Beneficial ownership transparency in the Philippines: supporting law enforcement, public procurement, and tax

Oliver Leonardo, Director of the Securities and Exchange Commission of the Philippines, presenting at the training session on the use of beneficial ownership data in public procurement

An Open Ownership long read

Open Ownership and the United Nations Office on Drugs and Crime (UNODC) recently delivered a series of engagements in the Philippines, a frontrunner on beneficial ownership (BO) transparency in the Southeast Asia region. The Philippine Securities and Exchange Commission (SEC) is leading efforts to encourage government agencies working in law enforcement, public procurement and tax to use BO data, which this work aimed to complement.

Beneficial ownership data use training for law enforcement

Over two days in Manila, OO and UNODC partnered with the SEC to deliver a highly interactive training programme for law enforcement agencies (LEAs). This work was supported by the US Department of State International Narcotics and Law Enforcement. The aim was to support Philippine law enforcement agencies to discuss their current use of BO data, and further their knowledge about how to most effectively leverage it as part of their investigations and case-building. The sessions also covered how to access various sources of BO information domestically and internationally.

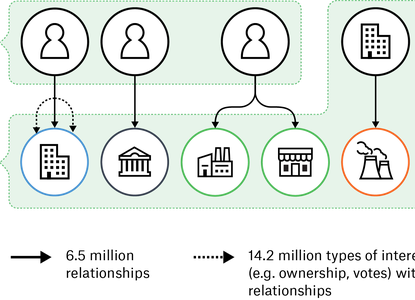

OO colleagues facilitated interactive sessions to help participants deepen their understanding of the more complex aspects of beneficial ownership. They discussed the various ways in which natural persons can exercise ownership and control over corporate vehicles; from direct shareholding to direct control via rights to appoint board members, and indirect control through family members. The law enforcement actors in attendance also shared examples of real cases, and collaboratively developed scenarios to better understand how BO data can help advance an investigation. For example, BO data has been used in the Philippines to investigate and prosecute investment scams carried out by unlicensed corporate entities.

Participants and presenters engaged in active discussions during the focus group discussion with public procurement authorities

The workshop provided a platform for law enforcement staff to discuss challenges and identify avenues to overcome them. For example, it was noted that access to ownership data is not equal for different LEAs, with some agencies having waited several weeks to receive data they had requested. This can be a barrier in executing effective, efficient investigations, as time is often of the essence. Some agencies also said that banking secrecy laws can pose a challenge in carrying out investigations.

Nevertheless, by combining BO information with other sources, such as bank account information, agencies have been able to use SEC data to help prosecute crimes such as fraud and money-laundering.

Participants shared their ideas and learning at the training sessions on beneficial data use by law enforcement agencies

Beneficial ownership data use in public procurement

As of March 2023, the Financial Action Task Force (FATF) recommends that countries ensure that procurement authorities can access BO information, given the well-documented and recognised high risk for corruption and fraud in public procurement processes. Complying with FATF’s Recommendation 24 (Guidance on Beneficial Ownership of Legal Persons) is an important priority for the Philippines, which was added to the FATF grey list in June 2021. FATF’s grey list is the informal term used for “Jurisdictions under Increased Monitoring”.

During a focus group discussion convened by Open Ownership, UNODC and the SEC, procurement authorities discussed several of the practical measures needed for the effective implementation of BOT for procurement, such as having robust data-sharing agreements in place.

Open Ownership staff presented on the benefits of combining BO data with public procurement data, including country examples from the UK and Kenya, and described the tools that Open Ownership has developed to aid this analysis. This includes work to connect the dots between beneficial ownership and procurement data with the aim of improving processes and identifying risk. In another project, Open Ownership has used Bluetail, a prototype system that uses BO, procurement, and politically exposed person data to automatically flag corruption risks in tenders.

Andrej Leontiev, partner at Taylor Wessing Law Firm and co-author of the BO legislation in Slovakia, spoke about their experience establishing a BO register for private entities dealing with public funds and public assets (including public procurement of goods and services). He described the various measures in place to assure that BO data reaches a high standard of accuracy, including the use of “gatekeepers” to exercise and document the verification of the respective beneficial owners on behalf of these private entities. Andrej also emphasised the importance of publishing BO information to allow for oversight in the use of public funds, and to help improve data accuracy through the reporting of potential errors or falsehoods in the register.

There were active discussions among participants during the focus group discussion with public procurement authorities

Beneficial ownership data use for tax transparency

This focus group discussion was likewise co-organised by OO, UNODC, and the SEC. Officials from the Bureau of Internal Revenue were invited to share their experience in using BO data from the central register for tax enforcement. Participants also discussed potential ways forward for increased cooperation to advance shared policy objectives.

Open Ownership presented global perspectives on BO data use by tax authorities. First, a review of sources of information available to tax authorities was provided, including public sources such as the newly relaunched OO register. Second, we shared a series of use-cases based on real-life examples of tax authorities using BO data to identify hidden ownership and tax liabilities, encourage compliance, and detect ownership connections between entities and arrangements. And third, we covered enabling factors that can make the use of BO data for tax enforcement more effective, including harnessing anti-money laundering frameworks.

Beneficial ownership transparency in the Philippines

The SEC holds one of the region’s most well-developed and well-populated central BO registers. These collaborative engagements highlighted both that the information in it is being used, and that further efforts are needed to verify the data and to make sure it is structured so that it can be efficiently accessed by all relevant agencies. This includes agencies involved in procurement and law enforcement. This vision for fully integrated and active BO data use is shared among several agencies.

Moreover, making BO data public in the country would increase its usefulness to actors outside government, for example taxpayers who have an interest in monitoring public contracting. It would also allow civil society and the public to independently verify the information, improving its value to government and non-government users alike.

Related articles and publications

Publication type

Blog post

Country focus

Philippines

Topics

Procurement,

Tax

Sections

Implementation