Use and impact of public beneficial ownership registers: Denmark

Case studies

The role of intermediaries in Denmark’s data ecosystem

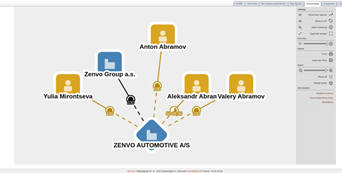

Many data service providers ingest BO data from the CVR into their own platforms using its API and combine it with other public data. They provide analysis and visualisation tools to help customers use and understand the data (Figure 3). For example, BiQ has been using the DBA’s API since the register was launched in 2017. BiQ offers various products to help customers search, connect, and analyse public information. Its main clients work in customer support, onboarding new clients, sales, fraud detection, AML and KYC, and debt collection. These clients include private sector, civil society, and government actors. Beyond providing specific products to support clients with KYC and onboarding, BiQ’s clients tend to use the platform as a way of accessing a lot of data in one place, thereby making it easier to see how various pieces of data may be connected. The platform includes BOI and other data from the CVR, the CPR, the register of debtors, politically exposed persons and relatives and close associates lists, sanctions lists, and public information about creditors, property, telephone subscribers, financial overviews, and networks of individuals and companies.[60]

Another BiQ tool aims to support both businesses and governments to prevent and detect fraud. Again, this tool builds on publicly available data, including BOI, to help users make sense of historical data and connections between corporate vehicles and people in order to detect red flags that may be indicative of fraud. This can include specific ownership patterns over time and across different entities.

Denmark has also seen data services being developed to fit the specific needs of investigative journalists. For example, the company KM24 has been using the DBA’s API since 2017 to ingest BO data and use it in monitoring and analysis tools which clients can access on a password-protected platform. The company was founded by two journalists who had years of experience in data analysis and investigative journalism to develop a tool for their sector. In addition to BO data, their platform monitors many other data sources, such as other CVR data, bankruptcy data, the Danish property register, court judgements, and board of appeal decisions.

Government agencies are also BOI users. Whilst SKAT and the DBA have developed tools using BOI to help detect tax fraud, they are also major clients of BiQ.[61] The analytical tools developed by the private sector are not always possible or cost-effective for governments to develop themselves. The fact that regulated entities and government agencies are reliant on these services highlights the importance of the broad range of data users in the ecosystem to help fight financial crime with a legitimate interest in accessing the information. Whatever the outcomes are of any changes to the access regime, access for a broad range of relevant non-government users should be safeguarded.

Figure 3. A BiQ tool showing a visualisation of connections between people and corporate vehicles[62]

“Beneficial ownership data is a small part of our product offer but a very important part, especially as many of our customers use our services to fulfil KYC requirements [and support] fraud detection. [...] Our customers tell us that the amount of time saved by using our platform is substantial.”[63]

Henrik Kristian Christensen, Marketing Manager, BiQ

Using beneficial ownership data in investigative and business journalism

Informing business decisions

Business journalism plays an important role in both informing business and investment decisions as well as ensuring transparency and accountability in the corporate world. This includes scrutiny of the financial sector to help prevent financial crises as well as monitoring the environmental, social, and governance performance of companies.[64] To effectively monitor, analyse, and report on economic and financial activity, business journalists need to have a comprehensive and up-to-date understanding of the business landscape. As information on the real owners of corporate vehicles is critical for this, business journalists in Denmark use BO data from the CVR on a regular basis. In one case, a large Danish accounting company ended its ties to a car company after the business newspaper Børsen, using the CVR data, had uncovered a Russian connection.[65]

“We need to know what’s going on in our country, including knowing who owns what. It is a basic part of democracy and it helps provide a healthy business environment where companies can trade in fair terms and citizens can make informed decisions [...].”[66]

Kevin Grønnemann, Journalist, Børsen

Investigating real estate fraud

In another example, investigative journalists from Børsen and DR published a series of articles about PwC and DBO Real Estate.[67] Following the advice of a lawyer, six partners of PwC agreed to loan over DKK 100 million privately to DBO Real Estate, a company registered in Denmark, to buy rental properties in the country.[68] Subsequently, complaints emerged by tenants against the company, including about sudden increases in rent and cuts in water, gas, and electricity supply allegedly linked to DBO Real Estate’s heavy renovation plans and failure to pay providers.[69] Tenants provided information to the journalists about two individuals involved in the daily operations of the company and its real estate holdings who did not hold official positions. Further investigations revealed that the two individuals were convicted fraudsters who were active in the real estate industry during the 2008 financial crisis, and were playing a key role in DBO Real Estate.[70]

