakub Dürr, “Final Audit Report: Audit No. REGC414CZ0133”, European Commission, 2019, 19, https://ec.europa.eu/regional_policy/sources/docoffic/official/reports/cz_functioning_report/cz_functioning_report_en.pdf.

[63] Michael W. Hudson et al., “Global banks defy U.S. crackdowns by serving oligarchs, criminals and terrorists”, ICIJ, 20 September 2020, https://www.icij.org/investigations/fincen-files/global-banks-defy-u-s-crackdowns-byserving-oligarchs-criminals-and-terrorists/.

[64] See, for example: “Privacy – violating UBO register misses the mark”, Privacy First, 15 June 2020, https://www.privacyfirst.nl/aandachtsvelden/wetgeving/item/1193-privacyschendend-ubo-register-schiet-doel-voorbij.html.

[65] See: Tymon Kiepe and Eva Okunbor, “Beneficial ownership data in procurement”, Open Ownership, March 2021, https://www.openownership.org/uploads/OO%20BO%20Data%20in%20Procurement.pdf.

[66] See, for example: Kim, P.S., Halligan, J., Cho, N., Oh, C. and Eikenberry, A. (2005) ‘Towards Participatory and Transparent Governance: Report on the Sixth Global Forum on Reinventing Government’, Public Administration Review 65 (6): 646-654. 649; Hazell, R. and Worthy, B. (2009) ‘Impact of Freedom of Information on Central Government’, unpublished end of award report to the Economic and Social Research Council, Constitution Unit, University College, London; John Gaventa and Rosemary McGee, “The Impact of Transparency and Accountability Initiatives”, Development Policy Review, 2 August 2013, https://assets.publishing.service.gov.uk/media/57a08aabed915d622c00084b/60827_DPRGaventaMcGee_Preprint.pdf; Capturing the social relevance of government transparency and accountability using a behavioral lens; Stephan Grimmelikhuijsen and Albert Meijer, “Effects of Transparency on the Perceived Trustworthiness of a Government Organization: Evidence from an Online Experiment”, Journal of Public Administration Research and Theory, 24(1):137-157, https://www.researchgate.net/publication/270814803_Effects_of_Transparency_on_the_Perceived_Trustworthiness_of_a_Government_Organization_Evidence_from_an_Online_Experiment.

[67] Tymon Kiepe and Eva Okunbor, “Beneficial ownership data in procurement”, Open Ownership, March 2021, https://www.openownership.org/uploads/OO%20BO%20Data%20in%20Procurement.pdf.

[68] See, for instance: Cynthia O’Murchu and Robert Smith, “Gupta carved up business empire in attempt to secure UK Covid loans”, Financial Times, 15 April 2021, https://www.ft.com/content/b2c846db-2537-47e3-a75d-5118c69ba54a.

[69] Associated Press, “‘Not Like Every Time:’ Beirut Blast Victims Want the Truth”, Voices of America, 6 February 2021, https://www.voanews.com/middle-east/not-every-time-beirut-blast-victims-want-truth.

[70] “Beirut Explosion: What We Know So Far”, BBC, 11 August 2020, https://www.bbc.com/news/world-middle-east-53668493.

[71] Felipe Arizon ”The Arrest News” 11, Shiparrested.com, October 2015, https://shiparrested.com/wp-content/uploads/2016/02/The-Arrest-News-11thissue.pdf.

[72] Ibid.

[73] “Beirut Explosion: What We Know So Far”, BBC, 11 August 2020, https://www.bbc.com/news/world-middle-east-53668493.

[74] “George Haswani”, Counter Extremism Project, n.d., https://www.counterextremism.com/extremists/george-haswani.

[75] Graham Barrow and Ray Blake, “British Shells and the Beirut Blast”, The Dark Money Files podcast, 17 January 2021, https://podcasts.apple.com/us/podcast/british-shells-and-the-beirut-blast/id1448635132?i=1000505495826.

[76] Martin Kenney, “Martin Kenney: Open company UBO registers are not the panacea to financial crime”, The FCPA Blog, 7 May 2018, https://fcpablog.com/2018/5/7/martin-kenney-open-company-ubo-registers-are-not-the-panacea/.

[77] Tymon Kiepe, “Verification of Beneficial Ownership Data”, Open Ownership, 7, https://www.openownership.org/uploads/OpenOwnership%20Verification%20Briefing.pdf.

[78] “Briefing: The case for beneficial ownership as open data”, Open Ownership, 3, https://www.openownership.org/uploads/briefing-on-beneficialownership-as-open-data.pdf.

[79] Tymon Kiepe, “Verification of Beneficial Ownership Data”, Open Ownership, https://www.openownership.org/uploads/OpenOwnership%20Verification%20Briefing.pdf.

[80] “The Companies We Keep: What the UK Open Data Register Actually Tells Us About Company Ownership”, Global Witness, July 2018, https://www.globalwitness.org/en/campaigns/corruption-and-money-laundering/anonymous-company-owners/companies-we-keep/#chapter-0/section-0.

[81] “Corporate transparency and register reform: Consultation on options to enhance the role of Companies House and increase the transparency of UK corporate entities”, Department for Business, Energy and Industrial Strategy, May 2019, https://assets.publishing.service.gov.uk/government/uploarporate_transparency_and_register_reform.pdf.

[82] “Corporate Transparency and Register Reform: Government response to the consultation on options to enhance the role of Companies House and increase the transparency of UK corporate entities”, Department for Business, Energy and Industrial Strategy, 18 September 2020, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/925059/corporate-transparency-register-reformgovernment-response.pdf.

[83] See, for example: J. Patrick Meagher, “Corporate measures to prevent and detect corruption in Asia and the Pacific: Frameworks and Practices in 31 Jurisdictions”, ADB and OECD, 11, https://www.oecd.org/site/adboecdanti-corruptioninitiative/ADB-OECD-Corporate-Measures-to-Preventand-Detect-Corruption-ENG.pdf; Bianca Vaz Mondo, “Accountability as a Deterrent to Corruption: New Evidence from Brazilian Municipalities”, ECPR, 2015, https://ecpr.eu/Events/Event/PaperDetails/23591.

[84] Gemma Cartin, “Offshore in the UK, Analysing the Use of Scottish Limited Partnerships in Corruption and Money Laundering”, Transparency International UK, June 2017, https://www.transparency.org.uk/sites/default/files/pdf/publications/Offshore_In_The_UK_TIUK_June_2017.pdf.

[85] Jaccy Gascoyne, “The Use of Scottish Limited Partnerships in Money laundering Schemes”, MLROs.com, n.d., https://mlros.com/the-use-ofscottish-limited-partnerships-in-money-laundering-schemes/; David Leask and Richard Smith, “Scots shell companies used to launder £4 billion out of Russia”, The Herald, 27 March 2017, https://www.heraldscotland.com/news/15183346.scots-shell-companies-used-to-launder-4-billion-out-of-russia/.

[86] Ibid.

[87] “Hard Data on Lessons Learned from the UK Beneficial Ownership Register”, Global Witness, 30 May 2019, https://www.globalwitness.org/documents/19733/GW.Fact_Sheet_on_UK_Register_Data_for_US.May302019_w0hQoid.pdf.

[88] Ibid.

[89] Nienke Palstra, “Three ways the UK’s register of the real owners of companies is already proving its worth”, Global Witness, 24 July 2018, https://www.globalwitness.org/en/blog/three-ways-uks-register-real-owners-companies-already-proving-its-worth/.