To establish the true owners of DBO Real Estate, the investigative team used various public data sources, including the CVR. Historical ownership information showed that DBO Real Estate was initially owned by Danish nationals before ownership was transferred to a company registered in Luxembourg. The team’s inquiries in Luxembourg were inconclusive in identifying the real owner of DBO Real Estate, prompting the DBA to review the company’s documentation. Documents that the journalists accessed showed that the authorities concluded the companies in the group should be forcibly dissolved due to the large degree of uncertainty about their ownership. The company and its subsidiaries were subsequently declared bankrupt.[71] The lawyer had to step down, and all six PwC partners withdrew their investments from the company.[72]

Investigating potential sanctions evasion

BOI from the CVR is often used by journalists as a starting point in investigations. Danish journalists mention that the ability to subscribe to updates is very useful to monitor a company of interest for an investigation. Once subscribed, CVR users are notified by email of any changes in corporate information for that specific company, such as any changes in legal or beneficial ownership. In another case, Kevin Grønnemann, journalist at Børsen, received information that suggested a sanctioned Russian individual was involved in a company registered in Denmark. Indeed, he could see the name of this individual listed on the company’s page on the CVR. He subscribed to the company’s page and was informed of a change in legal ownership to a Czech company, itself owned by an individual with a Czech address. By checking the Czech corporate register, Grønnemann discovered that the Czech company was instead owned by an individual with a Russian address. Grønnemann subsequently contacted the company, holding them to account and asking them to explain the discrepancy.[73] This example shows how journalists can use BOI to help investigate and monitor potential sanctions evasion. It also illustrates how even where BOI is outdated or inaccurate, BO disclosures are still useful sources of information, as discrepancies can raise red flags and provide clues for further investigations.

“Data on the CVR may not always be 100% correct but, when it is not, it still allows you to ask critical questions [...] It is a very important tool to fact check something or start an investigation.”[74]

Kevin Grønnemann, Journalist, Børsen

Investigative journalists from Børsen and Ekstra Bladet commend the CVR’s transparency and usefulness. However, they also echo other investigative journalists that the misuse of corporate vehicles often involves transnational connections, and the availability and accessibility of registers in other countries is often a barrier to investigations.

Both journalists and private sector users state that connecting domestic BOI with data from other jurisdictions would save considerable time and resources. Whilst corporate data service providers have played a major role in connecting, cleaning, and standardising different domestic datasets, gaps in the data still remain, and not all users can afford these services.

“Without a European or global beneficial ownership database, it is still too easy for people who want to hide ownership. [...]”[75]

Johan Christensen, Editor of Investigations, Børsen

Reliance on the register to drive up participation by regulated entities

The Danish private sector is one of the main user groups of BO data in the CVR. It is systematically used by entities that have a legal obligation to adhere to AML/combating the financing of terrorism requirements, such as in the financial and real estate sectors. According to guidance by the Danish financial supervisory authority (FSA), regulated entities are required to take “reasonable measures” to verify a beneficial owner’s identity. The FSA specifically allows regulated entities to use BOI from the CVR as a source to verify who the customer’s beneficial owners are, “if the undertaking believes that a customer relationship represents a limited risk”.[76]

By contrast, in cases of increased risk, the FSA requires regulated entities to verify the information obtained from the CVR using independent sources. To illustrate, a representative from the Danish Association of Chartered Estate Agents explained that BOI from the CVR is extremely valuable to association members, and downloading and saving a CVR extract forms part of the CDD process.

All regulated entities have an obligation to alert the DBA if there are discrepancies between BOI held on the CVR and information from other independent sources. As discussed, this forms part of the CVR’s suite of verification mechanisms. The ability of regulated entities to rely on CVR data is essential to their active participation in this process. In other countries in the process of implementing reforms, financial sector representatives have said they will resist the introduction of requirements to report discrepancies if they are not allowed to rely on the register. The robust mechanisms that Denmark has introduced to ensure the accuracy of the CVR data is critical to allowing regulated entities to rely on the register.

“Beneficial ownership is an essential piece of data to perform KYC [...]. When regulated entities receive information from a client, they typically compare it with the data in the CVR or with data from private data distributors that primarily get it from the CVR.”[77]

Senior Professional, Finans og Leasing

However, interviewees from regulated entities also explained that when new corporate customers are part of a larger chain of other corporate vehicles with beneficial owners located outside of Denmark, they continue to face major challenges. One explained how the lack of BO registers in some jurisdictions and the lack of user-friendly registers in others creates a significant obstacle to effective due diligence processes. Additionally, regulated entities have expressed concerns over potential negative implications of the CJEU judgement on access for their members.

Endnotes

[60] “PEP-liste”, Finanstilsynet, updated 30 November 2023, https://www.finanstilsynet.dk/Tal-og-Fakta/PEP-liste; “BiQ compliance”, BiQ, n.d., https://biq.dk/biqs-loesninger/biq-compliance

[61] Hattens, Beneficial Ownership; Interview with Henrik Kristian Christensen, Marketing Manager, BiQ, 20 September 2023.

[62] “BiQ Insight”, BiQ, n.d., https://data.biq.dk/.

[63] Interview with Henrik Kristian Christensen, Marketing Manager, BiQ, 20 September 2023.

[64] “The role of business journalism in a financial crisis”, Reuters Institute for the Study of Journalism, University of Oxford, 26 April 2023, https://reutersinstitute.politics.ox.ac.uk/calendar/role-business-journalism-financial-crisis.

[65] Kevin Grønnemann, “Revisor forlader superbilfirma efter omtale af russisk forbindelse”, Børsen, 30 March 2022, https://borsen.dk/nyheder/virksomheder/revisor-forlader-superbilfirma-efter-omtale-af-russisk-forbindelse?b_source=virksomheder&b_medium=row_0&b_campaign=news_4; Beierholm LinkedIn, “Beierholm afbryder alt samarbejde med russiske og belarussiske virksomheder”, 2022, https://www.linkedin.com/posts/beierholm_beierholm-afbryder-alt-samarbejde-med-russiske-activity-6908049613182382080-Q1KM?utm_source=share&utm_medium=member_desktop.

[66] Interview with Kevin Grønnemann, Journalist, Børsen, 7 September 2023.

[67] See: Johan Christensen and Thomas G. Svaneborg, “Svindeldømt advokat styrede koncern før PwC-partneres millioninvestering”, Børsen, 18 June 2023, https://borsen.dk/nyheder/virksomheder/svindeldomt-advokat-og-haandlanger-for-bjorn-stiedl-kontrollerede-ejendomskoncern.

[68] Jonas Deiborg and Morten Frandsen, “Toprevisorer har lånt 100 millioner kroner til udskældt ejendomskoncern”, DR, 31 May 2023, https://www.dr.dk/nyheder/indland/toprevisorer-har-laant-100-millioner-kroner-til-udskaeldt-ejendomskoncern.

[69] Deiborg and Frandsen, “Toprevisorer har lånt 100 millioner kroner til udskældt ejendomskoncern”.

[70] Anna Danielsen Gille and Jonas Deiborg, “Endnu en dømt spekulant fra finanskrisen har nøglerolle i ejendomsselskab: Lejere truet med opsagt kontrakt”, DR, 26 May 2023, https://www.dr.dk/nyheder/indland/endnu-en-doemt-spekulant-fra-finanskrisen-har-noeglerolle-i-ejendomsselskab-lejere.

[71] Jonas Deiborg, “Efter DR-afsløringer: Mystik om bagmænd sender kritiseret ejendomskoncern i graven”, DR, 18 October 2023, https://www.dr.dk/nyheder/indland/efter-dr-afsloeringer-mystik-om-bagmaend-sender-kritiseret-ejendomskoncern-i-graven.

[72] Jonas Deiborg and Morten Frandsen, “Ny afsløring i sag om kritiseret ejendomsnetværk: Koster topadvokat jobbet”, DR, 1 June 2023, https://www.dr.dk/nyheder/indland/ny-afsloering-i-sag-om-kritiseret-ejendomsnetvaerk-koster-topadvokat-jobbet; Deiborg and Frandsen, “Toprevisorer har lånt 100 millioner kroner til udskældt ejendomskoncern”.

[73] Hattens, Beneficial Ownership.

[74] Interview with Kevin Grønnemann, Journalist, Børsen, 7 September 2023.

[75] Interview with Johan Christensen, Editor of Investigations, Børsen, 27 September 2023.

[76] Finanstilsynet, The FSA’s Guide to the Act on Measures to Prevent Money Laundering and Financing of Terrorism (the AML Act) (Copenhagen: Finanstilsynet, 2020), 69, https://www.dfsa.dk/-/media/Tilsyn/hvidvask/AML_act_2021.pdf.

[77] Email interview with Senior Professional, Finans og Leasing, 11 and 25 September 2023.